Form 4972 2015

What is the Form 4972

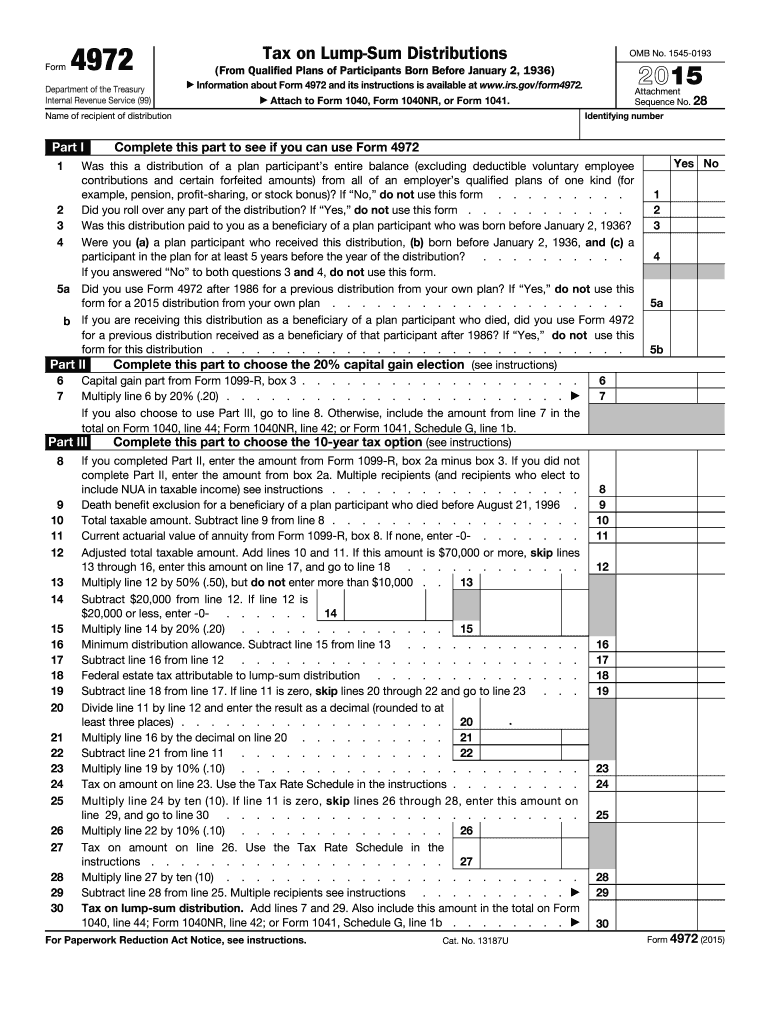

The Form 4972 is a tax form used by individuals to report and calculate the tax on lump-sum distributions from retirement plans. This form is particularly relevant for taxpayers who receive distributions from pensions, profit-sharing plans, or other qualified retirement plans. By using Form 4972, taxpayers can determine if they qualify for special tax treatment, which may reduce their overall tax liability. The form helps in calculating the tax owed on the distribution and is crucial for accurate tax reporting.

How to use the Form 4972

Using Form 4972 involves several steps to ensure accurate completion and submission. First, gather all necessary documents related to the lump-sum distribution, including details of the retirement plan and any previous contributions. Next, fill out the form by providing personal information, the amount of the distribution, and any applicable deductions. It's essential to follow the instructions carefully to avoid errors. Once completed, the form can be submitted with your annual tax return to the IRS, ensuring that all information is accurate and complete.

Steps to complete the Form 4972

Completing Form 4972 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your Social Security number and details of the distribution.

- Enter your personal information in the designated sections of the form.

- Report the total amount of the lump-sum distribution received.

- Calculate the tax using the provided worksheets to determine if you qualify for special tax treatment.

- Review the completed form for accuracy before submission.

By following these steps, you can ensure that your Form 4972 is filled out correctly, minimizing the risk of errors that could lead to penalties or delays in processing.

Legal use of the Form 4972

The legal use of Form 4972 is essential for compliance with tax regulations. This form must be used correctly to report lump-sum distributions accurately. Failure to do so can result in penalties or additional taxes owed. It is important to ensure that all information is truthful and complete, as the IRS may audit submissions. Understanding the legal implications of using Form 4972 can help taxpayers navigate their obligations and avoid potential issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for Form 4972 align with the general tax return deadlines. Typically, the form must be submitted by April 15 of the year following the tax year in which the distribution was received. If you require additional time, you may file for an extension, but this does not extend the time to pay any taxes owed. It is crucial to be aware of these deadlines to avoid late fees and interest charges.

Required Documents

To complete Form 4972, several documents are necessary. These include:

- Form W-2 or Form 1099-R, which reports the distribution amount.

- Any previous tax returns that may provide context for the distribution.

- Documentation of contributions to the retirement plan, if applicable.

Having these documents ready will streamline the process of filling out the form and ensure accuracy in reporting.

Eligibility Criteria

Eligibility for using Form 4972 is primarily based on the type of distribution received. Taxpayers must have received a lump-sum distribution from a qualified retirement plan. Additionally, certain conditions must be met, such as the age of the taxpayer and the type of retirement plan. Understanding these criteria is essential for determining whether Form 4972 is applicable to your situation.

Quick guide on how to complete 2015 form 4972

Complete Form 4972 effortlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Form 4972 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Form 4972 with ease

- Find Form 4972 and click Get Form to begin.

- Utilize the tools available to complete your form.

- Select important sections of your documents or redact sensitive data using the tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you want to submit your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, the hassle of searching for forms, or corrections that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from your preferred device. Modify and electronically sign Form 4972 and ensure effective communication at any point in your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 4972

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 4972

How to generate an electronic signature for your PDF online

How to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is Form 4972 and how is it used?

Form 4972 is used by taxpayers to calculate the tax on a lump-sum distribution from a qualified retirement plan. It allows individuals to report the tax implications of such distributions efficiently. Understanding Form 4972 is crucial to ensure compliance and optimize tax liability.

-

How can airSlate SignNow help with Form 4972?

With airSlate SignNow, you can easily create, send, and eSign Form 4972 electronically. This not only streamlines the process but also ensures that your documents are securely stored and easily accessible. The platform simplifies compliance with tax regulations while saving you time.

-

What are the pricing options for using airSlate SignNow for Form 4972?

airSlate SignNow offers flexible pricing plans that accommodate varying business needs, starting from affordable monthly subscriptions. Each plan includes features that streamline sending and signing documents, including Form 4972. Check our pricing page for detailed insights into costs based on usage.

-

Can I integrate airSlate SignNow with my existing software for handling Form 4972?

Yes, airSlate SignNow integrates seamlessly with many popular applications, enhancing your current workflows for handling Form 4972. This integration allows for effortless data transfer and ensures that your document processes remain efficient. Explore our integration options to find the best fit for your business needs.

-

What features does airSlate SignNow offer for managing Form 4972?

airSlate SignNow provides robust features such as template creation, automated workflows, and real-time tracking for Form 4972. These tools empower users to manage, sign, and store their documents efficiently. Additionally, advanced security measures ensure your sensitive information is protected.

-

Is airSlate SignNow suitable for businesses of all sizes when dealing with Form 4972?

Absolutely! airSlate SignNow is designed to meet the needs of businesses of all sizes, making it easy to manage Form 4972 regardless of volume or complexity. Our intuitive interface caters to small startups and large enterprises alike, ensuring everyone can benefit from our eSigning solutions.

-

What security measures does airSlate SignNow implement for Form 4972 documents?

airSlate SignNow employs industry-leading security protocols, including encryption and secure cloud storage, to protect your Form 4972 documents. We prioritize your data privacy and comply with regulatory standards to ensure safe document handling. Rest assured that your information remains confidential and secure.

Get more for Form 4972

- Assessor home page jefferson county missouri form

- Individual unique form feb 20 19pmd departamento

- Get and sign form 1528 physicians statement fill out

- 4802 planilla corporacion 12 15 departamento de hacienda form

- Totals for this return form

- Income tax return for exempt businesses under the puerto rico 489075950 form

- 05 166 2020 texas franchise tax affiliate schedule for final report form

- Form 501 annual information return summary of reports

Find out other Form 4972

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe