8829 Simplified Method Worksheet 1992

What is the 8829 Simplified Method Worksheet

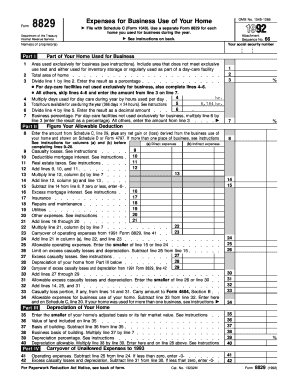

The 8829 Simplified Method Worksheet is a form used by taxpayers in the United States to calculate the expenses associated with the business use of a home. This worksheet is particularly beneficial for self-employed individuals who want to claim deductions for home office use. The simplified method allows for a standard deduction based on square footage, simplifying the process of calculating allowable expenses. It is essential for taxpayers to understand the purpose of this form to maximize their eligible deductions while ensuring compliance with IRS regulations.

How to use the 8829 Simplified Method Worksheet

Using the 8829 Simplified Method Worksheet involves several straightforward steps. First, taxpayers need to determine the total square footage of their home office space. The IRS allows a deduction of five dollars per square foot, up to a maximum of three hundred square feet. Once the square footage is established, taxpayers can fill in the worksheet with the calculated deduction amount. It's important to keep accurate records of the home office's dimensions and any related expenses to support the deduction claim during tax filing.

Steps to complete the 8829 Simplified Method Worksheet

Completing the 8829 Simplified Method Worksheet requires careful attention to detail. Here are the essential steps:

- Measure the square footage of the home office space.

- Multiply the square footage by five dollars to calculate the deduction.

- Fill in the worksheet with the calculated amount.

- Ensure that all information is accurate and complete before submission.

By following these steps, taxpayers can efficiently complete the worksheet and ensure they are claiming the correct deductions for their home office expenses.

Legal use of the 8829 Simplified Method Worksheet

The 8829 Simplified Method Worksheet is legally recognized by the IRS as a valid means for claiming home office deductions. To ensure legal compliance, taxpayers must adhere to IRS guidelines regarding home office usage. This includes using the space exclusively for business purposes and maintaining proper records to substantiate the deduction. Failure to comply with these requirements could result in penalties or disallowance of the deduction during an audit.

IRS Guidelines

The IRS provides specific guidelines for using the 8829 Simplified Method Worksheet. Taxpayers must ensure that their home office meets the criteria set forth by the IRS, including exclusive use for business and regular use. Additionally, the IRS outlines the maximum allowable deduction based on square footage. Familiarizing oneself with these guidelines is crucial for taxpayers to avoid potential issues during tax filing and to ensure they are maximizing their deductions legally.

Eligibility Criteria

To utilize the 8829 Simplified Method Worksheet, taxpayers must meet certain eligibility criteria. Primarily, the taxpayer must be self-employed or a business owner using part of their home for business purposes. The home office must be used regularly and exclusively for business activities. Additionally, the taxpayer must not have claimed home office deductions using the regular method in the same tax year. Meeting these criteria is essential for successfully claiming deductions on the worksheet.

Quick guide on how to complete 8829 simplified method worksheet

Accomplish 8829 Simplified Method Worksheet effortlessly on any gadget

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage 8829 Simplified Method Worksheet on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign 8829 Simplified Method Worksheet with ease

- Obtain 8829 Simplified Method Worksheet and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to finalize your changes.

- Select how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Edit and electronically sign 8829 Simplified Method Worksheet and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8829 simplified method worksheet

Create this form in 5 minutes!

How to create an eSignature for the 8829 simplified method worksheet

The way to make an electronic signature for your PDF file in the online mode

The way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The way to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The way to make an eSignature for a PDF file on Android

People also ask

-

What is the 8829 simplified method worksheet?

The 8829 simplified method worksheet is a crucial tool for calculating the home office deduction using the simplified method provided by the IRS. This worksheet allows you to easily determine your deductible expenses based on the square footage of your home office. By using the 8829 simplified method worksheet, you can streamline the process and maximize your deductions.

-

How can airSlate SignNow help me with my 8829 simplified method worksheet?

airSlate SignNow provides a seamless platform for eSigning and sending documents, including your 8829 simplified method worksheet. You can easily upload, sign, and share this worksheet with your tax preparer or clients. Our user-friendly interface ensures you can manage your documents efficiently.

-

Is there a cost associated with using the 8829 simplified method worksheet through airSlate SignNow?

While the 8829 simplified method worksheet itself does not have a direct cost, using airSlate SignNow may involve subscription fees based on the plan you choose. Our pricing is competitive and offers great value for businesses needing an easy-to-use document management solution. Check our website for detailed information on pricing and features.

-

What features does airSlate SignNow offer for handling the 8829 simplified method worksheet?

airSlate SignNow offers a range of features that enhance the handling of the 8829 simplified method worksheet, including electronic signatures, document templates, and secure cloud storage. You can automate workflows and track document status in real time, ensuring smooth and efficient processing. These features make it easy to manage your tax documents.

-

Can I integrate airSlate SignNow with other accounting software for my 8829 simplified method worksheet?

Yes, airSlate SignNow integrates seamlessly with various accounting software platforms to support your management of the 8829 simplified method worksheet. This means you can streamline your workflow and access all necessary tools in one place. Check our integration section for a list of compatible software.

-

What are the benefits of using airSlate SignNow for my business documents?

Using airSlate SignNow provides numerous benefits, such as reduced turnaround time, increased compliance, and enhanced security for important documents like the 8829 simplified method worksheet. You’ll streamline your eSigning process and improve collaboration with clients and team members. This helps you focus on your business while ensuring important documents are managed efficiently.

-

Is airSlate SignNow secure for handling sensitive information like the 8829 simplified method worksheet?

Absolutely, airSlate SignNow employs advanced security protocols to protect your sensitive information, including the 8829 simplified method worksheet. We utilize encryption and secure cloud storage, ensuring that your documents remain confidential and protected against unauthorized access. You can trust us with your most important business documents.

Get more for 8829 Simplified Method Worksheet

Find out other 8829 Simplified Method Worksheet

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online