DR 0112EP Corporate Estimated Income Tax 2024-2026

What is the DR 0112EP Corporate Estimated Income Tax

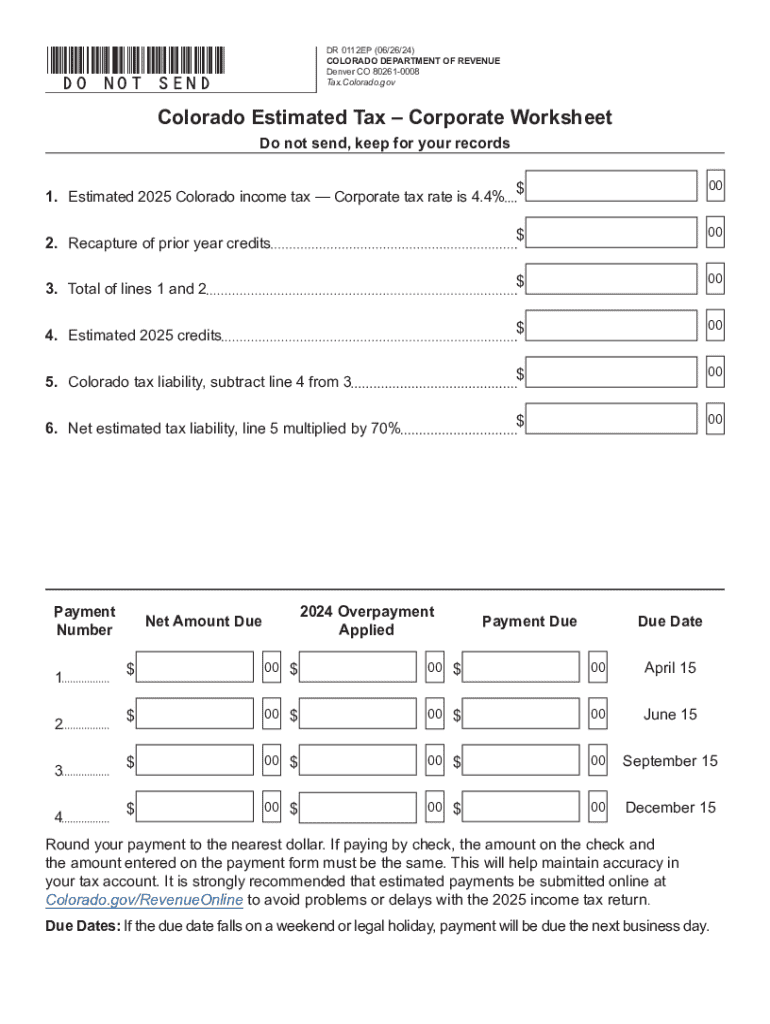

The DR 0112EP Corporate Estimated Income Tax form is a tax document used by corporations in the United States to estimate their income tax obligations for the year. This form allows businesses to report their expected income and calculate the estimated tax payments they need to make throughout the year. It is essential for corporations to accurately estimate their tax liability to avoid underpayment penalties and ensure compliance with federal and state tax regulations.

Steps to complete the DR 0112EP Corporate Estimated Income Tax

Completing the DR 0112EP form involves several key steps:

- Gather financial information: Collect data on projected income, deductions, and credits for the tax year.

- Calculate estimated tax: Use the gathered information to calculate the estimated tax liability based on current tax rates.

- Fill out the form: Enter the calculated estimates into the appropriate sections of the DR 0112EP form.

- Review for accuracy: Double-check all entries to ensure correctness and completeness.

- Submit the form: Follow the submission guidelines for filing the form either online or by mail.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the DR 0112EP form. Typically, the estimated tax payments are due quarterly. The deadlines are as follows:

- First quarter: April 15

- Second quarter: June 15

- Third quarter: September 15

- Fourth quarter: December 15

It is crucial for corporations to meet these deadlines to avoid penalties and interest on late payments.

Legal use of the DR 0112EP Corporate Estimated Income Tax

The DR 0112EP form serves a legal purpose by ensuring that corporations comply with tax laws. Proper use of this form helps businesses report their estimated income accurately, which is necessary for fulfilling tax obligations. Failure to file or incorrect filings can lead to legal repercussions, including fines and penalties from tax authorities.

Who Issues the Form

The DR 0112EP Corporate Estimated Income Tax form is issued by the state tax authority. In most cases, this is the Department of Revenue for the respective state where the corporation is registered. Each state may have its own version of the form, so it is important for corporations to use the correct form specific to their state.

Required Documents

To complete the DR 0112EP form, corporations need several key documents:

- Prior year tax returns to reference previous income and tax liability.

- Financial statements, including profit and loss statements.

- Records of any expected deductions and credits.

- Projected income for the current tax year.

Having these documents on hand facilitates accurate completion of the form and helps ensure compliance with tax regulations.

Create this form in 5 minutes or less

Find and fill out the correct dr 0112ep corporate estimated income tax

Create this form in 5 minutes!

How to create an eSignature for the dr 0112ep corporate estimated income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DR 0112EP Corporate Estimated Income Tax?

The DR 0112EP Corporate Estimated Income Tax is a form used by corporations in certain jurisdictions to report and pay estimated income taxes. It helps businesses manage their tax obligations efficiently and avoid penalties. Understanding this form is crucial for compliance and financial planning.

-

How can airSlate SignNow help with the DR 0112EP Corporate Estimated Income Tax?

airSlate SignNow provides a streamlined solution for signing and sending the DR 0112EP Corporate Estimated Income Tax form electronically. This ensures that your documents are processed quickly and securely, saving you time and reducing the risk of errors. Our platform simplifies the entire process, making tax compliance easier.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support the management of documents like the DR 0112EP Corporate Estimated Income Tax. You can choose a plan that fits your budget while ensuring you have access to essential tools for document management.

-

Are there any integrations available with airSlate SignNow for tax preparation software?

Yes, airSlate SignNow integrates seamlessly with various tax preparation software, allowing you to manage the DR 0112EP Corporate Estimated Income Tax form alongside your other financial documents. This integration enhances workflow efficiency and ensures that all your tax-related documents are in one place. You can easily send and sign documents directly from your preferred software.

-

What features does airSlate SignNow offer for managing corporate tax documents?

airSlate SignNow offers a range of features designed for managing corporate tax documents, including templates, automated reminders, and secure eSigning. These features are particularly useful for handling forms like the DR 0112EP Corporate Estimated Income Tax. Our platform ensures that your documents are organized and accessible, making tax season less stressful.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect sensitive documents, including the DR 0112EP Corporate Estimated Income Tax. Our compliance with industry standards ensures that your data remains confidential and secure throughout the signing process.

-

Can I track the status of my DR 0112EP Corporate Estimated Income Tax submissions?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your DR 0112EP Corporate Estimated Income Tax submissions in real-time. You will receive notifications when documents are viewed, signed, or completed, giving you peace of mind and keeping you informed throughout the process.

Get more for DR 0112EP Corporate Estimated Income Tax

- Camp medication form 24218610

- Affidavit of unchanged status citibank form

- Elements compounds and mixtures diagrams explaination and answers form

- Promissory note template wisconsin form

- Silhouette instalift consent sf docx form

- Commercial driver application form

- Antrag auf befreiung von der ausweispflicht form

- Bilingual agreement template form

Find out other DR 0112EP Corporate Estimated Income Tax

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT