Form 8829 Expenses for Business Use of Your Home 2020

What is the Form 8829 Expenses For Business Use Of Your Home

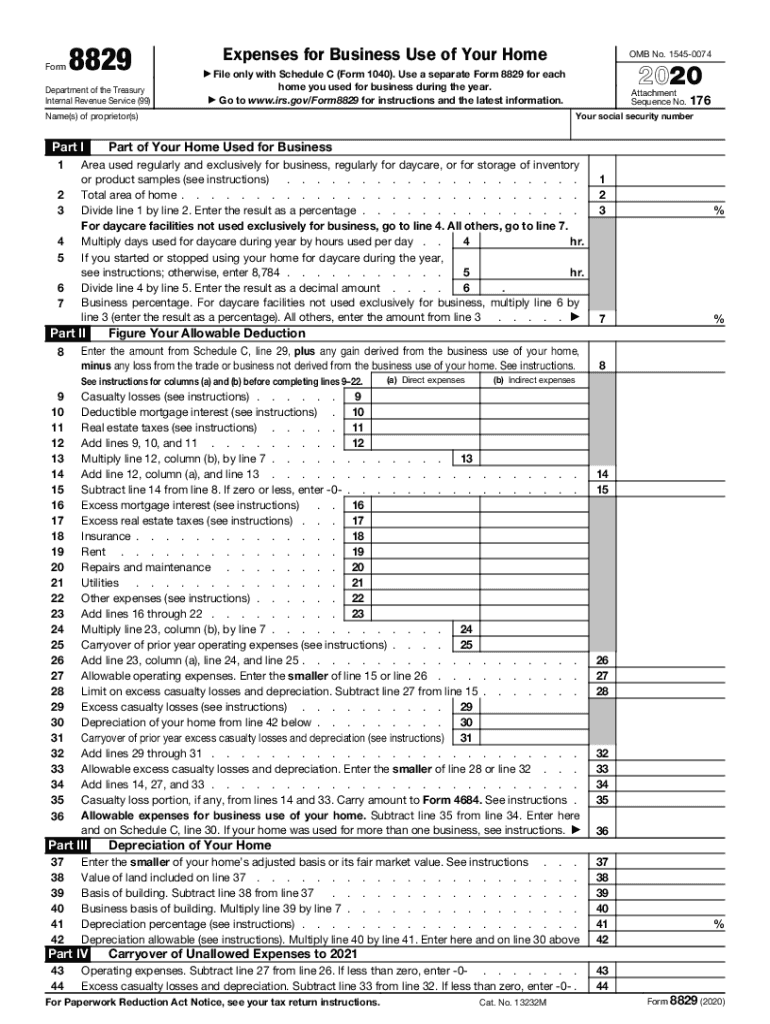

The Form 8829, officially known as the Expenses for Business Use of Your Home, is a tax form used by self-employed individuals to calculate the deductible expenses related to the business use of their home. This form allows taxpayers to determine the portion of their home expenses that can be allocated to their business activities, which may include mortgage interest, utilities, repairs, and depreciation. Understanding how to properly utilize this form is essential for maximizing deductions and ensuring compliance with IRS regulations.

How to use the Form 8829 Expenses For Business Use Of Your Home

Using the Form 8829 involves several steps to accurately report expenses associated with your home office. First, you need to determine if you qualify for the deduction by meeting specific criteria, such as using part of your home exclusively for business. Next, gather all relevant documentation, including receipts and invoices for home-related expenses. The form requires detailed information about the size of your home and the area used for business purposes. After filling out the form, you will calculate your total expenses and determine the allowable deduction, which will be reported on your tax return.

Steps to complete the Form 8829 Expenses For Business Use Of Your Home

Completing the Form 8829 involves a systematic approach:

- Determine eligibility: Ensure you meet the IRS criteria for claiming home office deductions.

- Gather documentation: Collect all necessary receipts and records of expenses related to your home.

- Fill in personal information: Provide your name, address, and other identifying details on the form.

- Calculate space used: Measure the area of your home used for business and the total square footage of your home.

- List expenses: Itemize all relevant expenses, including mortgage interest, utilities, and repairs.

- Complete calculations: Follow the form’s instructions to calculate your total deductible expenses.

- Review and submit: Double-check your entries for accuracy before submitting the form with your tax return.

IRS Guidelines

The IRS provides specific guidelines for completing Form 8829, which must be adhered to in order to ensure compliance. It is essential to keep accurate records of all expenses and to understand the distinctions between personal and business use of your home. The IRS outlines the types of expenses that can be deducted, including direct expenses, which are solely for the business area, and indirect expenses, which benefit the entire home. Familiarizing yourself with these guidelines can help avoid potential issues during tax filing.

Eligibility Criteria

To qualify for the deductions on Form 8829, certain eligibility criteria must be met. The space used for business must be your principal place of business, or a space used regularly and exclusively for business activities. Additionally, the taxpayer must be self-employed or a partner in a business to claim these deductions. Understanding these criteria is crucial for ensuring that you can legitimately claim the expenses related to your home office.

Required Documents

When preparing to complete the Form 8829, several documents are necessary to substantiate your claims. This includes:

- Receipts for home-related expenses, such as utilities, repairs, and mortgage interest.

- Documentation showing the square footage of your home and the area used for business.

- Any relevant tax documents from previous years that may affect your current deductions.

Having these documents organized and readily available will simplify the process of filling out the form and ensure accuracy in your claims.

Quick guide on how to complete 2020 form 8829 expenses for business use of your home

Effortlessly Prepare Form 8829 Expenses For Business Use Of Your Home on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form 8829 Expenses For Business Use Of Your Home on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign Form 8829 Expenses For Business Use Of Your Home

- Obtain Form 8829 Expenses For Business Use Of Your Home and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically made available by airSlate SignNow.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet signature.

- Review the information and click the Done button to save your changes.

- Select your preferred delivery method for your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassles of missing or lost documents, tedious form searches, or errors that require printing new copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device you select. Modify and electronically sign Form 8829 Expenses For Business Use Of Your Home to ensure effective communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 8829 expenses for business use of your home

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 8829 expenses for business use of your home

How to create an eSignature for your PDF file online

How to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF on Android devices

People also ask

-

What is a form 8829 PDF and why is it important?

A form 8829 PDF is used to calculate the expenses for business use of your home. It's important for taxpayers who qualify to claim deductions for home office expenses, which can signNowly impact tax returns.

-

How can airSlate SignNow help me with form 8829 PDF?

airSlate SignNow allows you to easily fill out, eSign, and securely send your form 8829 PDF. Our user-friendly platform simplifies the process, ensuring you can complete your tax documents without hassle.

-

Is there a cost to use airSlate SignNow for form 8829 PDF?

Yes, airSlate SignNow offers competitive pricing plans to accommodate different business needs. Whether you’re a small business or a large corporation, our plans are designed to be cost-effective while providing full access to features for handling your form 8829 PDF and more.

-

What features does airSlate SignNow offer for managing form 8829 PDF?

airSlate SignNow provides features such as document editing, eSigning, and automated workflows for managing your form 8829 PDF. These tools streamline your process, making document management efficient and straightforward.

-

Can I integrate airSlate SignNow with other tools for my form 8829 PDF?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, enhancing your productivity when working on form 8829 PDF. You can connect with tools like Google Drive, Dropbox, and more for easier access and storage.

-

How secure is my data when using airSlate SignNow for form 8829 PDF?

Your data is highly secure with airSlate SignNow. We use industry-standard encryption and robust security measures to ensure your form 8829 PDF and any personal information are protected at all times.

-

Can I track changes made to my form 8829 PDF with airSlate SignNow?

Absolutely! airSlate SignNow includes tracking features that allow you to monitor changes made to your form 8829 PDF, ensuring that every edit and signature is documented for future reference.

Get more for Form 8829 Expenses For Business Use Of Your Home

Find out other Form 8829 Expenses For Business Use Of Your Home

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document