26 CFR Chapter I INTERNAL REVENUE SERVICE, DEPARTMENT of 2020

Understanding the 2018 Tax Form 4972

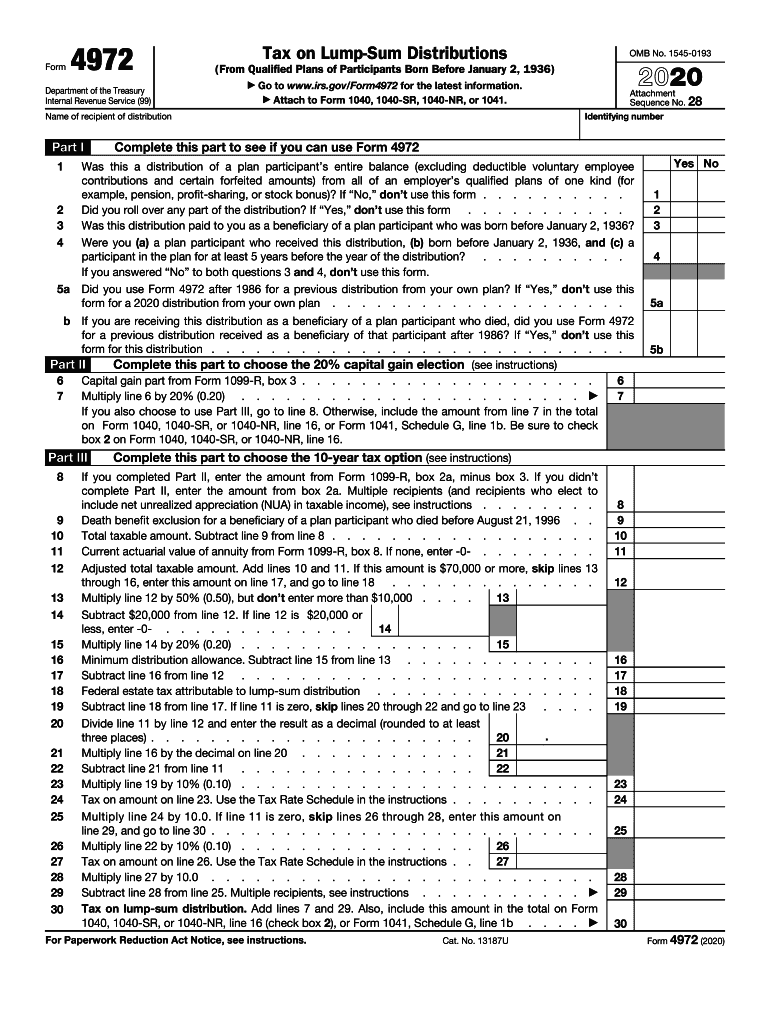

The 2018 tax form 4972 is used by individuals to report a lump-sum distribution from a qualified retirement plan. This form allows taxpayers to calculate the tax owed on such distributions using a special method that may result in a lower tax rate. It is essential for those who have received distributions from retirement accounts to understand how to correctly fill out this form to ensure compliance with IRS regulations.

Steps to Complete the 2018 Tax Form 4972

Filling out the 2018 tax form 4972 involves several key steps:

- Gather all necessary documents related to your lump-sum distribution, including Form 1099-R.

- Begin by entering your personal information at the top of the form, including your name and Social Security number.

- Calculate the total amount of your lump-sum distribution and report it in the appropriate section.

- Determine the tax rate applicable to your distribution by referring to the IRS guidelines for lump-sum distributions.

- Complete the calculations to find the total tax owed and ensure all figures are accurate.

- Sign and date the form before submission.

Filing Deadlines for the 2018 Tax Form 4972

It is crucial to be aware of the filing deadlines for the 2018 tax form 4972. Generally, tax forms are due by April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should ensure they file their forms on time to avoid penalties and interest on any taxes owed.

Legal Use of the 2018 Tax Form 4972

The 2018 tax form 4972 is legally recognized by the IRS as the appropriate document for reporting lump-sum distributions. To ensure that the form is valid, it must be filled out accurately and submitted in accordance with IRS regulations. E-signatures can be used for electronic submissions, provided they comply with the legal standards set forth by the IRS.

Required Documents for Filing the 2018 Tax Form 4972

When preparing to file the 2018 tax form 4972, it is important to gather the following documents:

- Form 1099-R, which reports the amount of the distribution.

- Any other relevant tax documents that detail income and deductions.

- Previous year’s tax return, if applicable, for reference.

Penalties for Non-Compliance with the 2018 Tax Form 4972

Failure to file the 2018 tax form 4972 correctly or on time can result in penalties from the IRS. These may include fines for late filing or underpayment of taxes owed. It is advisable to seek assistance if you are unsure about the completion of the form to avoid potential issues with compliance.

Quick guide on how to complete 26 cfr chapter i internal revenue service department of

Easily Prepare 26 CFR Chapter I INTERNAL REVENUE SERVICE, DEPARTMENT OF on Every Device

Managing documents online has become increasingly popular among both businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly and without delays. Handle 26 CFR Chapter I INTERNAL REVENUE SERVICE, DEPARTMENT OF on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to Edit and eSign 26 CFR Chapter I INTERNAL REVENUE SERVICE, DEPARTMENT OF Effortlessly

- Find 26 CFR Chapter I INTERNAL REVENUE SERVICE, DEPARTMENT OF and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign 26 CFR Chapter I INTERNAL REVENUE SERVICE, DEPARTMENT OF and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 26 cfr chapter i internal revenue service department of

Create this form in 5 minutes!

How to create an eSignature for the 26 cfr chapter i internal revenue service department of

The way to generate an eSignature for your PDF file in the online mode

The way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is the 2018 tax form 4972?

The 2018 tax form 4972 is used to report a lump-sum distribution from a qualified retirement plan. It allows taxpayers to calculate the tax owed on that distribution and determine the tax benefit. Understanding how to correctly file this form is crucial for compliance and optimizing your tax situation.

-

How can airSlate SignNow help with the 2018 tax form 4972?

airSlate SignNow enables you to easily send, eSign, and store your 2018 tax form 4972 securely online. This simplifies the process of signing and managing important tax documents, ensuring you meet submission deadlines without hassles. Our platform offers a streamlined experience to enhance your tax filing process.

-

What features does airSlate SignNow offer for managing the 2018 tax form 4972?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document storage, all of which are beneficial for managing the 2018 tax form 4972. These tools ensure that your forms are completed, signed, and stored safely, making tax season easier and more efficient. Additionally, you can set reminders to help you stay on track with your deadlines.

-

Is airSlate SignNow a cost-effective solution for filing the 2018 tax form 4972?

Yes, airSlate SignNow offers a cost-effective solution for managing your 2018 tax form 4972. With various pricing plans suitable for individuals and businesses, you can choose a plan that fits your budget while still accessing premium features. Our pricing allows you to save time and money during tax season.

-

Can I integrate airSlate SignNow with other tools for the 2018 tax form 4972?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and financial software, enhancing your ability to manage the 2018 tax form 4972 effectively. These integrations streamline workflows, helping you keep all your financial documents organized and accessible within your preferred applications.

-

What are the benefits of using airSlate SignNow for my 2018 tax form 4972?

Using airSlate SignNow for your 2018 tax form 4972 offers numerous benefits, including increased efficiency and reduced risk of errors. The platform's intuitive interface makes it easy to navigate and complete forms, while secure eSigning ensures the integrity of your documents. Overall, it enhances your tax filing experience.

-

Is it safe to use airSlate SignNow for sensitive forms like the 2018 tax form 4972?

Yes, airSlate SignNow prioritizes the security of your sensitive documents, including the 2018 tax form 4972. We use advanced encryption and strict compliance measures to safeguard your information and ensure that only authorized users have access. Your peace of mind is our top priority.

Get more for 26 CFR Chapter I INTERNAL REVENUE SERVICE, DEPARTMENT OF

- Wwwmandgcomdaminvestments1 of 4 mampampg withdrawal form dmampampg f or executorpersonal

- Chelson meadow van permit form

- All fields marked with an asterisk are required dnnindicating form controls as required using asterisks adgindicating form

- School admission transfer application form

- Hull city council application form

- Driver vehicle agency ireland form

- Bolton lock company order form

- Apply for taxi meter test ni form

Find out other 26 CFR Chapter I INTERNAL REVENUE SERVICE, DEPARTMENT OF

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online