Form 4972, Tax on Lump Sum Distributions from Qualified 2021

What is the Form 4972, Tax On Lump Sum Distributions From Qualified

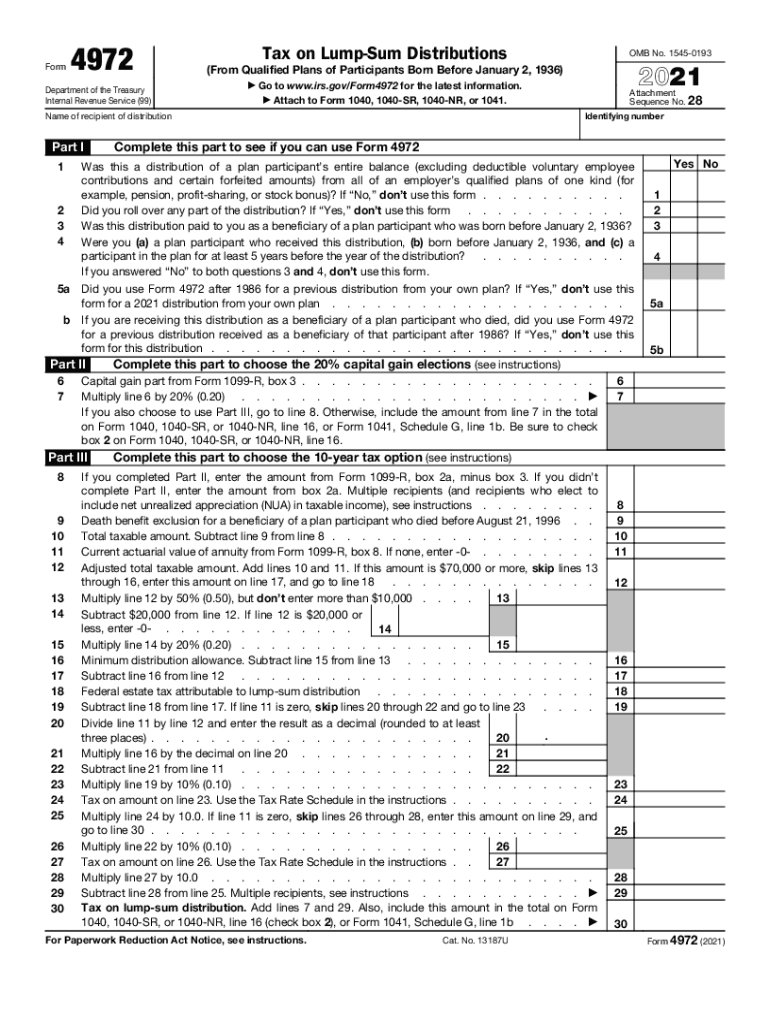

The Form 4972 is an IRS tax form used to report taxes on lump sum distributions from qualified retirement plans. This form is specifically designed for taxpayers who receive a one-time payment from retirement accounts such as pensions or profit-sharing plans. The purpose of the form is to calculate the tax owed on these distributions, which can often be subject to different tax rates compared to regular income. The IRS Form 4972 allows taxpayers to take advantage of special tax treatment for lump sum distributions, potentially reducing their overall tax liability.

How to use the Form 4972, Tax On Lump Sum Distributions From Qualified

Using the Form 4972 involves several steps that ensure accurate reporting of your lump sum distribution. First, gather all necessary information regarding your distribution, including the total amount received and any taxes previously withheld. Next, complete the form by entering your personal information and the details of the distribution. It is essential to follow the instructions carefully to ensure compliance with IRS regulations. After completing the form, you will calculate the tax owed based on the provided tax tables and your specific situation. Finally, submit the form along with your tax return to the IRS.

Steps to complete the Form 4972, Tax On Lump Sum Distributions From Qualified

Completing the Form 4972 requires attention to detail. Here are the steps to follow:

- Start by entering your name, address, and Social Security number at the top of the form.

- Report the total amount of your lump sum distribution in the designated field.

- Determine if any taxes were withheld from your distribution and report that amount.

- Use the IRS Form 4972 tax table to find the appropriate tax rate for your distribution amount.

- Calculate the total tax owed based on the information provided and enter it on the form.

- Review the completed form for accuracy before submitting it with your tax return.

Key elements of the Form 4972, Tax On Lump Sum Distributions From Qualified

Several key elements are crucial for understanding and completing the Form 4972:

- Distribution Amount: The total amount received from your retirement plan.

- Tax Withheld: Any federal taxes that have already been deducted from your distribution.

- Tax Rate: The applicable tax rate based on the IRS tax tables for lump sum distributions.

- Filing Requirements: Ensure you meet all IRS filing requirements to avoid penalties.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 4972. It is essential to refer to the latest IRS instructions to ensure compliance with current tax laws. The guidelines outline eligibility criteria for using the form, how to calculate taxes owed, and the necessary documentation required for submission. Staying informed about any changes in tax regulations is vital for accurate reporting and to avoid potential issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4972 align with the standard tax return deadlines. Generally, individual tax returns are due on April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to submit the Form 4972 by the deadline to avoid penalties and interest on any taxes owed. Taxpayers should also be aware of any extensions that may apply to their specific situation.

Quick guide on how to complete form 4972 tax on lump sum distributions from qualified

Prepare Form 4972, Tax On Lump sum Distributions From Qualified effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers a wonderful eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the needed form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly without waiting. Manage Form 4972, Tax On Lump sum Distributions From Qualified on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign Form 4972, Tax On Lump sum Distributions From Qualified with ease

- Access Form 4972, Tax On Lump sum Distributions From Qualified and click on Get Form to initiate.

- Utilize the tools available to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device of your choice. Edit and eSign Form 4972, Tax On Lump sum Distributions From Qualified and ensure effective communication at any step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4972 tax on lump sum distributions from qualified

Create this form in 5 minutes!

How to create an eSignature for the form 4972 tax on lump sum distributions from qualified

The way to make an electronic signature for your PDF file in the online mode

The way to make an electronic signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

The way to make an e-signature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The way to make an e-signature for a PDF file on Android

People also ask

-

What is Form 4972 and why should I use it?

Form 4972 is a tax form used to report and calculate capital gain distributions. Using Form 4972 can help you ensure that your tax reporting is accurate and compliant, maximizing your potential refunds or minimizing liabilities by accurately reporting these capital gains.

-

How can airSlate SignNow assist with signing Form 4972?

airSlate SignNow allows you to easily send and obtain signatures on your Form 4972 electronically. This service ensures that your documents are handled securely and efficiently, providing a streamlined process for both you and the signers.

-

Is there a cost associated with using airSlate SignNow for Form 4972?

The pricing for using airSlate SignNow varies based on your selected plan, but it is designed to be a cost-effective solution for both individuals and businesses. With a focus on providing excellent value, you can manage and e-sign documents like Form 4972 without breaking the bank.

-

What features does airSlate SignNow offer for managing Form 4972?

airSlate SignNow provides several features tailored to managing documents such as Form 4972, including customizable templates, electronic signatures, and real-time tracking of document status. This ensures an efficient signing process while keeping everything organized and accessible.

-

Are there integrations available with airSlate SignNow for Form 4972?

Yes, airSlate SignNow integrates seamlessly with various applications to facilitate the management of Form 4972. Whether you use CRM software or cloud storage solutions, these integrations help streamline your document workflow.

-

Can I store my signed Form 4972 securely with airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your signed documents, including Form 4972. This ensures that your sensitive information remains protected and easily accessible whenever you need it.

-

How can I share Form 4972 for signatures using airSlate SignNow?

You can share Form 4972 for signatures by simply uploading the document to airSlate SignNow and adding the recipients' email addresses. The recipients will receive a secure link to access the form and sign it digitally, making the process quick and efficient.

Get more for Form 4972, Tax On Lump sum Distributions From Qualified

Find out other Form 4972, Tax On Lump sum Distributions From Qualified

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free