Form IRS 1099 NEC Fill Online, Printable, Fillable 2024-2026

Understanding the IRS Form 1099 OID

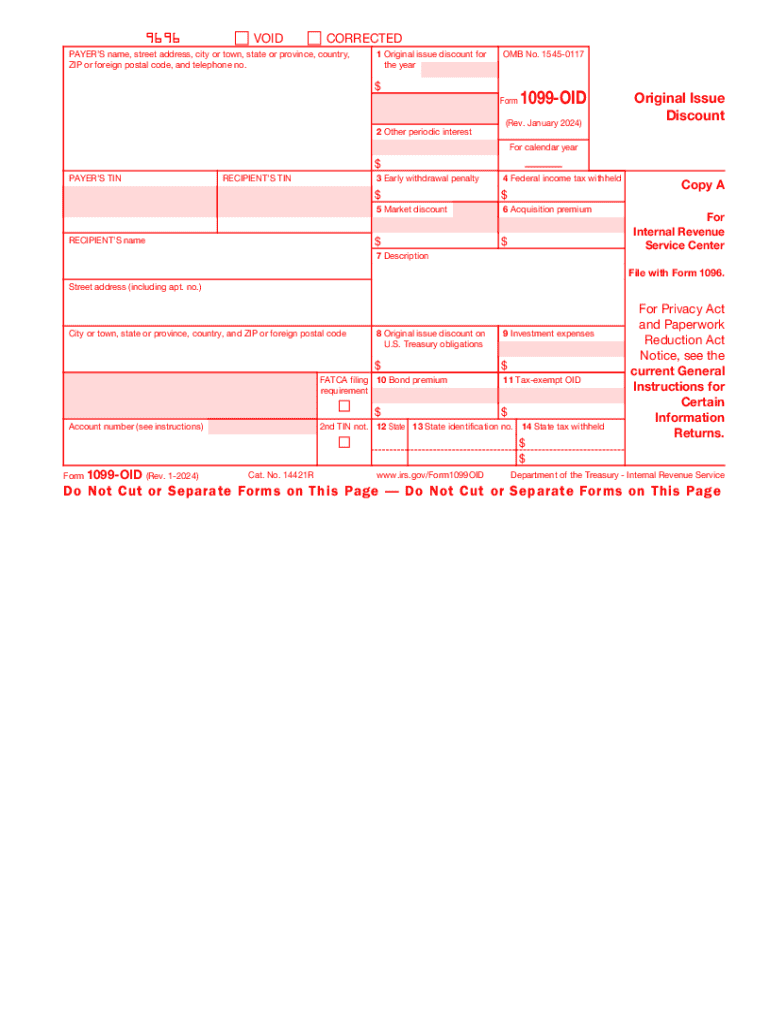

The IRS Form 1099 OID, or Original Issue Discount, is a tax document used to report the amount of original issue discount income that a taxpayer has received during the tax year. This form is particularly relevant for bondholders or investors who receive interest income from bonds issued at a discount. The form helps the IRS track income that may not be reported in traditional interest payments.

How to Complete the IRS Form 1099 OID

Completing the IRS Form 1099 OID involves several key steps. First, gather all necessary information, including the taxpayer's name, address, and taxpayer identification number (TIN). Next, report the total amount of original issue discount income in Box 1. If applicable, include any federal income tax withheld in Box 4. It is crucial to ensure that all information is accurate to avoid penalties.

Filing Deadlines for IRS Form 1099 OID

The deadline for filing the IRS Form 1099 OID is typically January thirty-first of the year following the tax year in which the income was received. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Timely filing is essential to avoid penalties and ensure compliance with IRS regulations.

Legal Use of the IRS Form 1099 OID

The IRS Form 1099 OID is legally required for reporting original issue discount income. Failure to file this form when required can result in significant penalties, including fines and interest on unpaid taxes. It is important for taxpayers to understand their obligations regarding this form to maintain compliance with tax laws.

Key Elements of the IRS Form 1099 OID

Key elements of the IRS Form 1099 OID include the payer's information, the recipient's information, and the amount of original issue discount income. Additionally, it may include details about any federal income tax withheld and other pertinent information related to the bond or investment. Understanding these elements is crucial for accurate reporting and compliance.

IRS Guidelines for Form 1099 OID

The IRS provides specific guidelines for completing and filing the Form 1099 OID. Taxpayers should refer to IRS Publication 1212 for detailed instructions on how to report original issue discount income. This publication outlines the requirements for various types of debt instruments and provides examples to aid in accurate reporting.

Quick guide on how to complete form irs 1099 nec fill online printable fillable

Effortlessly Prepare Form IRS 1099 NEC Fill Online, Printable, Fillable on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly option to conventional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly and without interruptions. Manage Form IRS 1099 NEC Fill Online, Printable, Fillable on any device using airSlate SignNow's Android or iOS applications and simplify any document-based task today.

The easiest method to alter and electronically sign Form IRS 1099 NEC Fill Online, Printable, Fillable effortlessly

- Find Form IRS 1099 NEC Fill Online, Printable, Fillable and click Get Form to commence.

- Make use of the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive data with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require the printing of new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any preferred device. Adjust and electronically sign Form IRS 1099 NEC Fill Online, Printable, Fillable and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form irs 1099 nec fill online printable fillable

Create this form in 5 minutes!

How to create an eSignature for the form irs 1099 nec fill online printable fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the oid amount download feature in airSlate SignNow?

The oid amount download feature in airSlate SignNow allows users to easily download the total financial amounts associated with signed documents. This feature enhances financial tracking and record-keeping for businesses, making it more efficient to manage document-related transactions.

-

How can I access the oid amount download option?

To access the oid amount download option, simply log into your airSlate SignNow account and navigate to the section where your completed documents are stored. From there, you can select the document and find the download feature that includes oid amounts, streamlining your financial management process.

-

Is there an additional cost for using the oid amount download feature?

No, there is no additional cost to use the oid amount download feature within airSlate SignNow. All users can benefit from this functionality as part of their subscription, offering a powerful tool for managing document financials without any hidden fees.

-

Can I integrate oid amount download with other software?

Yes, airSlate SignNow can be integrated with various other software systems to enhance workflow efficiency. The oid amount download feature can be seamlessly connected to your CRM or accounting tools, allowing for automatic updates and streamlined financial data management.

-

What types of documents can I use with the oid amount download feature?

You can use the oid amount download feature with any document that requires eSignature and financial transaction records. This includes contracts, invoices, and agreements, making it versatile for multiple business applications across all industries.

-

How does oid amount download help improve business efficiency?

The oid amount download feature helps improve business efficiency by providing quick access to financial information straight from signed documents. It reduces manual entry errors and speeds up financial reporting, allowing teams to focus on more strategic tasks.

-

Is oid amount download secure and compliant with data protection regulations?

Absolutely! The oid amount download feature in airSlate SignNow meets strict security standards and data protection regulations. Your data is encrypted and stored securely to ensure that sensitive financial information remains confidential and compliant with legal requirements.

Get more for Form IRS 1099 NEC Fill Online, Printable, Fillable

- Program schedule family law annual seminar plain talk on form

- No 05 3 02756 0 amana i k m fisher ampampamp stephanie j seymour form

- Fillable online application for membership sole form

- First dependency review fdprho form

- Dependency petition extended foster care ju 031300 form

- The petitioner seeking a guardianship for the child is form

- Statement and certificiation of guardian form

- Hearing findings conclusions and form

Find out other Form IRS 1099 NEC Fill Online, Printable, Fillable

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile