Form 8829 2016

What is the Form 8829

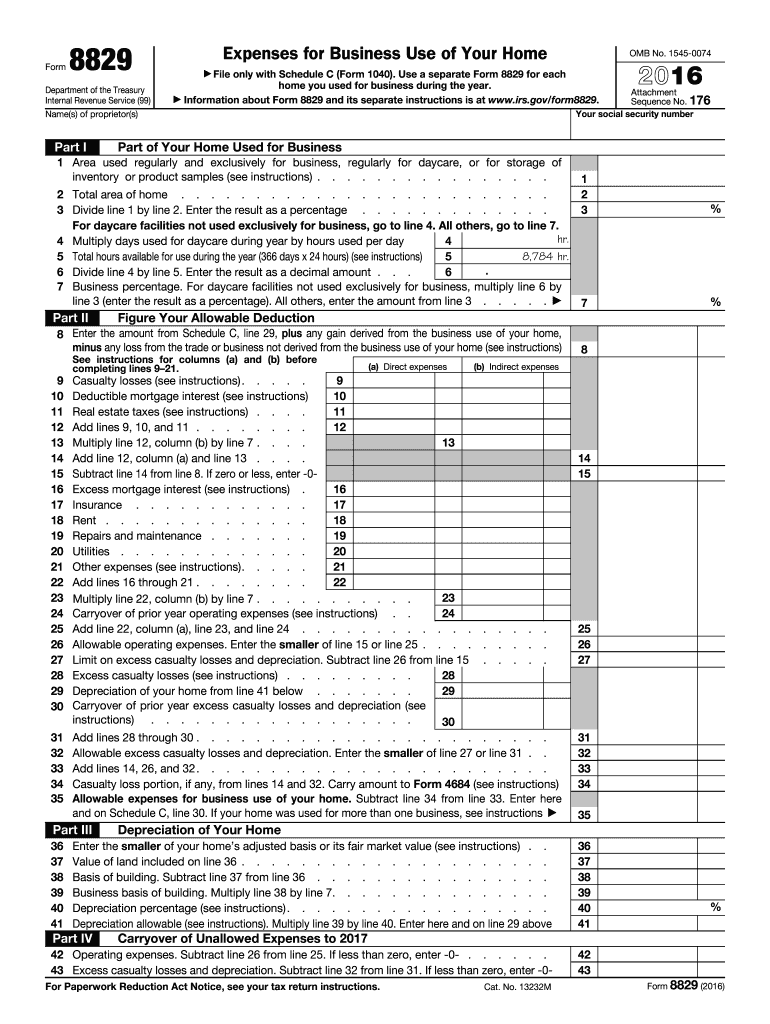

The Form 8829, officially known as the Expenses for Business Use of Your Home, is a tax form used by individuals who wish to deduct expenses related to the business use of their home. This form is particularly relevant for self-employed individuals and small business owners who operate from their residences. By completing this form, taxpayers can calculate the allowable expenses for their home office, which may include a portion of utilities, mortgage interest, property taxes, and depreciation.

How to use the Form 8829

Using the Form 8829 involves several steps to ensure accurate reporting of home office expenses. Taxpayers must first determine the percentage of their home used for business purposes. This is typically calculated based on the square footage of the home office compared to the total square footage of the home. After establishing this percentage, individuals can list qualifying expenses, such as repairs, maintenance, and utilities. It is important to keep detailed records of all expenses to support the deductions claimed on the form.

Steps to complete the Form 8829

Completing the Form 8829 requires careful attention to detail. Here are the essential steps:

- Determine the percentage of your home used for business by measuring the office space and total home area.

- Gather all relevant expense records, including receipts for utilities, mortgage interest, and repairs.

- Fill out the form by entering the calculated business use percentage and listing all applicable expenses.

- Calculate the total deductions based on the expenses and the business use percentage.

- Attach the completed Form 8829 to your tax return when filing.

