Form 1099 LS Rev December Internal Revenue Service 2019

What is the Form 1099 OID?

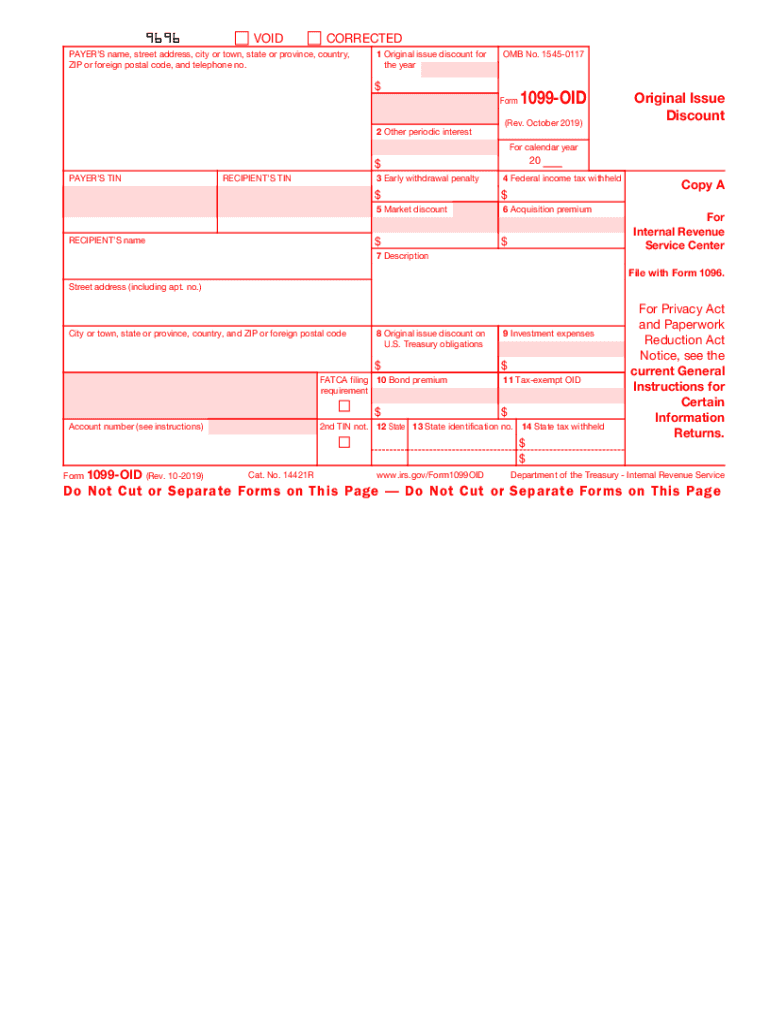

The Form 1099 OID, or Original Issue Discount form, is used to report the amount of original issue discount that has accrued on a bond or other financial instrument. This form is essential for taxpayers who have received interest income from bonds that were issued at a discount. The IRS requires this form to ensure that taxpayers accurately report their income for tax purposes. The 1099 OID form provides a clear breakdown of the interest income that must be reported on the taxpayer's annual income tax return.

Steps to complete the Form 1099 OID

Completing the Form 1099 OID involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all relevant financial documents related to the bonds or instruments that have accrued original issue discount. Next, accurately fill out the form by entering the issuer's information, the recipient's details, and the total OID amount. It is crucial to double-check all entries for accuracy, as errors can lead to complications with the IRS. Once completed, the form must be submitted to the IRS and a copy provided to the recipient.

Legal use of the Form 1099 OID

The legal use of the Form 1099 OID is governed by IRS regulations, which stipulate that the form must be used to report interest income from bonds issued at a discount. This ensures that taxpayers are compliant with federal tax laws. The form must be filed correctly and on time to avoid penalties. Additionally, the information reported on the 1099 OID must align with the taxpayer's overall income reporting to maintain transparency and legality in financial dealings.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 OID are crucial for compliance. Typically, the form must be submitted to the IRS by the end of February if filed on paper, or by the end of March if filed electronically. Recipients must also receive their copies by the same deadlines. It is important to keep track of these dates to avoid late filing penalties, which can add financial strain to the taxpayer.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Form 1099 OID. These guidelines include instructions on how to report the OID amount, the necessary information to include, and how to handle corrections if errors are discovered after submission. Familiarizing oneself with these guidelines can help ensure that the form is completed accurately and in accordance with IRS requirements.

Penalties for Non-Compliance

Failing to file the Form 1099 OID correctly or on time can result in significant penalties. The IRS imposes fines for late filings, incorrect information, and failure to provide copies to recipients. These penalties can vary based on the length of the delay and the size of the business. Understanding the consequences of non-compliance can motivate taxpayers to prioritize accurate and timely filing of this important form.

Quick guide on how to complete form 1099 ls rev december 2019 internal revenue service

Complete Form 1099 LS Rev December Internal Revenue Service effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Handle Form 1099 LS Rev December Internal Revenue Service on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign Form 1099 LS Rev December Internal Revenue Service without hassle

- Obtain Form 1099 LS Rev December Internal Revenue Service and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form—via email, text message (SMS), an invitation link, or download it to your computer.

Stop worrying about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from your selected device. Modify and eSign Form 1099 LS Rev December Internal Revenue Service while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1099 ls rev december 2019 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 1099 ls rev december 2019 internal revenue service

The way to generate an eSignature for a PDF document in the online mode

The way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What is an oid in the context of airSlate SignNow?

In the context of airSlate SignNow, an oid (object identifier) is a unique identifier assigned to documents, enabling seamless tracking and management throughout the eSigning process. This allows users to efficiently retrieve and reference specific documents, enhancing organization and workflow.

-

How does airSlate SignNow ensure document security when using oid?

airSlate SignNow prioritizes document security by implementing robust encryption methods and secure server infrastructure. Each document’s oid is protected, ensuring that sensitive information remains confidential during the eSigning process, giving users peace of mind.

-

What are the pricing options for using oid on airSlate SignNow?

airSlate SignNow offers a variety of pricing plans, starting with a basic option that includes essential features for managing oids. Each plan is designed to cater to different business needs, allowing companies to choose the most cost-effective solution that fits their document signing requirements.

-

Can I integrate oid with other applications using airSlate SignNow?

Yes, airSlate SignNow allows for easy integration with various applications through APIs that utilize oids for document management. This enhances functionality and helps businesses streamline their workflows by connecting with other tools they already use.

-

What benefits does using oid provide for businesses?

Utilizing oid in airSlate SignNow brings numerous benefits, including improved document management, easier tracking of audit trails, and enhanced organization of eSigned documents. This contributes to increased productivity, as users can quickly access the documents they need.

-

How can I track my documents using oid in airSlate SignNow?

Tracking documents with oid in airSlate SignNow is straightforward. Users can view the status of each document by its unique oid, monitor progress through the signing process, and receive alerts once actions are completed, ensuring efficient management.

-

What features related to oid does airSlate SignNow include?

airSlate SignNow offers features related to oid, such as customizable templates, real-time notifications, and detailed analytics about signing activity. These features enhance user experience and improve overall document management efficiency.

Get more for Form 1099 LS Rev December Internal Revenue Service

Find out other Form 1099 LS Rev December Internal Revenue Service

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now