Form 8829 2023

What is the Form 8829

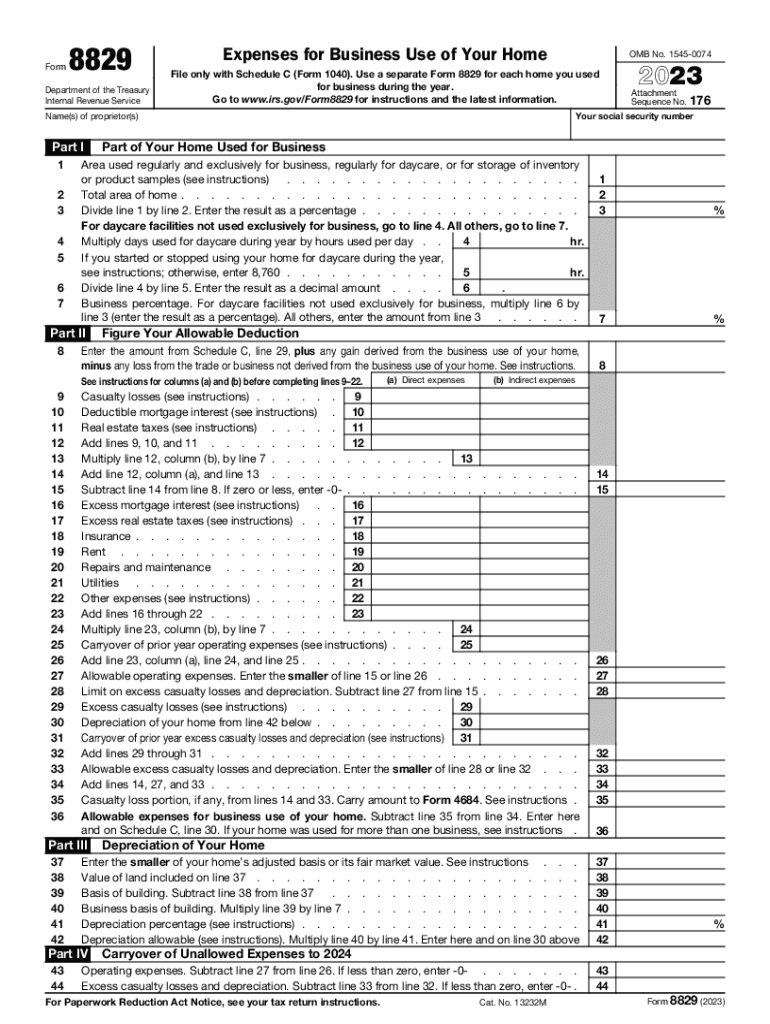

The 2018 Form 8829 is an essential tax document used by self-employed individuals and certain business owners in the United States to calculate and claim the home office deduction. This form allows taxpayers to report expenses related to the business use of their home, which can significantly reduce taxable income. The IRS Form 8829 is specifically designed to help individuals determine the allowable expenses for their home office, ensuring compliance with IRS regulations.

How to use the Form 8829

To effectively use the 2018 Form 8829, taxpayers must first ensure they qualify for the home office deduction. This involves confirming that a portion of their home is used exclusively and regularly for business activities. Once eligibility is established, individuals can fill out the form by detailing their home office expenses, which may include direct expenses, indirect expenses, and depreciation. Accurate record-keeping is crucial, as it supports the figures reported on the form and can help in case of an audit.

Steps to complete the Form 8829

Completing the 2018 Form 8829 involves several key steps:

- Determine eligibility for the home office deduction.

- Gather necessary documentation, such as utility bills, mortgage interest statements, and repair receipts.

- Calculate the square footage of the home office compared to the total home size.

- Fill out the form by entering direct and indirect expenses in the appropriate sections.

- Complete the calculation of the allowable deduction based on the total expenses reported.

- Transfer the deduction amount to the appropriate line on the tax return.

Legal use of the Form 8829

The 2018 Form 8829 must be used in accordance with IRS guidelines to ensure legal compliance. Taxpayers must accurately report all eligible expenses and maintain proper documentation to support their claims. Misuse of the form or claiming ineligible expenses can lead to penalties and interest charges from the IRS. Understanding the legal framework surrounding the home office deduction is crucial for taxpayers to avoid potential issues with their filings.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 8829. Taxpayers should refer to the IRS instructions for Form 8829 to understand the eligibility criteria, allowable expenses, and any limitations that may apply. The guidelines emphasize the importance of exclusive and regular use of the home office space for business purposes. Additionally, the IRS may update these guidelines periodically, so it is essential to refer to the most current information when preparing the form.

Required Documents

To complete the 2018 Form 8829 accurately, taxpayers should gather several key documents, including:

- Mortgage interest statements or rent receipts.

- Utility bills for the home.

- Receipts for repairs and maintenance related to the home office.

- Records of any depreciation calculations for the home.

- Documentation supporting the square footage of the home office.

Eligibility Criteria

To qualify for the home office deduction using the 2018 Form 8829, taxpayers must meet specific eligibility criteria set by the IRS. These include using a portion of the home exclusively for business purposes, conducting business activities regularly from that space, and ensuring that the home office is the principal place of business or a place where clients meet. Understanding these criteria is essential for accurately completing the form and claiming the deduction.

Quick guide on how to complete form 8829

Complete Form 8829 effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the appropriate forms and securely store them online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and without hassle. Manage Form 8829 on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to edit and eSign Form 8829 without any effort

- Find Form 8829 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to preserve your modifications.

- Choose how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to missing or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and eSign Form 8829 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8829

Create this form in 5 minutes!

How to create an eSignature for the form 8829

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2018 Form 8829 and why is it important?

The 2018 Form 8829 is used to claim expenses for business use of your home. It is essential for business owners seeking to maximize their tax deductions by accurately reporting home office expenses. Completing this form correctly can lead to signNow savings on your tax return.

-

How can airSlate SignNow assist with the 2018 Form 8829?

airSlate SignNow provides a streamlined way to prepare and eSign your 2018 Form 8829. Our platform simplifies document management, allowing you to focus on filling out the form accurately and securely. With our easy-to-use interface, getting your Form 8829 ready is efficient and hassle-free.

-

What features does airSlate SignNow offer for managing the 2018 Form 8829?

Our platform offers features like document eSigning, templates, and collaboration tools, which make it easy to manage the 2018 Form 8829. You can easily invite team members to review the form and track changes in real-time. This ensures that your form is accurate before submission.

-

Is airSlate SignNow affordable for small businesses needing the 2018 Form 8829?

Yes, airSlate SignNow is a cost-effective solution for small businesses. We offer competitive pricing plans that cater to various business sizes and needs, making it easy to eSign and manage important documents like the 2018 Form 8829 without breaking the bank.

-

Can I integrate airSlate SignNow with other software for handling the 2018 Form 8829?

Absolutely! airSlate SignNow integrates with a variety of software solutions, including accounting and tax preparation tools. This integration allows you to pull relevant information into your 2018 Form 8829 seamlessly, making the process of completing your form even quicker.

-

What are the benefits of using airSlate SignNow for the 2018 Form 8829?

Using airSlate SignNow for the 2018 Form 8829 provides benefits like enhanced security for your documents, ease of access, and the ability to obtain legally binding eSignatures. Our platform ensures that your information is protected while facilitating efficient workflows.

-

Can airSlate SignNow help me with past years' Form 8829?

While our primary focus is the 2018 Form 8829, airSlate SignNow can help you create and manage documents related to prior years. You can draft, eSign, and store all relevant documents securely on our platform, making it easier to keep your financial records organized.

Get more for Form 8829

- Kasaysayan ng guardians form

- Anti corruption form

- Family composition 248195229 form

- Tb skin test verification 06 10 clovis unified school district form

- Tool box talk form stepchangeinsafety

- Application for breakbond title form

- The local butcher overview news ampamp competitors form

- Lease file checklist 422624583 form

Find out other Form 8829

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple