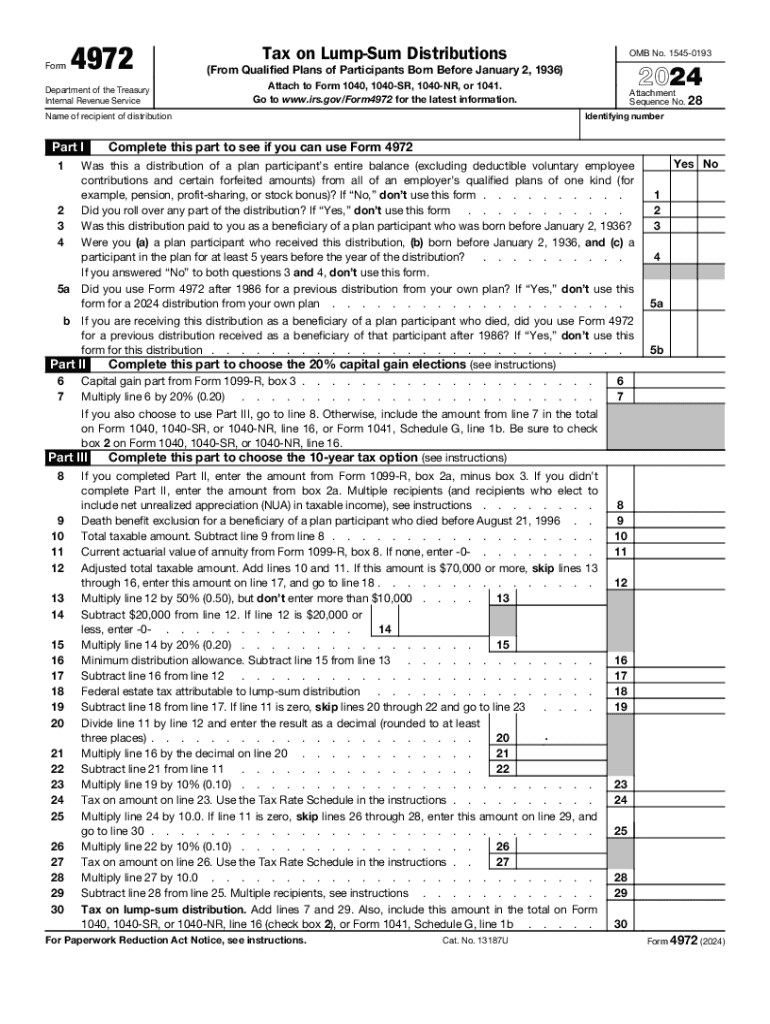

Form 4972, Tax on Lump Sum Distributions 2024-2026

Understanding Form 1099-R

Form 1099-R is a crucial tax document used in the United States to report distributions from retirement accounts, pensions, and other similar plans. This form is typically issued by financial institutions or plan administrators to individuals who have received a distribution. The information reported on Form 1099-R includes the total amount distributed, the taxable amount, and any federal income tax withheld. It is essential for taxpayers to accurately report this income on their tax returns, as failure to do so can lead to penalties.

Key Elements of Form 1099-R

Several important components are included in Form 1099-R that taxpayers should be aware of:

- Recipient Information: This section includes the taxpayer's name, address, and Social Security number.

- Distribution Amount: The total distribution amount is reported in Box 1, while Box 2a indicates the taxable amount.

- Federal Income Tax Withheld: Any federal tax withheld from the distribution is shown in Box 4.

- Distribution Code: This code in Box 7 indicates the type of distribution and can affect how the distribution is taxed.

Steps to Complete Form 1099-R

Completing Form 1099-R involves several steps to ensure accuracy:

- Gather Information: Collect all necessary information, including your Social Security number, the total distribution amount, and any tax withheld.

- Fill Out the Form: Enter the required information in the appropriate boxes, ensuring that all details are accurate.

