Irs Form 4972 2016

What is the IRS Form 4972

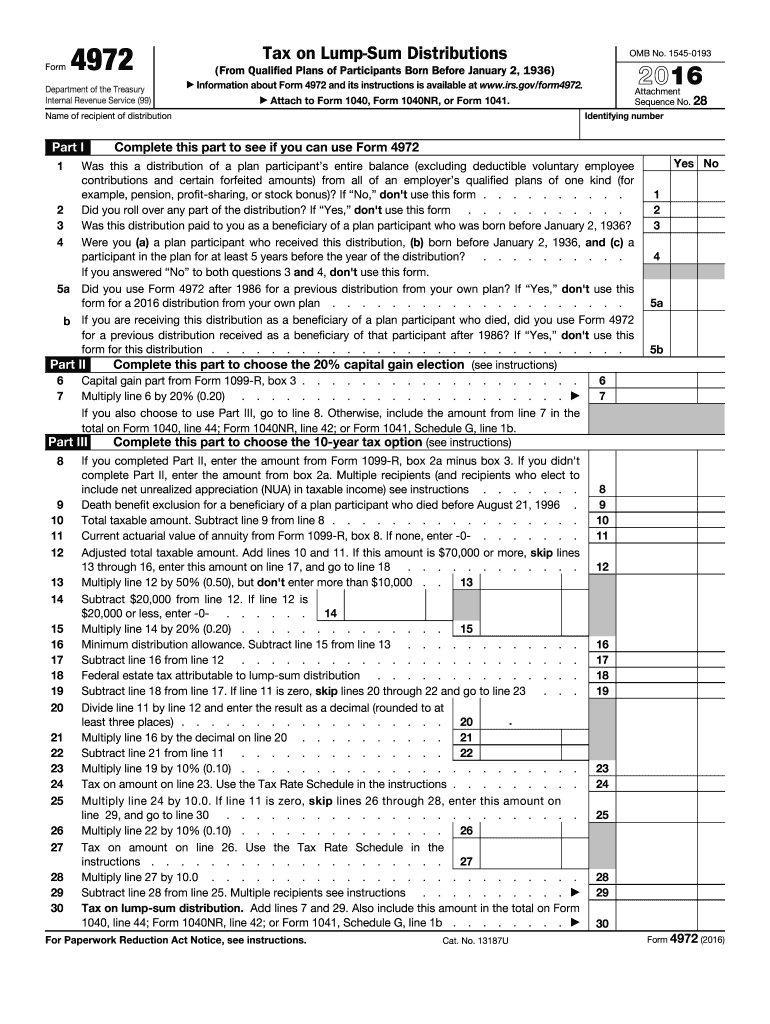

The IRS Form 4972 is a tax form used by individuals to report the tax on lump-sum distributions from retirement plans. This form is essential for taxpayers who receive a one-time payment from their retirement accounts, as it helps determine the tax liability associated with that distribution. The form allows taxpayers to calculate the tax owed on the distribution using a special tax rate, which can be beneficial compared to regular income tax rates.

How to use the IRS Form 4972

To use the IRS Form 4972, taxpayers should first ensure they are eligible to file it based on their retirement distribution type. Once eligibility is confirmed, the next step involves gathering necessary information, including the total amount of the distribution and any applicable deductions. The form requires detailed calculations to determine the taxable amount and the corresponding tax rate. After completing the form, taxpayers must include it with their annual tax return submitted to the IRS.

Steps to complete the IRS Form 4972

Completing the IRS Form 4972 involves several steps:

- Gather all relevant information regarding the lump-sum distribution.

- Determine if the distribution qualifies for special tax treatment.

- Fill out the form, starting with personal information and the distribution amount.

- Calculate the tax owed using the provided tables or formulas.

- Review the completed form for accuracy before submission.

Key elements of the IRS Form 4972

Key elements of the IRS Form 4972 include:

- Taxpayer identification information, including Social Security number.

- Details of the lump-sum distribution, including the total amount and type of retirement plan.

- Calculations for determining the taxable amount and tax owed.

- Signature and date, confirming the accuracy of the information provided.

Legal use of the IRS Form 4972

The legal use of the IRS Form 4972 is governed by IRS regulations that dictate how and when it should be filed. Taxpayers must ensure that they meet all eligibility criteria and comply with tax laws regarding retirement distributions. Filing the form accurately is crucial to avoid penalties and ensure that the correct amount of tax is paid. Additionally, using the form correctly can help taxpayers take advantage of lower tax rates applicable to lump-sum distributions.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 4972 align with the general tax return deadlines. Typically, individual tax returns are due on April fifteenth of each year. If additional time is needed, taxpayers can file for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties. Keeping track of these dates is essential for compliance and financial planning.

Quick guide on how to complete 2016 irs form 4972

Effortlessly Prepare Irs Form 4972 on Any Device

Digital document management has become increasingly favored by businesses and individuals. It serves as a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to draft, modify, and electronically sign your documents quickly and without delays. Manage Irs Form 4972 on any device through airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

Edit and Electronically Sign Irs Form 4972 with Ease

- Find Irs Form 4972 and click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with the features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to secure your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Irs Form 4972 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 irs form 4972

Create this form in 5 minutes!

How to create an eSignature for the 2016 irs form 4972

How to generate an electronic signature for your 2016 Irs Form 4972 online

How to create an electronic signature for your 2016 Irs Form 4972 in Google Chrome

How to generate an eSignature for putting it on the 2016 Irs Form 4972 in Gmail

How to generate an eSignature for the 2016 Irs Form 4972 from your mobile device

How to create an eSignature for the 2016 Irs Form 4972 on iOS devices

How to generate an eSignature for the 2016 Irs Form 4972 on Android

People also ask

-

What is IRS Form 4972?

IRS Form 4972 is used by taxpayers to report a lump-sum distribution from a retirement plan, allowing them to calculate the tax owed on that distribution. Understanding how to accurately complete IRS Form 4972 can help ensure that you are compliant with IRS regulations and avoid potential penalties.

-

How can airSlate SignNow help with IRS Form 4972?

airSlate SignNow offers an intuitive platform to securely send and eSign IRS Form 4972, making the process smooth and efficient. Our solution simplifies document management, allowing you to focus on completing your tax forms with ease.

-

Is there a cost associated with using airSlate SignNow for IRS Form 4972?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, starting at an affordable rate. The investment in our service provides excellent value for effortlessly managing documents like IRS Form 4972.

-

Can I integrate airSlate SignNow with other software for processing IRS Form 4972?

Absolutely! airSlate SignNow seamlessly integrates with popular software applications, allowing you to streamline your workflow when preparing IRS Form 4972. This integration enhances your document management efficiency, ensuring you can handle your tax filings with ease.

-

What features does airSlate SignNow provide for completing IRS Form 4972?

airSlate SignNow includes features like electronic signatures, document templates, and real-time collaboration, all designed to help you efficiently complete IRS Form 4972. These tools simplify the process of gathering signatures and finalizing tax documents.

-

Is it secure to use airSlate SignNow for processing IRS Form 4972?

Yes, airSlate SignNow prioritizes security by implementing industry-leading encryption and compliance measures to protect your documents, including IRS Form 4972. You can trust that your sensitive information remains confidential and secure throughout the signing process.

-

What benefits does airSlate SignNow offer for businesses handling IRS Form 4972?

By using airSlate SignNow, businesses enjoy streamlined document workflows and reduced turnaround times for IRS Form 4972. This efficiency helps save time and resources, allowing businesses to remain focused on their core operations while managing essential tax documentation.

Get more for Irs Form 4972

Find out other Irs Form 4972

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease