Form 1065 2012

What is the Form 1065

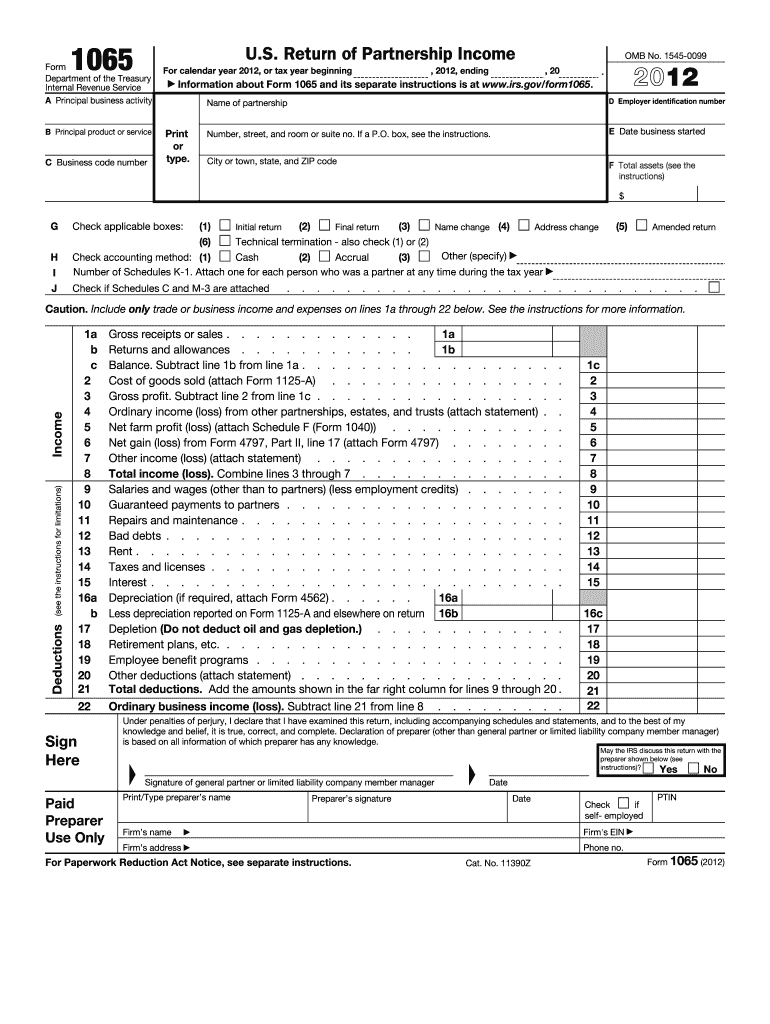

The Form 1065 is a tax document used by partnerships to report income, deductions, gains, and losses from their operations. This form is essential for partnerships to convey financial information to the Internal Revenue Service (IRS). Each partner in the partnership receives a Schedule K-1, which details their share of the partnership's income, deductions, and credits. This information is crucial for partners to accurately report their income on their individual tax returns.

How to use the Form 1065

Using the Form 1065 involves several steps to ensure accurate reporting. First, partnerships must gather all financial records, including income statements and expense reports. Next, they complete the form by providing details about the partnership, such as the name, address, and Employer Identification Number (EIN). After filling out the necessary sections, including income and deductions, the form must be signed by a partner before submission. It is important to ensure that all information is accurate and complete to avoid potential penalties.

Steps to complete the Form 1065

Completing the Form 1065 requires careful attention to detail. Here are the key steps:

- Gather necessary financial documents, including income and expense records.

- Provide the partnership's basic information, including name, address, and EIN.

- Report total income, including all sources of revenue.

- List deductions, such as operating expenses and salaries paid to partners.

- Complete the Schedule B section, answering questions about the partnership's operations.

- Fill out the Schedule K, which summarizes the partnership's income and deductions.

- Distribute the K-1 forms to each partner, detailing their share of income and deductions.

- Review the entire form for accuracy before signing and submitting it to the IRS.

Legal use of the Form 1065

The Form 1065 is legally binding when filled out correctly and submitted on time. It must comply with IRS regulations, and partnerships are required to file this form annually. Failure to file or inaccuracies can lead to penalties. Using electronic signatures through a secure platform can enhance the legal validity of the form, as long as the platform adheres to the relevant eSignature laws, such as the ESIGN Act and UETA.

Filing Deadlines / Important Dates

Partnerships must file Form 1065 by March 15 of each year, unless an extension is requested. If the deadline falls on a weekend or holiday, the due date is the next business day. It is crucial for partnerships to be aware of these deadlines to avoid late filing penalties. Extensions can be requested, allowing additional time for filing, but partnerships are still responsible for paying any taxes owed by the original due date.

Required Documents

To complete the Form 1065, partnerships need several key documents:

- Partnership agreement outlining the terms of the partnership.

- Financial statements, including income statements and balance sheets.

- Records of all income received and expenses incurred during the tax year.

- Information for each partner, including their share of income and deductions.

- Any prior year tax returns that may provide relevant information.

Quick guide on how to complete 2012 form 1065

Effortlessly Prepare Form 1065 on Any Device

Digital document management has gained traction among companies and individuals. It serves as a perfect environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Handle Form 1065 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Simplified Steps to Edit and eSign Form 1065

- Locate Form 1065 and click on Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and is legally equivalent to a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Form 1065 and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 form 1065

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 1065

The best way to create an electronic signature for your PDF in the online mode

The best way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is Form 1065 and why is it important for businesses?

Form 1065 is a partnership tax return form required by the IRS for businesses that operate as partnerships. It's crucial for reporting income, deductions, gains, and losses, as well as for informing partners of their share of the partnership's financial activities. Understanding how to properly fill out Form 1065 is essential for compliance and to avoid penalties.

-

How can airSlate SignNow help with signing Form 1065?

airSlate SignNow provides an efficient platform for electronically signing documents, including Form 1065. Our solution streamlines the signing process, making it quick and hassle-free. With advanced security features, you can ensure that your Form 1065 is signed and managed securely.

-

What are the pricing plans for using airSlate SignNow to handle Form 1065?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses looking to manage Form 1065 effectively. Whether you're a solo entrepreneur or a larger firm, we have a plan that will fit your budget and requirements. Sign up today to explore our cost-effective solutions.

-

Are there any specific features in airSlate SignNow designed for Form 1065?

Yes, airSlate SignNow includes features specifically designed to simplify the preparation and signing of Form 1065. With templates, reminders, and the ability to securely organize documents, businesses can effortlessly handle their partnership tax filings. These features make processing Form 1065 more efficient than ever before.

-

Can I integrate airSlate SignNow with other tools for handling Form 1065?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software to enhance your experience with Form 1065. This ensures that you can sync data smoothly and access all necessary documents in one place, making tax preparation easier.

-

What are the benefits of using airSlate SignNow for managing Form 1065?

Using airSlate SignNow to manage Form 1065 offers several benefits, including increased efficiency, reduced paper clutter, and enhanced security. Our platform allows you to complete tax forms quickly, enabling you to focus on other important aspects of your business while ensuring compliance with IRS regulations.

-

Is airSlate SignNow secure for handling sensitive information on Form 1065?

Yes, airSlate SignNow prioritizes the security of your data, making it a safe choice for handling sensitive information on Form 1065. We employ robust encryption and security protocols to protect your documents and ensure that your personal and financial information remains confidential.

Get more for Form 1065

- Ntrp self rate appeal form usta tennislink default page

- Share transfer form

- Wave worksheet form

- Rus6368a 96t rev 1 page 121 state atomic energy form

- Volunteer agreement form 9 19 17docx

- Child pick up authorization brent woodall foundation woodallkids form

- Golf range gizmo answer key pdf form

- Photo consent form

Find out other Form 1065

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter