4972 Form 2014

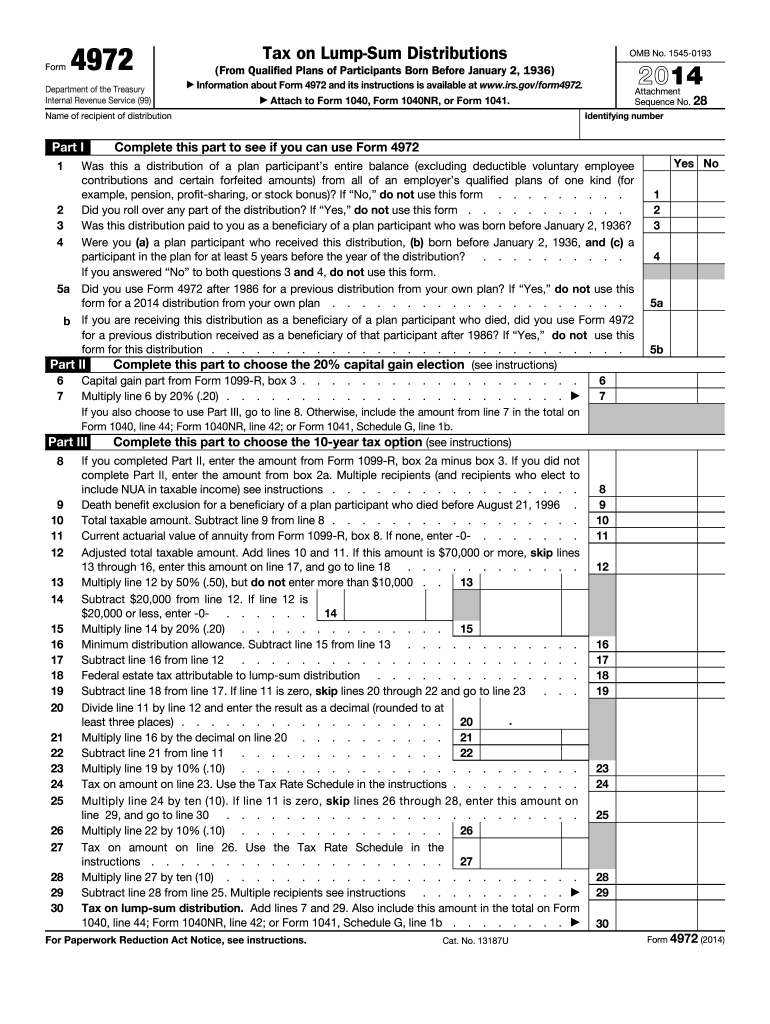

What is the 4972 Form

The 4972 Form, also known as the "Tax on Early Distributions from Retirement Plans," is a tax document used in the United States. It is specifically designed for individuals who receive early distributions from retirement accounts, such as 401(k) plans or IRAs. This form helps taxpayers calculate the additional tax owed on these distributions, which is typically ten percent unless certain exceptions apply. Understanding the purpose of the 4972 Form is essential for ensuring compliance with tax regulations and avoiding potential penalties.

How to obtain the 4972 Form

The 4972 Form can be obtained through various methods to ensure accessibility for all taxpayers. It is available directly from the Internal Revenue Service (IRS) website, where individuals can download and print the form. Additionally, taxpayers may request a physical copy by contacting the IRS or visiting a local IRS office. It is advisable to ensure you have the most current version of the form to avoid any issues during filing.

Steps to complete the 4972 Form

Completing the 4972 Form involves several steps to ensure accuracy and compliance with IRS guidelines. Begin by entering your personal information, including your name and Social Security number. Next, report the total amount of early distributions received from your retirement accounts. Then, calculate the additional tax owed by applying the appropriate percentage to the distribution amount. Finally, review the form for accuracy before submitting it with your tax return. It is important to keep a copy for your records.

Legal use of the 4972 Form

The legal use of the 4972 Form is governed by IRS regulations, which stipulate that it must be filed by individuals who take early distributions from their retirement plans. This form is crucial for ensuring that taxpayers report the correct amount of tax owed on these distributions. Failure to file the 4972 Form when required may result in penalties and interest charges. Therefore, understanding the legal implications of this form is vital for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the 4972 Form align with the general tax return deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth of each year. If you are filing for an extension, it is essential to ensure that the 4972 Form is submitted by the extended deadline to avoid penalties. Keeping track of these important dates helps taxpayers stay compliant and avoid unnecessary complications.

Examples of using the 4972 Form

There are various scenarios in which the 4972 Form may be utilized. For instance, if a taxpayer withdraws funds from a retirement account before reaching the age of fifty-nine and a half, they may need to file this form to report the early distribution. Another example includes individuals who inherit retirement accounts and withdraw funds early. In both cases, the 4972 Form serves as a tool to calculate the additional tax owed, ensuring that taxpayers fulfill their obligations under the law.

Quick guide on how to complete 2014 4972 form

Effortlessly Prepare 4972 Form on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle 4972 Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-oriented process today.

Edit and eSign 4972 Form with Ease

- Locate 4972 Form and click on Get Form to begin.

- Use the tools provided to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Review all information and click on the Done button to save your modifications.

- Choose how you want to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from the device of your choosing. Edit and eSign 4972 Form and guarantee excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 4972 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 4972 form

The way to generate an electronic signature for a PDF document in the online mode

The way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is the 4972 Form?

The 4972 Form, also known as 'Tax on Early Distributions from Retirement Plans,' is an IRS form used to calculate and report tax on early distributions from qualified retirement plans. Understanding the 4972 Form is essential for individuals facing penalties for early withdrawals, as it helps manage tax implications.

-

How can airSlate SignNow help with the 4972 Form?

With airSlate SignNow, you can easily create, send, and eSign your 4972 Form securely and efficiently. This user-friendly platform streamlines the process of preparing tax documents, ensuring that your 4972 Form is completed correctly and filed timely.

-

What are the pricing options for airSlate SignNow when dealing with the 4972 Form?

airSlate SignNow offers flexible pricing plans tailored to different business needs, making it affordable for users managing the 4972 Form and other documents. You can choose from various tiers that include options for enhanced features and integrations, ensuring value for your investment.

-

Is airSlate SignNow secure for submitting the 4972 Form?

Yes, airSlate SignNow is designed with advanced security features, ensuring that your 4972 Form and sensitive data are protected. The platform utilizes encryption and complies with industry standards, providing peace of mind as you handle your documents electronically.

-

Can I integrate airSlate SignNow with other software for the 4972 Form?

Absolutely! airSlate SignNow seamlessly integrates with various software solutions, enhancing your ability to manage the 4972 Form and your overall document workflow. You can connect with popular applications such as Google Drive, Salesforce, and more to streamline your processes.

-

What are the benefits of using airSlate SignNow for the 4972 Form?

Using airSlate SignNow for the 4972 Form offers numerous benefits, including time savings, improved accuracy, and enhanced compliance. The platform simplifies document management, making it easier for you to focus on your business while ensuring that your tax documents are handled efficiently.

-

Does airSlate SignNow offer customer support for the 4972 Form process?

Yes, airSlate SignNow provides robust customer support to assist you with any questions or concerns regarding the 4972 Form. Their dedicated support team is available to guide you through the eSigning process and help troubleshoot any issues you may encounter.

Get more for 4972 Form

Find out other 4972 Form

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form