8863 from Form 2024

What is the 8863 Form?

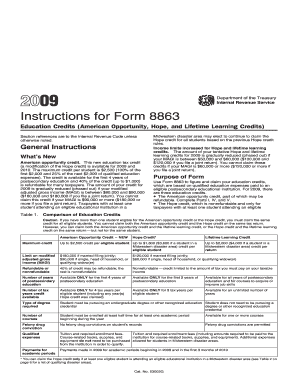

The 8863 Form, officially known as the Education Credits (American Opportunity and Lifetime Learning Credits) form, is utilized by taxpayers in the United States to claim education-related tax credits. These credits can significantly reduce the amount of tax owed, making higher education more accessible. The form is particularly relevant for students and their families, as it allows for the claiming of expenses related to qualified education, including tuition and fees.

How to Use the 8863 Form

To effectively use the 8863 Form, taxpayers must first determine their eligibility for the American Opportunity Credit or the Lifetime Learning Credit. Each credit has specific requirements regarding the type of education expenses that qualify. After confirming eligibility, individuals can fill out the form by providing necessary information such as the student’s details, the educational institution, and the amount of qualified expenses incurred. Properly completing the form ensures that taxpayers can maximize their benefits.

Steps to Complete the 8863 Form

Completing the 8863 Form involves several key steps:

- Gather all necessary documentation, including tuition statements (Form 1098-T) and receipts for qualified expenses.

- Determine eligibility for either the American Opportunity Credit or the Lifetime Learning Credit based on the educational program.

- Fill in the student’s information, including name, Social Security number, and the educational institution attended.

- Report the total qualified education expenses and any adjustments from prior years.

- Calculate the credits based on the provided information and follow the instructions for filing.

Eligibility Criteria

Eligibility for the 8863 Form varies based on the type of education credit being claimed. For the American Opportunity Credit, students must be enrolled at least half-time in a degree program and have not completed four years of higher education. The Lifetime Learning Credit has broader eligibility, allowing students to claim expenses for any post-secondary education. Income limits also apply, affecting the ability to claim these credits. It is essential to review the IRS guidelines to ensure compliance.

Filing Deadlines / Important Dates

Filing deadlines for the 8863 Form align with the standard tax return deadlines. Typically, taxpayers must submit their forms by April 15 of each year for the previous tax year. If additional time is needed, taxpayers can file for an extension, but it is crucial to ensure that any owed taxes are paid by the original deadline to avoid penalties. Keeping track of these dates helps in timely submissions and maximizes potential refunds.

Form Submission Methods

The 8863 Form can be submitted through various methods, including online filing, mailing, or in-person submission at designated IRS offices. Many taxpayers choose to file electronically using tax preparation software, which often simplifies the process and helps ensure accuracy. For those opting to mail the form, it is important to send it to the correct IRS address based on the taxpayer's location and to retain a copy for personal records.

Create this form in 5 minutes or less

Find and fill out the correct 8863 from form

Create this form in 5 minutes!

How to create an eSignature for the 8863 from form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 8863 From Form and why is it important?

The 8863 From Form is a tax form used to claim education credits for eligible students. It is important because it helps taxpayers reduce their tax liability by providing credits for qualified education expenses. Understanding how to properly fill out this form can lead to signNow savings.

-

How can airSlate SignNow help with the 8863 From Form?

airSlate SignNow streamlines the process of completing and signing the 8863 From Form by providing an easy-to-use digital platform. Users can fill out the form, add electronic signatures, and send it securely, ensuring compliance and efficiency. This eliminates the hassle of paper forms and speeds up the submission process.

-

Is there a cost associated with using airSlate SignNow for the 8863 From Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive and provides access to features that simplify the signing and management of documents, including the 8863 From Form. Investing in this solution can save time and reduce errors in your tax documentation.

-

What features does airSlate SignNow offer for managing the 8863 From Form?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for the 8863 From Form. These tools enhance the user experience by making it easy to manage documents and ensure that all necessary signatures are obtained promptly. Additionally, the platform supports collaboration among multiple users.

-

Can I integrate airSlate SignNow with other software for the 8863 From Form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage the 8863 From Form alongside your existing tools. This integration capability enhances workflow efficiency and ensures that all your documents are easily accessible in one place.

-

What are the benefits of using airSlate SignNow for the 8863 From Form?

Using airSlate SignNow for the 8863 From Form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick edits and electronic signatures, which can signNowly speed up the filing process. Additionally, it helps ensure that your forms are completed accurately and submitted on time.

-

Is airSlate SignNow secure for handling the 8863 From Form?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents like the 8863 From Form. The platform employs advanced encryption and security protocols to protect your data. You can trust that your information is secure while using our services.

Get more for 8863 From Form

- Skittles math pdf form

- Employee direct depositpaycard deposit form columbia edp

- Gc 085 fillable orm form

- 355s fillable form

- Debonairs franchise application form

- Zung scale form

- Missouri state emergency management agency mo gov form

- Www camdenmo org wp content uploadsnecessary requirements to obtain a construction permit form

Find out other 8863 From Form

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation