1065 Form for 2014

What is the 1065 Form For

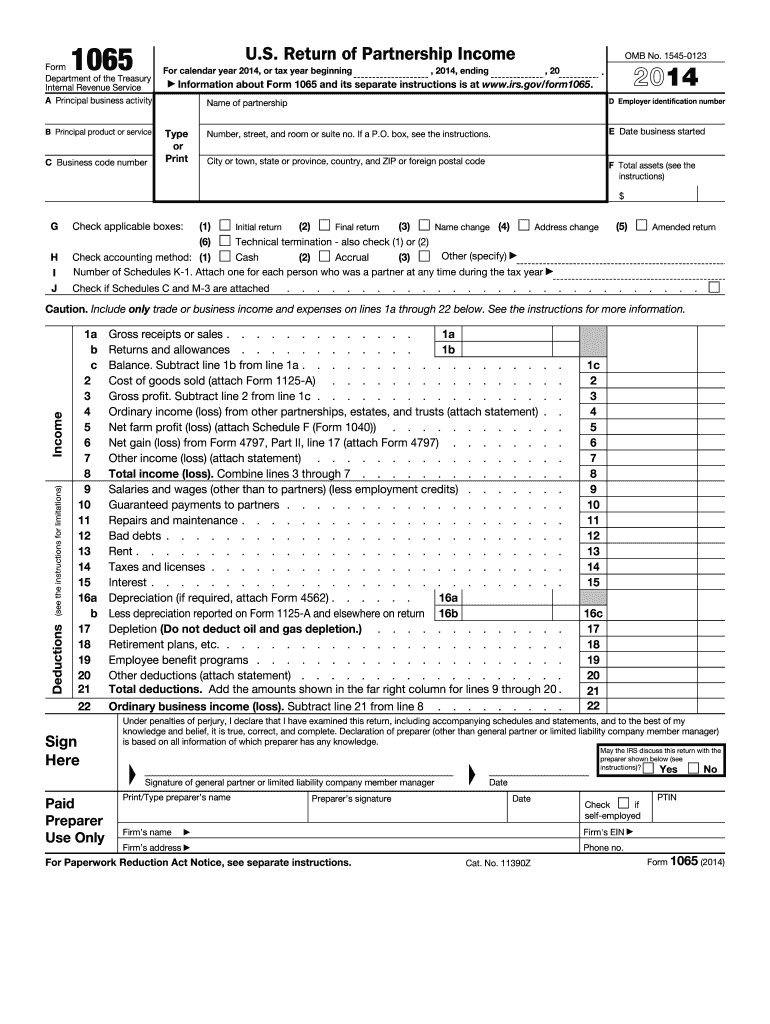

The 1065 Form is a crucial document used by partnerships in the United States to report income, deductions, gains, and losses from the partnership’s operations. It is essential for tax purposes, as it provides the Internal Revenue Service (IRS) with a comprehensive overview of the partnership's financial activities. Each partner receives a Schedule K-1, which details their share of the partnership's income, deductions, and credits, allowing them to report this information on their individual tax returns. Understanding the purpose of the 1065 Form is vital for compliance and ensuring accurate tax reporting.

Steps to Complete the 1065 Form For

Completing the 1065 Form involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary financial documents, including income statements, expense reports, and any relevant partnership agreements. Next, fill out the basic information section, which includes the partnership's name, address, and Employer Identification Number (EIN). Then, report the partnership's income and deductions on the appropriate lines, ensuring that all figures are accurate and supported by documentation. After completing the main form, prepare the Schedule K-1 for each partner, detailing their share of the partnership's income and deductions. Finally, review the entire form for accuracy before submission.

How to Obtain the 1065 Form For

The 1065 Form can be easily obtained from the IRS website or through various tax preparation software. For those who prefer a physical copy, it is available at local IRS offices and can also be requested by phone. Many tax professionals also have access to the form and can assist in its completion. It is essential to ensure that you are using the most current version of the form, as the IRS updates it periodically to reflect changes in tax laws and regulations.

Filing Deadlines / Important Dates

Filing the 1065 Form is subject to specific deadlines that partnerships must adhere to for compliance. Generally, the form is due on the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is typically due by March 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Partnerships may also request a six-month extension to file, but this does not extend the time to pay any taxes owed.

Legal Use of the 1065 Form For

The 1065 Form serves a legal purpose in documenting the financial activities of partnerships for tax purposes. It ensures transparency and compliance with IRS regulations, which is essential for avoiding penalties and legal issues. Properly completing and filing the form helps establish the legitimacy of the partnership's income and deductions. Additionally, the information provided on the 1065 Form can be used in legal contexts, such as audits or disputes, to verify the partnership's financial standing and operations.

Key Elements of the 1065 Form For

Several key elements must be included in the 1065 Form to ensure it is complete and accurate. These include the partnership's name, address, and EIN, as well as the total income, deductions, and credits. Additionally, the form requires detailed reporting of each partner's share of income, deductions, and credits through the Schedule K-1. Accurate reporting of these elements is crucial for compliance with IRS regulations and for the partners' individual tax filings.

Quick guide on how to complete 1065 form for 2014

Prepare 1065 Form For seamlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It presents an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to access the right form and securely keep it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents swiftly without delays. Manage 1065 Form For on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign 1065 Form For with ease

- Locate 1065 Form For and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or cover sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal authority as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, invite link, or download it to your PC.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 1065 Form For and ensure superb communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1065 form for 2014

Create this form in 5 minutes!

How to create an eSignature for the 1065 form for 2014

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF on Android devices

People also ask

-

What is the 1065 Form For and who needs it?

The 1065 Form For is a tax document that partnerships must file with the IRS to report income, deductions, gains, and losses. It's essential for partnerships, including multi-member LLCs, to accurately report their financial information and distribute K-1 forms to partners. Proper filing helps ensure tax compliance and can prevent penalties.

-

How can airSlate SignNow help with the 1065 Form For?

airSlate SignNow streamlines the process of completing and eSigning the 1065 Form For by providing an easy-to-use platform for document management. Users can upload their form, add necessary signatures, and send it securely to all partners for review and approval. This efficiency reduces the time spent on paperwork, allowing businesses to focus on their core operations.

-

Is there a cost associated with using airSlate SignNow for the 1065 Form For?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when managing the 1065 Form For. The plans are designed to be cost-effective, ensuring that businesses of all sizes can access the tools necessary for smooth document signing and management. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow provide for the 1065 Form For?

airSlate SignNow includes a range of features to simplify the handling of the 1065 Form For, including customizable templates, advanced eSignature options, and real-time tracking of document status. These features enhance collaboration among partners, ensuring that everyone can participate efficiently in the filing process.

-

Can I integrate airSlate SignNow with other software for the 1065 Form For?

Absolutely! airSlate SignNow offers seamless integrations with popular software tools such as Google Drive, Dropbox, and various accounting platforms. This capability allows users to easily import and export their 1065 Form For, making it a versatile solution for managing tax documents and workflows.

-

How secure is the information when using airSlate SignNow for the 1065 Form For?

Security is a top priority at airSlate SignNow. When using the platform for the 1065 Form For, all documents are encrypted, ensuring that sensitive information remains protected. Additionally, the platform complies with industry standards and regulations to give users peace of mind when managing their tax-related documents.

-

What are the benefits of using airSlate SignNow for eSigning the 1065 Form For?

Using airSlate SignNow for eSigning the 1065 Form For offers numerous benefits, including faster turnaround times for document approvals and reduced reliance on paper. The platform makes it easy to track who has signed and when, enhancing accountability among partners. Overall, it streamlines the filing process, making tax compliance simpler and more efficient.

Get more for 1065 Form For

- Tpt opt out form

- Natwest one card application form

- Additional cardholder form

- Mortgage deed form

- Clone town survey form

- Tom bosley so we had life death illness everything form

- Gmp subject access form 815 b2014b greater manchester police

- Forest school medical information form together we grow manorfarm inf bucks sch

Find out other 1065 Form For

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online