8829 Form 2011

What is the 8829 Form

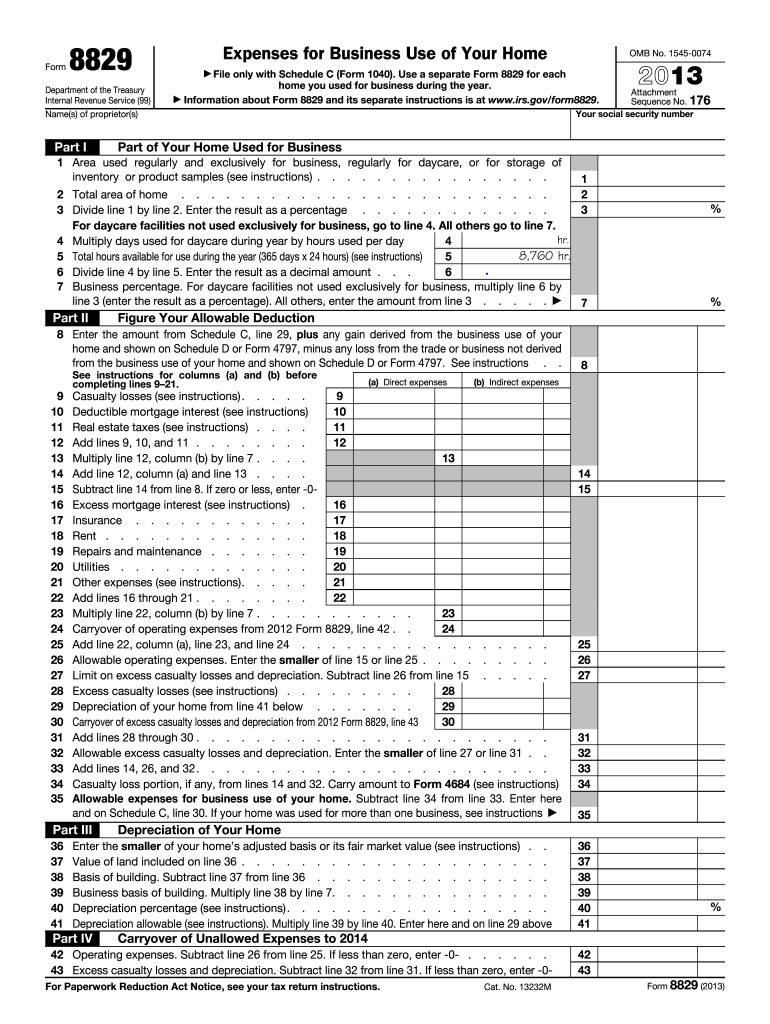

The 8829 Form, officially known as the "Expenses for Business Use of Your Home," is a tax form used by self-employed individuals in the United States to claim deductions for expenses related to the business use of their home. This form allows taxpayers to calculate the allowable expenses for their home office, including direct expenses like repairs and utilities, as well as a portion of indirect expenses such as mortgage interest and property taxes. Understanding how to accurately complete the 8829 Form is essential for maximizing tax deductions and ensuring compliance with IRS regulations.

How to use the 8829 Form

Using the 8829 Form involves several steps to ensure accurate reporting of home office expenses. Taxpayers should first determine if they qualify for the home office deduction, which typically requires that the space be used regularly and exclusively for business purposes. Once eligibility is confirmed, the next step is to gather all relevant financial records, including receipts for expenses. The form itself consists of various sections where taxpayers will enter information about the size of their home, the portion used for business, and the total expenses incurred. Completing the form accurately is crucial for a successful tax filing.

Steps to complete the 8829 Form

To complete the 8829 Form, follow these steps:

- Determine the total area of your home and the area used exclusively for business.

- Gather documentation of all expenses related to your home office, including utilities, repairs, and mortgage interest.

- Fill out Part I of the form, which details the business use of your home.

- Complete Part II, where you will enter the specific expenses you are claiming.

- Calculate the total deduction and transfer the amount to your tax return.

Legal use of the 8829 Form

The legal use of the 8829 Form is governed by IRS guidelines, which stipulate that the home office must be used regularly and exclusively for business activities. This means that personal use of the space can disqualify the deduction. Additionally, the expenses claimed must be substantiated with accurate records. Utilizing the form in accordance with IRS regulations ensures that deductions are legitimate and helps avoid potential audits or penalties.

Required Documents

When preparing to complete the 8829 Form, it is essential to have the following documents on hand:

- Mortgage statements or lease agreements.

- Utility bills for the home.

- Receipts for repairs and maintenance related to the home office.

- Property tax statements.

- Any other documentation that supports the claimed expenses.

Filing Deadlines / Important Dates

Filing the 8829 Form must align with the annual tax return deadlines. Typically, for most taxpayers, this means submitting the form by April fifteenth of the following year. If additional time is needed, taxpayers can request an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties. Keeping track of these dates is crucial for compliance and to ensure that deductions are claimed in a timely manner.

Examples of using the 8829 Form

Several scenarios illustrate the practical use of the 8829 Form. For instance, a freelance graphic designer working from home may use a dedicated room as an office. By measuring the square footage of the office and the entire home, they can determine the percentage of their home used for business. Another example includes a consultant who uses a portion of their basement exclusively for client meetings. In both cases, accurately completing the 8829 Form allows them to claim relevant deductions, reducing their overall tax liability.

Quick guide on how to complete 2011 8829 form

Complete 8829 Form seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage 8829 Form across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign 8829 Form effortlessly

- Obtain 8829 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all information and click the Done button to save your modifications.

- Select how you wish to deliver your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign 8829 Form and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 8829 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 8829 form

How to create an electronic signature for a PDF document in the online mode

How to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is the 8829 Form and why is it important?

The 8829 Form is an IRS document used by business owners to claim deductions for home office expenses. Understanding how to fill out the 8829 Form accurately can help you maximize your tax savings and ensure compliance. It allows you to track expenses like utilities, rent, and maintenance directly related to your home office.

-

How can airSlate SignNow assist with the 8829 Form?

airSlate SignNow provides a seamless eSigning solution, allowing you to easily complete and send the 8829 Form. With our user-friendly interface, you can fill out the form digitally and get signatures quickly, making the process efficient and stress-free. This ensures that your important tax documents are organized and securely stored.

-

What are the pricing options for using airSlate SignNow for the 8829 Form?

airSlate SignNow offers several pricing packages tailored to different business needs, including options suited for freelancers, small businesses, and larger enterprises. Our plans provide flexibility with features that support the completion of documents like the 8829 Form. Visit our pricing page for detailed information on how you can get started.

-

Is airSlate SignNow secure for submitting the 8829 Form?

Absolutely! airSlate SignNow employs top-tier encryption and security protocols to protect your sensitive data while handling documents like the 8829 Form. You can trust that your information is safe during transmission and storage, ensuring peace of mind as you manage your tax documentation securely.

-

Can I integrate airSlate SignNow with other tax software for easier 8829 Form submissions?

Yes, airSlate SignNow integrates seamlessly with various tax software platforms, enhancing your workflow when it comes to submitting documents like the 8829 Form. These integrations allow you to sync your information and save time, ensuring a smooth experience while managing your tax forms and filings.

-

What features does airSlate SignNow offer for managing the 8829 Form?

With airSlate SignNow, you can enjoy features such as templates, document tracking, and automated reminders tailored for the 8829 Form. These functionalities streamline your workflow, making it easy to manage your home office deductions effectively. Plus, our platform allows collaboration with other stakeholders in your business.

-

How does airSlate SignNow improve the efficiency of processing the 8829 Form?

airSlate SignNow improves efficiency by digitizing the entire document process, allowing you to fill out and eSign the 8829 Form quickly. The platform reduces turnaround time, eliminates the need for printing, scanning, and mailing, thus streamlining your workflow. This means you can focus more on your business rather than on paperwork.

Get more for 8829 Form

- Sales tax return form city of centennial

- Acr99019ai form

- Real property conveyance fee statement of value and receipt form

- Senior citizen must be at least age 65 by december 31st of the year for which the exemption is sought form

- Form d5 ampquotnotification of dissolution or surrenderampquot ohio

- Application for vendors license to make taxable sales form

- Tbor 1 form

- Application for international fuel tax agreement ifta ohio form

Find out other 8829 Form

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form