- Review for Errors: Double-check all entries to avoid mistakes that could lead to tax issues.

- Submit the Form: Send the completed form to the IRS and provide a copy to the recipient by the required deadline.

IRS Guidelines for Form 1099-R

The IRS provides specific guidelines regarding the issuance and filing of Form 1099-R. Taxpayers must be aware of the following:

- Filing Deadlines: Form 1099-R must be filed with the IRS by January thirty-first of the year following the distribution.

- Corrections: If an error is discovered after filing, a corrected form must be submitted to rectify the mistake.

- Record Keeping: Taxpayers should retain copies of Form 1099-R and any supporting documents for at least three years.

Common Scenarios for Using Form 1099-R

Form 1099-R is commonly used in various situations, such as:

- Pension Distributions: Individuals receiving monthly pension payments may receive this form annually.

- Retirement Account Withdrawals: Withdrawals from IRAs or 401(k) plans typically generate a Form 1099-R.

- Rollovers: When funds are rolled over from one retirement account to another, Form 1099-R may still be issued, indicating the distribution.

Tax Implications of Form 1099-R

Understanding the tax implications of distributions reported on Form 1099-R is essential for accurate tax filing. The taxable amount reported in Box 2a will be included in the taxpayer's gross income. Depending on the type of distribution, different tax rules may apply, such as early withdrawal penalties for distributions taken before age fifty-nine and a half. Taxpayers should consult IRS guidelines or a tax professional to ensure compliance and optimize their tax situation.

Create this form in 5 minutes or less

Find and fill out the correct form 4972 tax on lump sum distributions

Create this form in 5 minutes!

How to create an eSignature for the form 4972 tax on lump sum distributions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 1099 R?

Form 1099 R is a tax form used to report distributions from pensions, annuities, retirement plans, and other similar sources. It is essential for individuals to understand what is form 1099 R to ensure accurate tax reporting and compliance. This form provides crucial information about the amount distributed and any taxes withheld.

-

How can airSlate SignNow help with form 1099 R?

airSlate SignNow simplifies the process of sending and eSigning form 1099 R. With our platform, businesses can easily manage and distribute this important tax document securely and efficiently. Understanding what is form 1099 R is crucial, and our solution ensures that you can handle it seamlessly.

-

What features does airSlate SignNow offer for managing tax forms like 1099 R?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are beneficial for managing tax forms like 1099 R. These features ensure that you can create, send, and receive signed documents quickly. Knowing what is form 1099 R is just the beginning; our tools help you manage it effectively.

-

Is airSlate SignNow cost-effective for small businesses handling form 1099 R?

Yes, airSlate SignNow is a cost-effective solution for small businesses that need to handle form 1099 R. Our pricing plans are designed to fit various budgets while providing essential features for document management. Understanding what is form 1099 R can help you save time and money during tax season.

-

Can I integrate airSlate SignNow with other software for managing form 1099 R?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage form 1099 R. This integration allows for seamless data transfer and ensures that you have all the necessary information at your fingertips. Knowing what is form 1099 R is crucial, and our integrations enhance your workflow.

-

What are the benefits of using airSlate SignNow for form 1099 R?

Using airSlate SignNow for form 1099 R provides numerous benefits, including enhanced security, faster processing times, and improved compliance. Our platform ensures that your documents are signed and stored securely, reducing the risk of errors. Understanding what is form 1099 R is vital, and our solution supports you in managing it effectively.

-

How does airSlate SignNow ensure the security of form 1099 R?

airSlate SignNow prioritizes security by using advanced encryption and secure storage for documents like form 1099 R. Our platform complies with industry standards to protect sensitive information. Knowing what is form 1099 R is important, and our security measures ensure that your data remains safe throughout the process.

Get more for Form 4972, Tax On Lump Sum Distributions

Find out other Form 4972, Tax On Lump Sum Distributions

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online