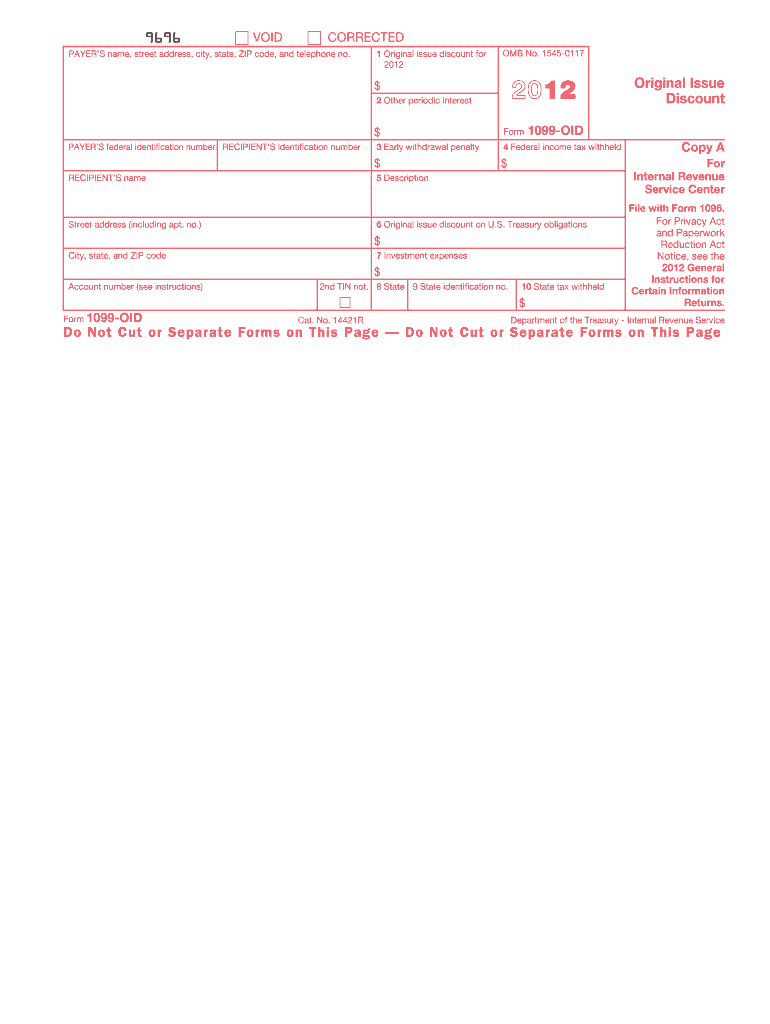

1099 Oid Form 2012

What is the 1099 Oid Form

The 1099 OID Form, officially known as the Original Issue Discount Information Return, is a tax document used in the United States to report original issue discounts on certain types of debt instruments. This form is essential for both issuers and holders of these financial instruments, as it provides information on the amount of interest income that must be reported for tax purposes. The form is typically issued by banks, financial institutions, or other entities that issue bonds or notes that have an original issue discount.

How to use the 1099 Oid Form

To use the 1099 OID Form, taxpayers must first receive it from the issuer of the debt instrument. Once received, the form provides the necessary details to report the original issue discount as income on the taxpayer's federal tax return. It is crucial to accurately input the information from the form into the appropriate sections of the tax return, ensuring compliance with IRS regulations. Taxpayers should keep a copy of the 1099 OID Form for their records, as it serves as proof of income reported to the IRS.

Steps to complete the 1099 Oid Form

Completing the 1099 OID Form involves several steps:

- Gather necessary information, including the issuer's details, taxpayer identification number, and the amount of original issue discount.

- Fill out the form accurately, ensuring that all fields are completed, including the recipient's name and address.

- Report the total amount of original issue discount in the appropriate section of the form.

- Review the completed form for accuracy before submitting it to the IRS.

- Keep a copy of the form for personal records.

Legal use of the 1099 Oid Form

The legal use of the 1099 OID Form is governed by IRS regulations, which require accurate reporting of income derived from original issue discounts. Failure to report this income can lead to penalties and interest charges. It is essential for both issuers and recipients to understand their responsibilities regarding this form to ensure compliance with tax laws. The form must be filed by the issuer with the IRS, and recipients must report the income on their tax returns to avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 OID Form are critical for compliance. Typically, issuers must send the form to recipients by January thirty-first of the year following the tax year in which the original issue discount was realized. Additionally, the form must be filed with the IRS by the end of February if submitted on paper, or by March thirty-first if filed electronically. It is important to adhere to these deadlines to avoid penalties.

Who Issues the Form

The 1099 OID Form is issued by financial institutions, banks, and other entities that provide debt instruments with original issue discounts. These issuers are responsible for compiling the necessary information regarding the original issue discount and providing it to both the IRS and the recipients of the form. Understanding who issues the form is important for taxpayers to ensure they receive the necessary documentation for accurate tax reporting.

Quick guide on how to complete 1099 oid 2012 form

Complete 1099 Oid Form effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to generate, modify, and electronically sign your documents promptly without delays. Handle 1099 Oid Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to amend and electronically sign 1099 Oid Form effortlessly

- Locate 1099 Oid Form and hit Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides for that specific purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Decide how you want to send your form—via email, SMS, invitation link, or download it to your computer.

Disregard lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from any device of your choice. Edit and electronically sign 1099 Oid Form and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 oid 2012 form

Create this form in 5 minutes!

How to create an eSignature for the 1099 oid 2012 form

The best way to make an eSignature for your PDF file in the online mode

The best way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is a 1099 Oid Form and why do I need it?

The 1099 Oid Form is used to report original issue discount income, typically for bonds or other debt instruments. If you earn interest on investments that qualify, the IRS requires that you report this income using the 1099 Oid Form. Utilizing airSlate SignNow can help streamline the eSigning process for these forms, ensuring timely submission and compliance.

-

How can airSlate SignNow assist with filling out the 1099 Oid Form?

airSlate SignNow provides an efficient way to fill out and electronically sign your 1099 Oid Form. Our platform allows you to easily input necessary information and securely send your completed form to recipients or tax professionals. This simplifies the process and ensures accuracy when filing your taxes.

-

Is airSlate SignNow cost-effective for handling multiple 1099 Oid Forms?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Our solution allows for bulk processing of documents, including multiple 1099 Oid Forms, which can signNowly reduce administrative costs and time. Consider our subscription options to find the best fit for your needs.

-

What features does airSlate SignNow offer for managing 1099 Oid Forms?

With airSlate SignNow, you can easily create, edit, and manage your 1099 Oid Forms. Features include customizable templates, secure cloud storage, and integrated tracking for sent documents. These tools enhance your workflow and ensure that your forms are always organized and accessible.

-

Can I integrate airSlate SignNow with my accounting software for 1099 Oid Forms?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software platforms, making it easy to manage your 1099 Oid Forms directly from your preferred tools. This integration allows for smoother data transfer and reduces the chances of errors during the tax filing process.

-

What are the benefits of using airSlate SignNow for 1099 Oid Form submissions?

Using airSlate SignNow for your 1099 Oid Form submissions provides numerous benefits, including enhanced security, reduced turnaround times, and improved accuracy. Our electronic signature solution ensures that your forms are signed and submitted promptly, helping you stay compliant with IRS regulations.

-

How secure is my information when using airSlate SignNow for 1099 Oid Forms?

Security is a top priority at airSlate SignNow. Your information, including 1099 Oid Forms, is protected with advanced encryption and secure data storage protocols. You can trust that your sensitive financial documents are safe and handled with the utmost confidentiality.

Get more for 1099 Oid Form

- Register now for aua practice management conference aua form

- Articulation partnerships for concorde california form

- Tmdsas application handbook official tmdsas guide to the texas universities medical application process form

- For new studentsccri community college of rhode island form

- Fillable health insurance marketplace statement form 1095 a

- Practice management conference aua2019 form

- Disclosure concerning arbitration and class action waiver form

- Rental application form davies property management

Find out other 1099 Oid Form

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure