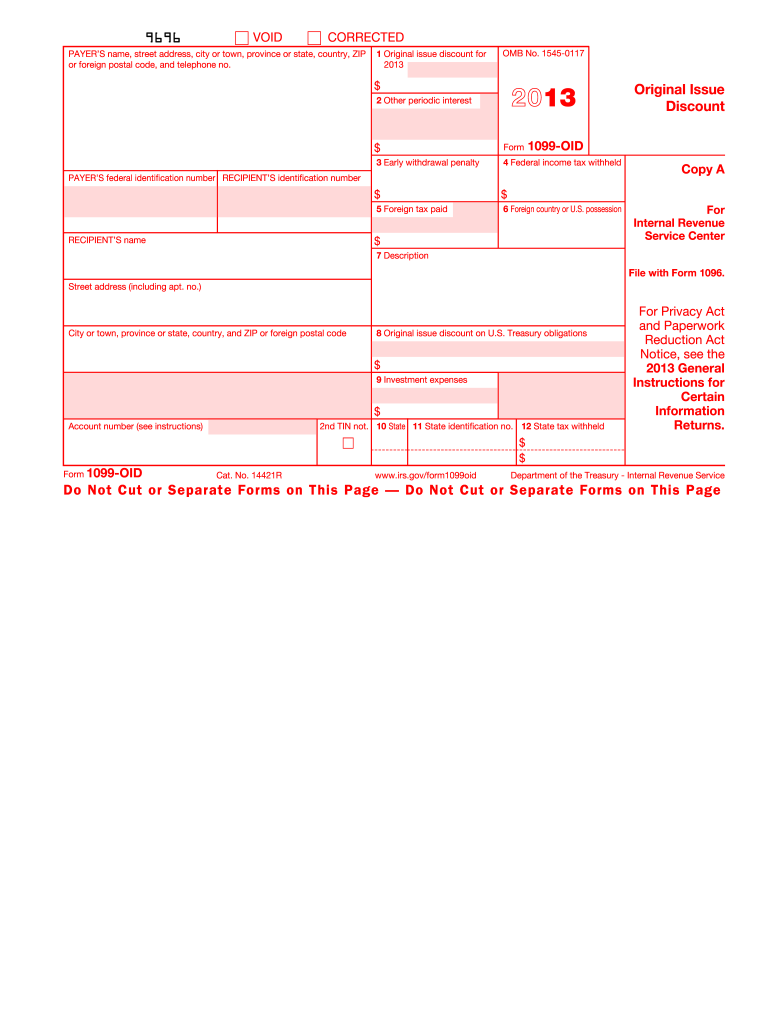

1099 Oid Form 2013

What is the 1099 Oid Form

The 1099 Oid Form is a tax document used in the United States to report original issue discount (OID) income. OID refers to the difference between the stated redemption price at maturity and the issue price of a debt instrument. This form is essential for reporting income that is not paid out in cash but is instead accrued over time. Taxpayers must report this income to the Internal Revenue Service (IRS) to ensure compliance with tax obligations.

How to use the 1099 Oid Form

To use the 1099 Oid Form, individuals or businesses must first determine if they have received OID income during the tax year. If OID income is applicable, the form must be filled out accurately, detailing the amount of OID income earned. Taxpayers should include this information when filing their tax returns. It is important to ensure that all figures are correct to avoid potential issues with the IRS.

Steps to complete the 1099 Oid Form

Completing the 1099 Oid Form involves several key steps:

- Gather relevant financial information, including the amount of OID income received.

- Obtain the correct version of the 1099 Oid Form, which can be accessed through the IRS website or tax preparation software.

- Fill in the taxpayer's identification information, including name, address, and Social Security number or Employer Identification Number.

- Report the total OID income in the appropriate section of the form.

- Review the completed form for accuracy before submission.

Legal use of the 1099 Oid Form

The legal use of the 1099 Oid Form is governed by IRS regulations. Taxpayers must file this form to report OID income accurately. Failure to report OID income can lead to penalties and interest charges from the IRS. It is crucial to adhere to the guidelines set forth by the IRS to ensure compliance and avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 Oid Form are critical for compliance. Generally, the form must be submitted to the IRS by the end of January of the following year. Additionally, recipients of the form should receive their copies by the same deadline. It is advisable to keep track of these dates to avoid late filing penalties.

Who Issues the Form

The 1099 Oid Form is typically issued by financial institutions or entities that have paid OID income to taxpayers. This may include banks, bond issuers, or other financial organizations. These entities are responsible for providing accurate information on the form to ensure that taxpayers can report their income correctly.

Quick guide on how to complete 2013 1099 oid form

Complete 1099 Oid Form effortlessly on any device

Online document management has gained popularity among enterprises and individuals. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, enabling you to access the necessary form and secure it digitally. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Handle 1099 Oid Form on any device using airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest method to edit and electronically sign 1099 Oid Form without hassle

- Find 1099 Oid Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you prefer to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign 1099 Oid Form and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 1099 oid form

Create this form in 5 minutes!

How to create an eSignature for the 2013 1099 oid form

The best way to generate an electronic signature for a PDF document in the online mode

The best way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is a 1099 Oid Form and who needs it?

The 1099 Oid Form is used to report original issue discount income that is typically applicable to bondholders. Individuals and entities who receive interest income from such financial instruments are required to fill out this form to ensure accurate tax reporting.

-

How can airSlate SignNow help with filling out a 1099 Oid Form?

airSlate SignNow provides a user-friendly platform that allows you to easily prepare and electronically sign your 1099 Oid Form. With its intuitive interface, you can complete the form quickly and ensure that all necessary information is accurately captured.

-

Is it safe to use airSlate SignNow for sensitive documents like the 1099 Oid Form?

Yes, airSlate SignNow takes security seriously. The platform uses industry-standard encryption and secure servers to protect your information, making it safe to use for sensitive documents such as the 1099 Oid Form.

-

Can I integrate airSlate SignNow with my existing accounting software for 1099 Oid Forms?

Absolutely! airSlate SignNow offers seamless integration with various accounting software, enabling you to efficiently manage your financial documents, including the 1099 Oid Form, within your existing workflow.

-

What are the key benefits of using airSlate SignNow for 1099 Oid Forms?

Using airSlate SignNow for 1099 Oid Forms simplifies the process of preparing, signing, and submitting these documents. It enhances workflow efficiency, reduces the risk of errors, and ensures compliance with tax regulations.

-

What pricing options are available for using airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs. Whether you are a small business or a larger organization, you can choose a plan that fits your budget while ensuring access to features necessary for managing 1099 Oid Forms.

-

How long does it take to complete a 1099 Oid Form using airSlate SignNow?

Completing a 1099 Oid Form using airSlate SignNow can take just minutes, thanks to the platform's streamlined design. By providing templates and easy-to-follow prompts, you can quickly fill out and finalize the form efficiently.

Get more for 1099 Oid Form

- Form 14039 sp rev 12 2020 identity theft affidavit spanish version

- Form 5471 rev december 2020 information return of us persons with respect to certain foreign corporations

- 2020 instructions for form 4797 instructions for form 4797 sales of business propertyalso involuntary conversions and recapture

- 2020 form w 4sp internal revenue service

- Form 1040 sr us tax return for seniors internal

- 2020 form 8879 c irs e file signature authorization for form 1120

- 2020 form 8829 expenses for business use of your home

- About form 2555 foreign earned incomeinternal revenue

Find out other 1099 Oid Form

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template