Irs Form 4972 2023

What is the IRS Form 4972

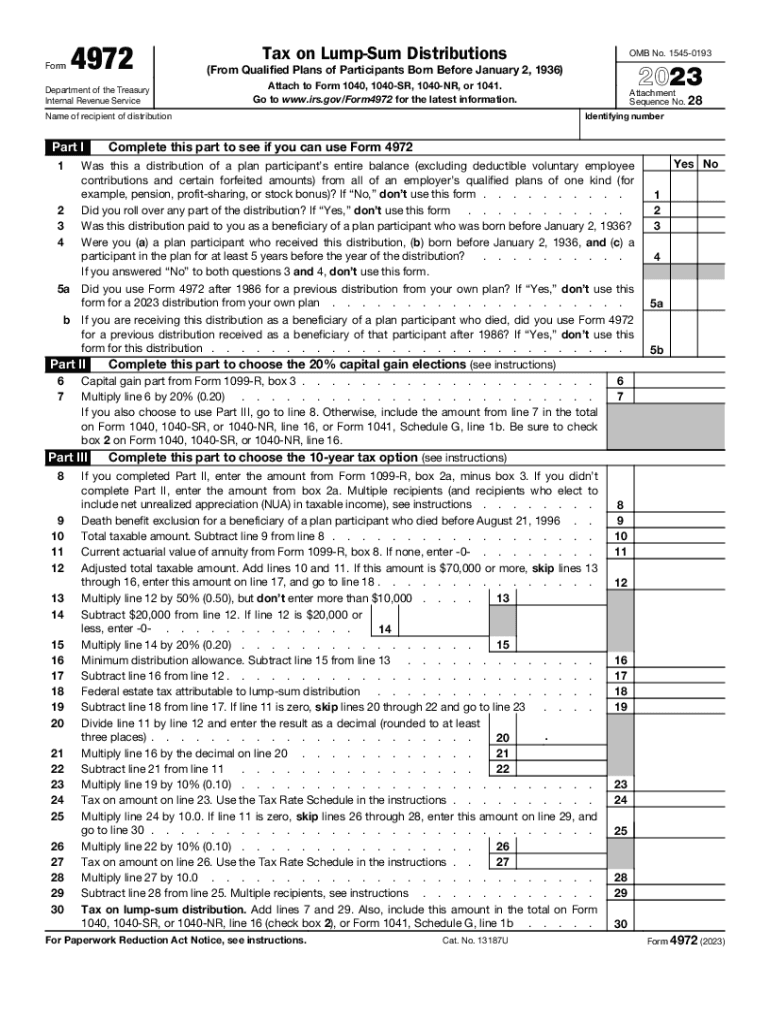

The IRS Form 4972 is a tax form used by individuals to report and calculate the tax on a lump-sum distribution from a qualified retirement plan. This form allows taxpayers to determine the tax implications of receiving a one-time payment from their retirement savings, which may include pensions or other retirement accounts. The form is particularly relevant for those who have received a lump-sum distribution and wish to take advantage of favorable tax treatment under certain conditions.

How to Use the IRS Form 4972

To use the IRS Form 4972, taxpayers must first gather relevant information regarding their lump-sum distribution, including the total amount received and the type of retirement plan involved. The form requires details about the distribution, including the date it was received and any applicable tax withholding. Taxpayers can calculate the tax owed on the distribution by following the instructions provided on the form, which guide them through the necessary calculations and reporting requirements.

Steps to Complete the IRS Form 4972

Completing the IRS Form 4972 involves several steps:

- Gather all necessary documents related to the lump-sum distribution, including the distribution statement from the retirement plan.

- Fill out the personal information section, including your name, address, and Social Security number.

- Report the total amount of the lump-sum distribution in the designated section.

- Calculate the taxable amount using the specific instructions provided on the form.

- Complete any additional sections that apply to your situation, such as tax withholding information.

- Review the form for accuracy and completeness before submission.

Key Elements of the IRS Form 4972

Important elements of the IRS Form 4972 include:

- Taxpayer Information: Basic details such as name, address, and Social Security number.

- Lump-Sum Distribution Amount: The total amount received from the retirement plan.

- Tax Calculation: A section dedicated to calculating the tax owed on the distribution.

- Withholding Information: Details regarding any taxes withheld from the distribution.

Filing Deadlines / Important Dates

Taxpayers must file the IRS Form 4972 by the tax return deadline, which is typically April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to keep track of any changes to the tax calendar that may affect filing deadlines.

Required Documents

When completing the IRS Form 4972, taxpayers should have the following documents ready:

- The distribution statement from the retirement plan.

- Any prior tax returns that may provide context for the current tax situation.

- Documentation of any tax withholdings related to the lump-sum distribution.

Quick guide on how to complete irs form 4972

Accomplish Irs Form 4972 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the needed form and securely store it online. airSlate SignNow equips you with all the features necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Irs Form 4972 on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to modify and eSign Irs Form 4972 effortlessly

- Find Irs Form 4972 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or disorganized files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow caters to all your document management needs in a few clicks from any device of your choice. Alter and eSign Irs Form 4972 to ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 4972

Create this form in 5 minutes!

How to create an eSignature for the irs form 4972

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 4972 and how do I use it with airSlate SignNow?

Form 4972 is used to report the lump-sum distributions from qualified retirement plans. With airSlate SignNow, you can easily create, edit, and electronically sign form 4972, simplifying the process of managing your retirement documents and ensuring compliance with IRS requirements.

-

Can I integrate form 4972 with other software using airSlate SignNow?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to connect form 4972 with your preferred software for enhanced productivity. You can integrate with CRM systems, cloud storage solutions, and more, ensuring that all your documents are easily accessible.

-

What are the costs associated with using airSlate SignNow for form 4972?

airSlate SignNow provides a cost-effective solution for managing documents like form 4972. Pricing plans are flexible, allowing businesses to choose an option that fits their budget and needs, with various features included in each plan to enhance your document management experience.

-

What features does airSlate SignNow offer for handling form 4972?

airSlate SignNow includes features like electronic signatures, cloud storage, and robust templates that streamline the completion of form 4972. Additionally, you can track document statuses and collaborate with others in real-time, ensuring a smooth workflow.

-

How does airSlate SignNow ensure the security of my form 4972?

AirSlate SignNow prioritizes the security of your documents, including form 4972, with advanced encryption methods and access controls. Our platform complies with industry standards to protect your sensitive information and gives you peace of mind while electronically signing.

-

Is it easy to get started with airSlate SignNow for form 4972?

Absolutely! Getting started with airSlate SignNow for form 4972 is a breeze. Our user-friendly interface allows you to create and manage your documents efficiently, with helpful resources and customer support available to guide you through the process.

-

Can multiple users access and work on form 4972 through airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on form 4972, making it easier for teams to work together. You can share documents, receive feedback, and track changes, enhancing collaboration and ensuring timely completion of your forms.

Get more for Irs Form 4972

- Painting contract for contractor mississippi form

- Trim carpenter contract for contractor mississippi form

- Fencing contract for contractor mississippi form

- Hvac contract for contractor mississippi form

- Landscape contract for contractor mississippi form

- Commercial contract for contractor mississippi form

- Contract contractor pdf form

- Renovation contract for contractor mississippi form

Find out other Irs Form 4972

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF