8829 Form 2014

What is the 8829 Form

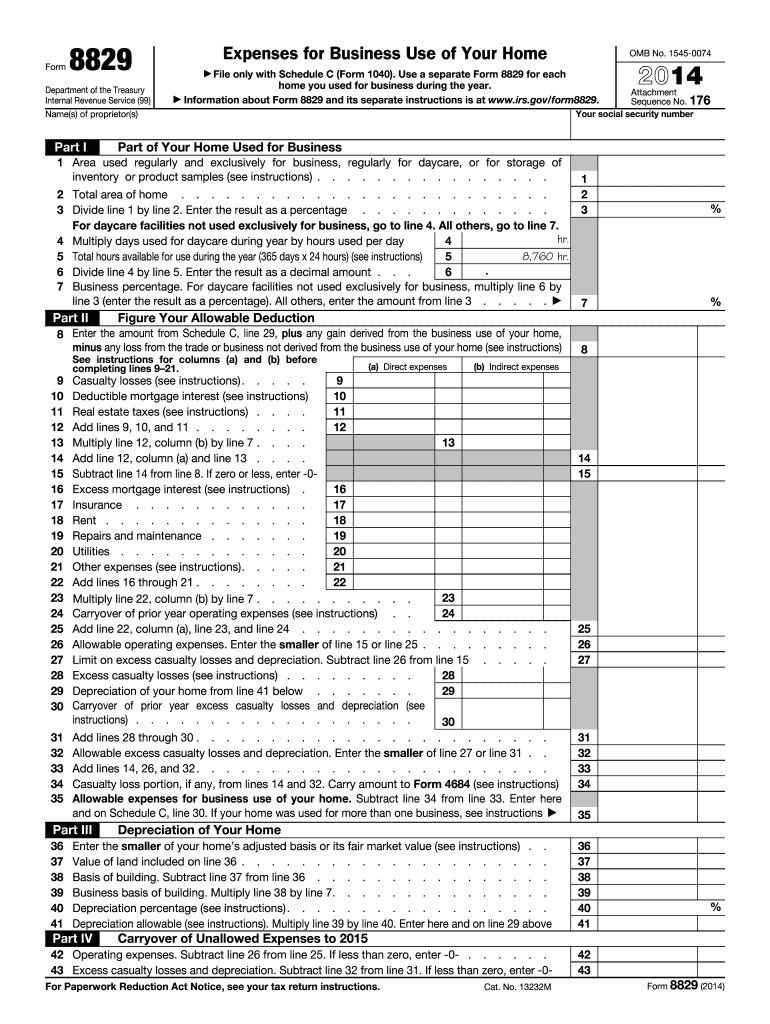

The 8829 Form, officially known as the "Expenses for Business Use of Your Home," is a tax form used by self-employed individuals and certain business owners in the United States. This form allows taxpayers to deduct expenses related to the portion of their home that is used for business purposes. By accurately completing the 8829 Form, individuals can potentially lower their taxable income, making it a valuable tool for managing business finances.

How to use the 8829 Form

To use the 8829 Form effectively, taxpayers must first determine the percentage of their home that is dedicated to business use. This can be calculated based on the square footage of the home office compared to the total square footage of the home. Once this percentage is established, various expenses can be allocated accordingly. Common expenses that can be deducted include mortgage interest, utilities, repairs, and depreciation. It is essential to keep detailed records of all expenses to support the deductions claimed on the form.

Steps to complete the 8829 Form

Completing the 8829 Form involves several key steps:

- Gather documentation of all home-related expenses, including receipts and bills.

- Calculate the total square footage of your home and the square footage of your home office.

- Determine the percentage of your home used for business by dividing the office space by the total home space.

- Fill out the form by entering the calculated percentages and total expenses in the appropriate sections.

- Review the completed form for accuracy before submitting it with your tax return.

Legal use of the 8829 Form

The 8829 Form is legally recognized by the Internal Revenue Service (IRS) as a valid means for claiming deductions related to home office expenses. To ensure compliance, it is crucial to adhere to IRS guidelines regarding eligibility and documentation. The form must be filled out accurately, and all claimed expenses should be substantiated with proper records. Misuse of the form or incorrect claims can lead to penalties or audits by the IRS.

IRS Guidelines

The IRS provides specific guidelines for using the 8829 Form, which include eligibility criteria for claiming home office deductions. Taxpayers must use a portion of their home regularly and exclusively for business purposes. The IRS also outlines which expenses are deductible and how to calculate them. Familiarizing oneself with these guidelines can help ensure that the form is completed correctly and that all eligible deductions are claimed.

Required Documents

When completing the 8829 Form, it is essential to have the following documents on hand:

- Receipts for home-related expenses, such as utilities and repairs.

- Mortgage statements or lease agreements.

- Documentation that shows the square footage of the home and the home office.

- Any other records that support the expenses being claimed.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the 8829 Form. Generally, the form is due on the same date as the individual’s tax return, which is typically April fifteenth of each year. If additional time is needed, taxpayers can file for an extension, but it is important to ensure that the form is submitted by the extended deadline to avoid penalties.

Quick guide on how to complete 2014 8829 form

Complete 8829 Form effortlessly on any device

Digital document management has become widespread among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the features to create, modify, and eSign your documents swiftly without delays. Manage 8829 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The simplest way to modify and eSign 8829 Form with ease

- Find 8829 Form and click Get Form to begin.

- Utilize the tools we provide to finish your form.

- Emphasize important sections of your documents or redact sensitive information with tools available from airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere moments and carries the same legal validity as a traditional handwritten signature.

- Review all details and click the Done button to preserve your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Alter and eSign 8829 Form to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 8829 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 8829 form

The best way to generate an electronic signature for your PDF online

The best way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is the 8829 Form and why is it important?

The 8829 Form is a tax document used by self-employed individuals to claim deductions for expenses related to the business use of their home. Understanding its requirements is crucial for maximizing tax benefits and ensuring compliance with IRS regulations.

-

How can airSlate SignNow help with filling out the 8829 Form?

airSlate SignNow offers a user-friendly platform to digitally sign and securely send your completed 8829 Form. This streamlines the process, making it easier for you to manage your tax documentation and ensure timely submission.

-

Is there a cost associated with using airSlate SignNow for the 8829 Form?

Yes, airSlate SignNow operates on a subscription-based pricing model. However, the cost is competitive and often signNowly lower than traditional methods, making it an economical choice for handling your 8829 Form and other documents.

-

What features does airSlate SignNow provide for the 8829 Form?

airSlate SignNow offers features such as document templates, customizable workflows, and secure eSigning capabilities specifically designed for forms like the 8829 Form. These tools enhance efficiency and accuracy in your tax preparation process.

-

Can I integrate airSlate SignNow with other software for my 8829 Form?

Absolutely! airSlate SignNow easily integrates with popular applications such as Google Drive, Dropbox, and CRMs, allowing you to manage your 8829 Form alongside other essential business tools seamlessly.

-

What are the benefits of using airSlate SignNow for my 8829 Form?

Using airSlate SignNow for your 8829 Form provides numerous benefits, including improved efficiency, reduced paperwork, and enhanced security for sensitive tax information. This digital solution simplifies the filing process while ensuring all paperwork is safely stored.

-

How secure is the signing process for the 8829 Form with airSlate SignNow?

The security of your 8829 Form is a top priority for airSlate SignNow. Our platform employs industry-standard encryption and robust security measures to safeguard your documents and personal information throughout the signing process.

Get more for 8829 Form

Find out other 8829 Form

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template