Legal use of the Form 8829

The Form 8829 is legally recognized by the IRS for reporting home office expenses. To ensure compliance, taxpayers must adhere to IRS guidelines regarding the eligibility of expenses. This includes using the space exclusively and regularly for business purposes. It is crucial to maintain accurate records and documentation to substantiate claims in case of an audit. Failure to comply with these regulations may result in penalties or disallowed deductions.

Key elements of the Form 8829

Several key elements are essential when filling out the Form 8829:

- Business Use Percentage: This is the ratio of the home office space to the total home space.

- Direct Expenses: Costs directly related to the home office, such as repairs specific to the office.

- Indirect Expenses: These are expenses for the entire home, like utilities and mortgage interest, prorated based on the business use percentage.

- Depreciation: If applicable, this allows for the deduction of the cost of the home office over time.

Filing Deadlines / Important Dates

When filing the Form 8829, it is important to adhere to tax deadlines. Typically, individual tax returns are due on April fifteenth each year. If additional time is needed, taxpayers can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. Keeping track of these dates ensures compliance and helps avoid unnecessary fees.

Examples of using the Form 8829

Examples of using the Form 8829 include scenarios where individuals operate a consulting business from home or run a small online retail shop. In these cases, they can deduct a portion of their home expenses based on the space used for business. For instance, if a taxpayer has a dedicated office that occupies ten percent of their home, they can claim ten percent of eligible expenses such as utilities and mortgage interest. This form helps maximize tax deductions for those who qualify for home office deductions.

Quick guide on how to complete form 8829 2016

Complete Form 8829 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed forms, as you can locate the necessary template and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your paperwork promptly without hold-ups. Handle Form 8829 on any device using airSlate SignNow's Android or iOS applications, and streamline any document-related process today.

The easiest method to adjust and electronically sign Form 8829 effortlessly

- Access Form 8829 and click Get Form to begin.

- Use the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced paperwork, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Change and electronically sign Form 8829 and ensure exceptional communication at any phase of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8829 2016

Create this form in 5 minutes!

How to create an eSignature for the form 8829 2016

How to generate an electronic signature for your Form 8829 2016 online

How to create an electronic signature for your Form 8829 2016 in Google Chrome

How to generate an electronic signature for putting it on the Form 8829 2016 in Gmail

How to generate an electronic signature for the Form 8829 2016 from your smart phone

How to make an eSignature for the Form 8829 2016 on iOS devices

How to make an electronic signature for the Form 8829 2016 on Android devices

People also ask

-

What is Form 8829 and how can airSlate SignNow help with it?

Form 8829 is used for claiming expenses for business use of your home. With airSlate SignNow, you can easily create, send, and eSign your Form 8829 digitally, streamlining the process of filing your taxes and ensuring accuracy in your submissions.

-

How much does airSlate SignNow cost for using forms like Form 8829?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. You can start with a free trial and choose a plan that fits your budget, allowing you to efficiently manage documents like Form 8829 without breaking the bank.

-

Can I integrate airSlate SignNow with my accounting software for Form 8829?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, making it easy to manage your Form 8829 alongside your financial documents. This integration helps streamline your workflow and keeps all your important information in one place.

-

Is it secure to eSign Form 8829 with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security and complies with industry standards to ensure your eSigned Form 8829 is safe. Your data is encrypted, and we implement advanced security measures to protect your documents from unauthorized access.

-

What features does airSlate SignNow offer for managing Form 8829?

airSlate SignNow provides a range of features for managing Form 8829, including customizable templates, easy document sharing, and real-time tracking of signatures. These features help you stay organized and efficient while handling your business expenses.

-

How can I ensure my Form 8829 is completed correctly using airSlate SignNow?

To ensure your Form 8829 is completed correctly, airSlate SignNow offers guided workflows and pre-filled templates that minimize errors. Additionally, you can collaborate with team members to review the form before submission, ensuring accuracy.

-

Can I access my Form 8829 on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is mobile-friendly, allowing you to access and manage your Form 8829 on any device. This flexibility enables you to sign documents and track their status on the go, making it convenient for busy professionals.

Get more for Form 8829

Find out other Form 8829

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free