1099 Oid Form 2016

What is the 1099 Oid Form

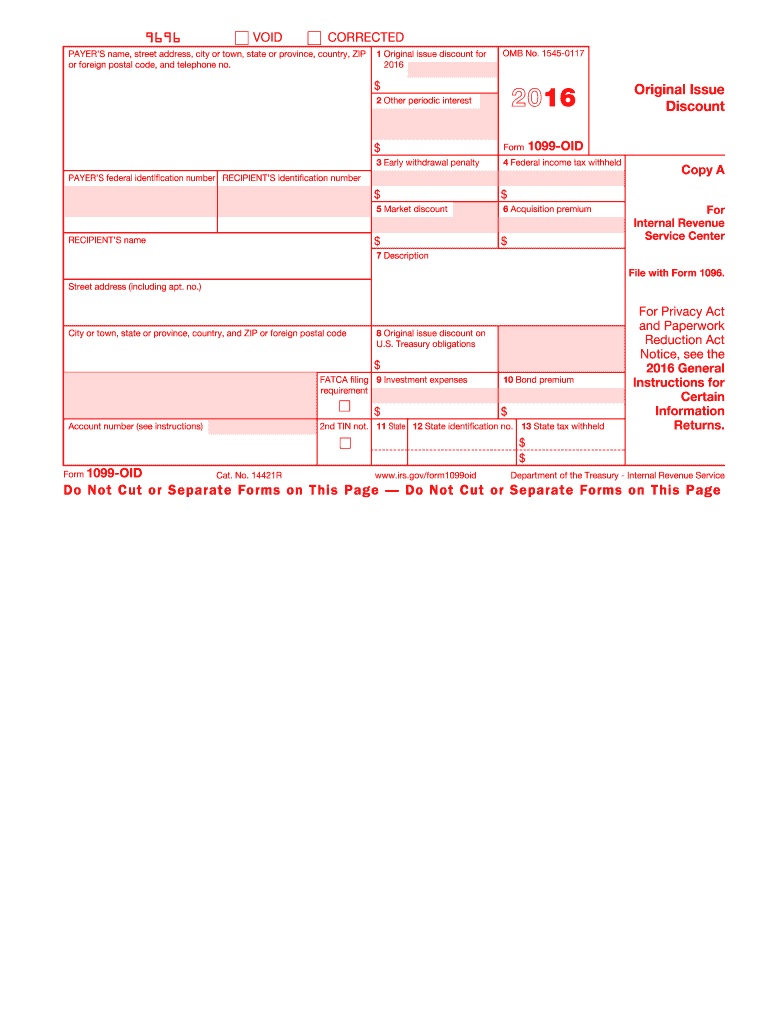

The 1099 Oid Form, officially known as the Original Issue Discount (OID) form, is a tax document used in the United States. It reports the amount of OID that a taxpayer has accrued on certain types of debt instruments. This includes bonds and other securities that are issued at a discount to their face value. The form is essential for taxpayers who need to report income that is not received in cash but rather accrued over time, allowing the IRS to track and ensure proper tax compliance.

How to use the 1099 Oid Form

Using the 1099 Oid Form involves several steps to ensure accurate reporting of income. Taxpayers must first receive the form from the issuer of the debt instrument, typically by January 31 of the following tax year. Once received, the taxpayer should review the information for accuracy, including the OID amount and any other relevant details. This form must then be included with the taxpayer's annual income tax return, typically filed by April 15. It is crucial to report the OID income on the correct line of the tax return to avoid discrepancies with the IRS.

Steps to complete the 1099 Oid Form

Completing the 1099 Oid Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including the name and taxpayer identification number (TIN) of the issuer and the taxpayer.

- Enter the total OID amount accrued during the tax year in the designated box.

- Provide any additional information required, such as the bond's issue date and maturity date.

- Review the completed form for accuracy before submission.

Key elements of the 1099 Oid Form

The 1099 Oid Form contains several key elements that are essential for proper reporting. These include:

- Issuer Information: Name, address, and TIN of the entity that issued the debt instrument.

- Recipient Information: Name, address, and TIN of the taxpayer receiving the OID.

- OID Amount: The total amount of OID that must be reported as income.

- Interest Payments: Any interest payments made during the year, if applicable.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the 1099 Oid Form. Taxpayers should refer to IRS Publication 1212, which outlines the rules for OID and how to report it correctly. It is important to follow these guidelines to ensure compliance and avoid potential penalties. The IRS requires that the form be filed with the agency and a copy provided to the taxpayer, ensuring transparency in income reporting.

Filing Deadlines / Important Dates

Timely filing of the 1099 Oid Form is crucial to avoid penalties. The form must be issued to the taxpayer by January 31 of the year following the tax year in which the OID was accrued. Additionally, the form must be filed with the IRS by the end of February if submitted on paper or by March 31 if filed electronically. Keeping track of these deadlines helps ensure compliance with IRS regulations.

Quick guide on how to complete 1099 oid 2016 form

Effortlessly Prepare 1099 Oid Form on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents quickly and without hassle. Manage 1099 Oid Form on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related tasks today.

How to Edit and eSign 1099 Oid Form with Ease

- Find 1099 Oid Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information using the tools airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhaustive form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from your preferred device. Edit and eSign 1099 Oid Form to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 oid 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 1099 oid 2016 form

How to make an eSignature for the 1099 Oid 2016 Form online

How to create an electronic signature for your 1099 Oid 2016 Form in Chrome

How to make an electronic signature for signing the 1099 Oid 2016 Form in Gmail

How to create an eSignature for the 1099 Oid 2016 Form straight from your smartphone

How to make an electronic signature for the 1099 Oid 2016 Form on iOS

How to make an electronic signature for the 1099 Oid 2016 Form on Android devices

People also ask

-

What is a 1099 Oid Form?

The 1099 Oid Form is used to report original issue discount income to the IRS. It is typically issued by financial institutions to report interest income from bonds and other debt instruments. Understanding the 1099 Oid Form is crucial for accurate tax reporting.

-

How can airSlate SignNow help with the 1099 Oid Form?

airSlate SignNow simplifies the process of sending and signing the 1099 Oid Form electronically. Our platform allows you to create, manage, and securely eSign your tax documents, ensuring compliance and efficiency. You can easily track the status of your 1099 Oid Form, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for the 1099 Oid Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including features for managing the 1099 Oid Form. Our plans are designed to be cost-effective while providing robust functionality for document management and eSigning. You can choose a plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer for managing the 1099 Oid Form?

airSlate SignNow provides a range of features for managing your 1099 Oid Form, including customizable templates, secure eSigning, and automated workflows. These features streamline the process and reduce the risk of errors, ensuring your forms are completed accurately and efficiently. Additionally, you can store and access your forms securely in the cloud.

-

Can I integrate airSlate SignNow with other software for the 1099 Oid Form?

Yes, airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage your 1099 Oid Form alongside your other financial tasks. This integration enhances workflow efficiency and ensures that your documents are seamlessly connected with your financial systems. Check our integration options to find the best fit for your needs.

-

What are the benefits of using airSlate SignNow for the 1099 Oid Form?

Using airSlate SignNow for your 1099 Oid Form comes with numerous benefits, including improved efficiency, reduced paper usage, and enhanced security. Our platform allows for quick eSigning and real-time tracking, ensuring you meet deadlines without hassle. Additionally, you can access your forms from anywhere, making remote work easier.

-

How secure is airSlate SignNow when handling the 1099 Oid Form?

airSlate SignNow prioritizes the security of your documents, including the 1099 Oid Form. We implement industry-standard encryption, secure cloud storage, and comply with privacy regulations to protect your sensitive information. You can confidently send and store your forms, knowing they are safe from unauthorized access.

Get more for 1099 Oid Form

- California manufactured certificate for transfer without probate form

- Performance testing report analysis manageengine

- Pss_rr virginia department of criminal justice services dcjs virginia form

- Experience verification form

- Dmv 8016 form

- Member packet fwhcc form

- Blank receipt of passport form

- Dundee blood pressure chart form

Find out other 1099 Oid Form

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word