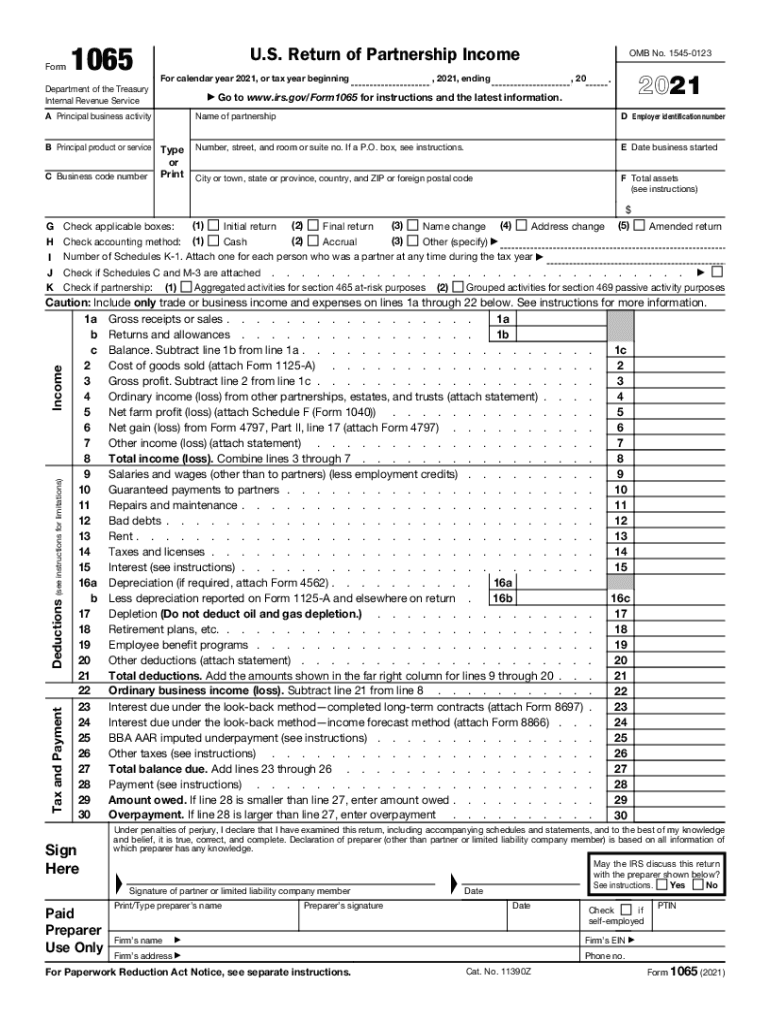

Form 1065 U S Return of Partnership Income 2021

What is the Form 1065 U.S. Return of Partnership Income

The Form 1065 is a tax return used by partnerships to report income, gains, losses, deductions, and credits from the partnership's operations. It is essential for partnerships, as it provides the IRS with a comprehensive overview of the partnership's financial activities for the year. Each partner receives a Schedule K-1, which details their share of the partnership's income and deductions, allowing them to report this information on their individual tax returns. Understanding the purpose and structure of the Form 1065 is crucial for compliance and accurate tax reporting.

Steps to Complete the Form 1065 U.S. Return of Partnership Income

Completing the Form 1065 involves several key steps:

- Gather necessary financial information, including income, expenses, and deductions for the partnership.

- Fill out the basic information section, including the partnership's name, address, and Employer Identification Number (EIN).

- Report income and deductions on the appropriate lines, ensuring accuracy in calculations.

- Complete the Schedule B, which includes questions about the partnership's operations and ownership.

- Prepare Schedule K-1 for each partner, detailing their share of income, deductions, and credits.

- Review the completed form for accuracy and ensure all required signatures are obtained.

- Submit the form to the IRS by the designated deadline.

IRS Guidelines for Form 1065

The IRS provides specific guidelines for completing and filing the Form 1065. These guidelines include:

- Filing deadlines: Form 1065 is typically due on the 15th day of the third month after the end of the partnership's tax year.

- Required signatures: The form must be signed by a partner or an authorized representative of the partnership.

- Recordkeeping: Partnerships must maintain accurate records of all income and expenses reported on the form.

- Compliance with tax laws: Partnerships must ensure that they comply with all applicable federal and state tax laws when completing the form.

Filing Deadlines / Important Dates for Form 1065

It is important to be aware of the filing deadlines for Form 1065 to avoid penalties. The standard deadline is:

- March 15 for partnerships operating on a calendar year basis.

- If the partnership has a fiscal year, the form is due on the 15th day of the third month following the end of the fiscal year.

Extensions can be requested, allowing an additional six months to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Legal Use of the Form 1065 U.S. Return of Partnership Income

The Form 1065 is legally binding when completed accurately and submitted to the IRS. It serves as an official record of the partnership's income and expenses, which can be used in legal contexts, such as audits or disputes. Ensuring that the form is filled out in compliance with IRS regulations is vital for maintaining the partnership's legal standing and avoiding potential penalties.

Who Issues the Form 1065

The Form 1065 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax administration in the United States. Partnerships must use the latest version of the form, which can be obtained directly from the IRS website or through authorized tax software. It is important to ensure that the correct version is used for the relevant tax year to comply with IRS requirements.

Quick guide on how to complete 2021 form 1065 us return of partnership income

Easily Prepare Form 1065 U S Return Of Partnership Income on Any Device

Online document management has surged in popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents quickly and without delays. Handle Form 1065 U S Return Of Partnership Income on any device with airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

The Simplest Way to Edit and Electronically Sign Form 1065 U S Return Of Partnership Income

- Find Form 1065 U S Return Of Partnership Income and click on Get Form to begin.

- Utilize the available tools to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require reprinting document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 1065 U S Return Of Partnership Income to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 1065 us return of partnership income

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 1065 us return of partnership income

How to generate an electronic signature for a PDF in the online mode

How to generate an electronic signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

How to generate an e-signature straight from your smart phone

How to make an e-signature for a PDF on iOS devices

How to generate an e-signature for a PDF document on Android OS

People also ask

-

What is form 1065 and why do I need it?

Form 1065 is used by partnerships to report income, deductions, gains, and losses. Filing this form is essential for compliance with IRS regulations, and using airSlate SignNow makes it easy to eSign and submit the form 1065 securely and efficiently.

-

How can airSlate SignNow help with my form 1065?

With airSlate SignNow, you can quickly prepare, send, and eSign form 1065, streamlining your workflow. The platform allows for easy collaboration with partners and ensures that your form 1065 is submitted on time, reducing the chances of errors.

-

What features does airSlate SignNow offer for filing form 1065?

airSlate SignNow provides advanced features such as document templates, in-person signing, and automated reminders to help you manage your form 1065 efficiently. These features ensure that the signing process is quick, accurate, and compliant with all legal requirements.

-

Is airSlate SignNow cost-effective for filing form 1065?

Yes, airSlate SignNow offers a cost-effective solution for filing form 1065. With flexible pricing plans tailored for businesses of all sizes, you can select an option that fits your budget while benefiting from powerful eSigning capabilities.

-

Can I integrate airSlate SignNow with other accounting software for form 1065?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting and financial software, making it easy to manage your form 1065 alongside your other financial documents. This integration helps maintain accuracy and efficiency in your filing process.

-

What documents do I need besides form 1065?

In addition to form 1065, you will need supporting documents such as your partnership agreement, financial statements, and K-1 forms for each partner. airSlate SignNow simplifies this process by allowing you to upload and eSign all related documents in one platform.

-

How secure is my information when using airSlate SignNow for form 1065?

airSlate SignNow prioritizes your security by employing top-grade encryption and compliance with industry standards. When you use airSlate SignNow to eSign and submit your form 1065, you can trust that your sensitive information is well-protected.

Get more for Form 1065 U S Return Of Partnership Income

- Hawaii estate 497304463 form

- Notice of dishonored check civil keywords bad check bounced check hawaii form

- Hawaii certificate form

- Mutual wills containing last will and testaments for unmarried persons living together with no children hawaii form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children hawaii form

- Mutual wills or last will and testaments for unmarried persons living together with minor children hawaii form

- Non marital cohabitation living together agreement hawaii form

- Paternity case package establishment of paternity hawaii form

Find out other Form 1065 U S Return Of Partnership Income

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure