Trustee or Issuer of Your Individual Retirement Arrangement IRA to Report 2024

What is the Trustee Or Issuer Of Your Individual Retirement Arrangement IRA To Report

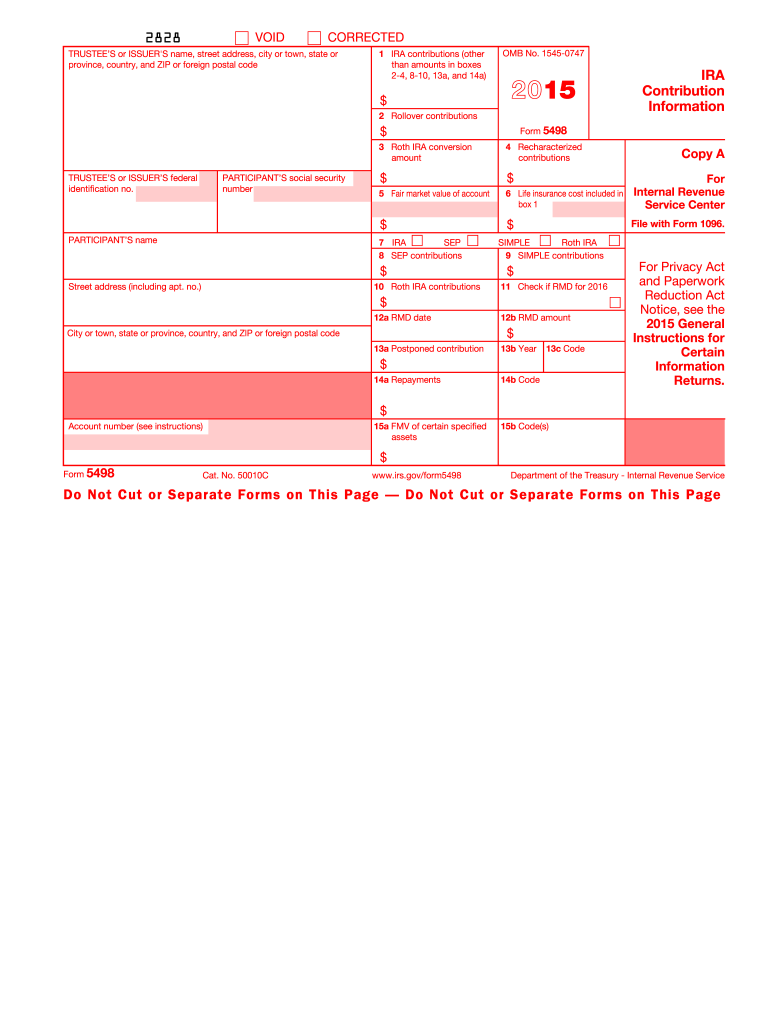

The Trustee or Issuer of your Individual Retirement Arrangement (IRA) is responsible for reporting specific information to the Internal Revenue Service (IRS). This reporting typically includes details about contributions, distributions, and the overall balance of the IRA. The form serves to ensure compliance with tax regulations and helps the IRS track the tax implications of retirement accounts. Understanding this reporting requirement is crucial for both trustees and account holders to maintain proper records and avoid potential penalties.

Steps to complete the Trustee Or Issuer Of Your Individual Retirement Arrangement IRA To Report

Completing the reporting process involves several key steps:

- Gather necessary documentation, including account statements and transaction records.

- Determine the reporting period, which usually aligns with the calendar year.

- Fill out the required form accurately, ensuring all information is complete and correct.

- Review the form for any errors or omissions before submission.

- Submit the form to the IRS by the designated deadline, either electronically or via mail.

Legal use of the Trustee Or Issuer Of Your Individual Retirement Arrangement IRA To Report

The legal framework surrounding the Trustee or Issuer reporting requirements is established by the IRS. Compliance with these regulations is essential to avoid penalties and ensure that the IRA retains its tax-advantaged status. Trustees must adhere to the guidelines set forth in IRS publications and relevant tax codes. This includes maintaining accurate records and ensuring timely submission of reports to the IRS.

IRS Guidelines

The IRS provides specific guidelines for trustees and issuers regarding the reporting of IRA activities. These guidelines outline what information must be reported, the format for reporting, and the deadlines for submission. It is important for trustees to stay updated on any changes to these guidelines to ensure compliance. Regularly reviewing IRS publications and updates can help trustees fulfill their reporting obligations effectively.

Required Documents

To complete the reporting process, certain documents are required. These typically include:

- Account statements detailing contributions and distributions.

- Transaction records for the reporting period.

- Any relevant correspondence with the IRS or account holders.

Having these documents organized and readily available can streamline the reporting process and ensure accuracy.

Penalties for Non-Compliance

Failure to comply with the reporting requirements can result in significant penalties. The IRS may impose fines for late submissions or inaccuracies in the reported information. Additionally, non-compliance can jeopardize the tax-advantaged status of the IRA, leading to potential tax liabilities for account holders. Understanding these penalties emphasizes the importance of timely and accurate reporting by trustees and issuers.

Create this form in 5 minutes or less

Find and fill out the correct trustee or issuer of your individual retirement arrangement ira to report

Create this form in 5 minutes!

How to create an eSignature for the trustee or issuer of your individual retirement arrangement ira to report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of the Trustee Or Issuer Of Your Individual Retirement Arrangement IRA To Report?

The Trustee Or Issuer Of Your Individual Retirement Arrangement IRA To Report is responsible for managing your IRA and ensuring compliance with IRS regulations. They handle the reporting of contributions, distributions, and any other transactions related to your retirement account. This role is crucial for maintaining the tax-advantaged status of your IRA.

-

How does airSlate SignNow help with IRA documentation?

airSlate SignNow provides an efficient platform for managing and eSigning all necessary IRA documentation. By using our service, you can easily send, receive, and store documents securely, ensuring that your Trustee Or Issuer Of Your Individual Retirement Arrangement IRA To Report has all the required paperwork. This streamlines the process and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while ensuring that your Trustee Or Issuer Of Your Individual Retirement Arrangement IRA To Report can efficiently manage documentation. Our cost-effective solutions make it easy to get started.

-

Can airSlate SignNow integrate with other financial tools?

Yes, airSlate SignNow seamlessly integrates with a variety of financial tools and software. This allows your Trustee Or Issuer Of Your Individual Retirement Arrangement IRA To Report to access and manage documents alongside other financial data. Our integrations enhance productivity and ensure that all necessary information is readily available.

-

What benefits does airSlate SignNow offer for IRA management?

Using airSlate SignNow for IRA management provides numerous benefits, including enhanced security, ease of use, and time savings. Your Trustee Or Issuer Of Your Individual Retirement Arrangement IRA To Report can quickly eSign documents and track their status, ensuring compliance and reducing administrative burdens. This allows for a more efficient management of your retirement assets.

-

Is airSlate SignNow compliant with IRS regulations?

Absolutely, airSlate SignNow is designed to comply with all relevant IRS regulations. This compliance is essential for your Trustee Or Issuer Of Your Individual Retirement Arrangement IRA To Report to ensure that all documentation is handled correctly. Our platform prioritizes security and regulatory adherence to protect your retirement investments.

-

How can I get support for using airSlate SignNow?

airSlate SignNow offers comprehensive customer support to assist you with any questions or issues. Whether you need help with document management or understanding how your Trustee Or Issuer Of Your Individual Retirement Arrangement IRA To Report works with our platform, our support team is available to guide you. You can signNow out via chat, email, or phone for prompt assistance.

Get more for Trustee Or Issuer Of Your Individual Retirement Arrangement IRA To Report

- Sanitation standard operating procedures form

- Csio property loss notice form

- Evidence of movement along faults answer key form

- Early release of superannuation on specified compassionate humanservices gov form

- Manufactur in pharmaceutical sop contract template form

- Manufactur proposal contract template form

- Manufactur review contract template form

- Food cater contract template form

Find out other Trustee Or Issuer Of Your Individual Retirement Arrangement IRA To Report

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile