About Form 8829, Expenses for Business Use of Your HomeInstructions for Form 8829 Internal Revenue ServiceAbout Form 8829, Expen 2022

Understanding Form 8829: Expenses for Business Use of Your Home

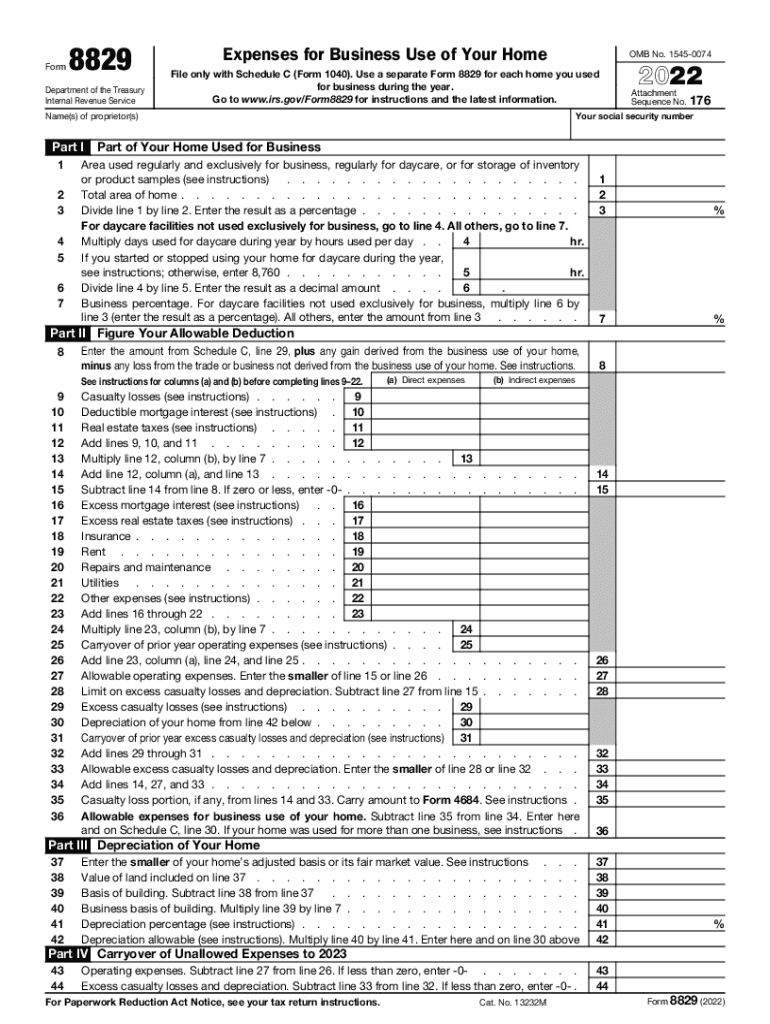

Form 8829 is a crucial document for individuals who wish to claim deductions for expenses related to the business use of their home. This form allows self-employed individuals and certain employees to report expenses associated with maintaining a home office. Key expenses that can be claimed include mortgage interest, utilities, repairs, and depreciation. Understanding how to properly fill out Form 8829 is essential for maximizing tax benefits while ensuring compliance with IRS regulations.

Steps to Complete Form 8829

Completing Form 8829 involves several steps that require careful attention to detail. First, you need to determine the percentage of your home used for business purposes. This is typically calculated by dividing the area used for business by the total area of your home. Next, gather all relevant expense records, including mortgage statements and utility bills. The form will guide you through entering these expenses, ensuring you categorize them correctly. Finally, review the completed form for accuracy before submitting it with your tax return.

Eligibility Criteria for Using Form 8829

To utilize Form 8829, you must meet specific eligibility criteria. Primarily, you must be self-employed or an employee who works from home for the convenience of your employer. The space used for business must be your principal place of business or a space used regularly and exclusively for business activities. Additionally, you must have incurred expenses related to the operation of your home office. Understanding these criteria can help you determine if you qualify for the deductions available through this form.

IRS Guidelines for Form 8829

The IRS provides detailed guidelines for completing Form 8829, which are essential for ensuring compliance. These guidelines outline what constitutes business use of a home, the types of expenses that can be deducted, and how to calculate the allowable deduction. It is important to familiarize yourself with these regulations to avoid errors that could lead to penalties or audits. The IRS also emphasizes the need for proper documentation to support your claims, reinforcing the importance of maintaining accurate records.

Common Mistakes When Filing Form 8829

Filing Form 8829 can be straightforward, but several common mistakes can lead to complications. One frequent error is miscalculating the percentage of the home used for business, which can result in incorrect deductions. Another mistake is failing to keep adequate records of expenses, which the IRS requires for substantiation. Additionally, some taxpayers overlook the necessity of using the correct version of the form for the tax year in question. Being aware of these pitfalls can help ensure a smoother filing experience.

Digital vs. Paper Submission of Form 8829

Form 8829 can be submitted either digitally or via paper, each method having its own advantages. Digital submission allows for quicker processing and confirmation of receipt by the IRS. It also reduces the risk of lost documents. Conversely, paper submissions may be preferred by those who are more comfortable with traditional methods. Regardless of the chosen method, it is essential to ensure that the form is completed accurately and submitted on time to avoid any penalties.

Quick guide on how to complete about form 8829 expenses for business use of your homeinstructions for form 8829 2020internal revenue serviceabout form 8829

Prepare About Form 8829, Expenses For Business Use Of Your HomeInstructions For Form 8829 Internal Revenue ServiceAbout Form 8829, Expen effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle About Form 8829, Expenses For Business Use Of Your HomeInstructions For Form 8829 Internal Revenue ServiceAbout Form 8829, Expen on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to alter and eSign About Form 8829, Expenses For Business Use Of Your HomeInstructions For Form 8829 Internal Revenue ServiceAbout Form 8829, Expen with ease

- Locate About Form 8829, Expenses For Business Use Of Your HomeInstructions For Form 8829 Internal Revenue ServiceAbout Form 8829, Expen and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark signNow sections of your documents or conceal sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign About Form 8829, Expenses For Business Use Of Your HomeInstructions For Form 8829 Internal Revenue ServiceAbout Form 8829, Expen and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8829 expenses for business use of your homeinstructions for form 8829 2020internal revenue serviceabout form 8829

Create this form in 5 minutes!

People also ask

-

What is Form 8829 and why is it important?

Form 8829 is used by business owners to calculate the expenses related to using a portion of their home for business. It's crucial for ensuring compliance with IRS regulations while maximizing allowable deductions. By properly filling out Form 8829, you can lower your taxable income and save money.

-

How can airSlate SignNow help with Form 8829?

airSlate SignNow streamlines the process of preparing and signing Form 8829. Our platform allows you to electronically fill out the form, ensuring all necessary fields are completed accurately. With airSlate SignNow, you can quickly send Form 8829 for eSignature, simplifying tax filing.

-

Is there a cost associated with using airSlate SignNow for Form 8829?

Yes, airSlate SignNow operates on a subscription model with pricing that caters to various business needs. The cost depends on the plan selected, but it remains cost-effective for most users. This investment can save you time and potential fees associated with filing inaccuracies related to Form 8829.

-

Can I integrate airSlate SignNow with other applications for Form 8829?

Absolutely! airSlate SignNow can be integrated with numerous applications, making it easier to manage your documents. These integrations help streamline your workflows for handling Form 8829 and ensure you have all necessary data from other systems effortlessly.

-

What features does airSlate SignNow offer for handling Form 8829?

airSlate SignNow provides a range of features specifically designed for document management, including templates, workflow automation, and secure eSigning. These tools enable you to prepare Form 8829 efficiently and ensure that it meets IRS standards for submission. Furthermore, you can track the status of the form easily.

-

How does airSlate SignNow ensure the security of my Form 8829?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols to protect your documents, including Form 8829, both during transmission and while stored on our servers. This commitment to security ensures that your sensitive information remains confidential.

-

What are the benefits of using airSlate SignNow for Form 8829?

Using airSlate SignNow for Form 8829 provides several benefits, including time savings, improved accuracy, and ease of use. Our platform simplifies the whole process, allowing you to focus on your business, while still ensuring that your taxes are filed correctly. Plus, the electronic signature feature expedites approvals.

Get more for About Form 8829, Expenses For Business Use Of Your HomeInstructions For Form 8829 Internal Revenue ServiceAbout Form 8829, Expen

Find out other About Form 8829, Expenses For Business Use Of Your HomeInstructions For Form 8829 Internal Revenue ServiceAbout Form 8829, Expen

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple