1065 Form 2016

What is the 1065 Form

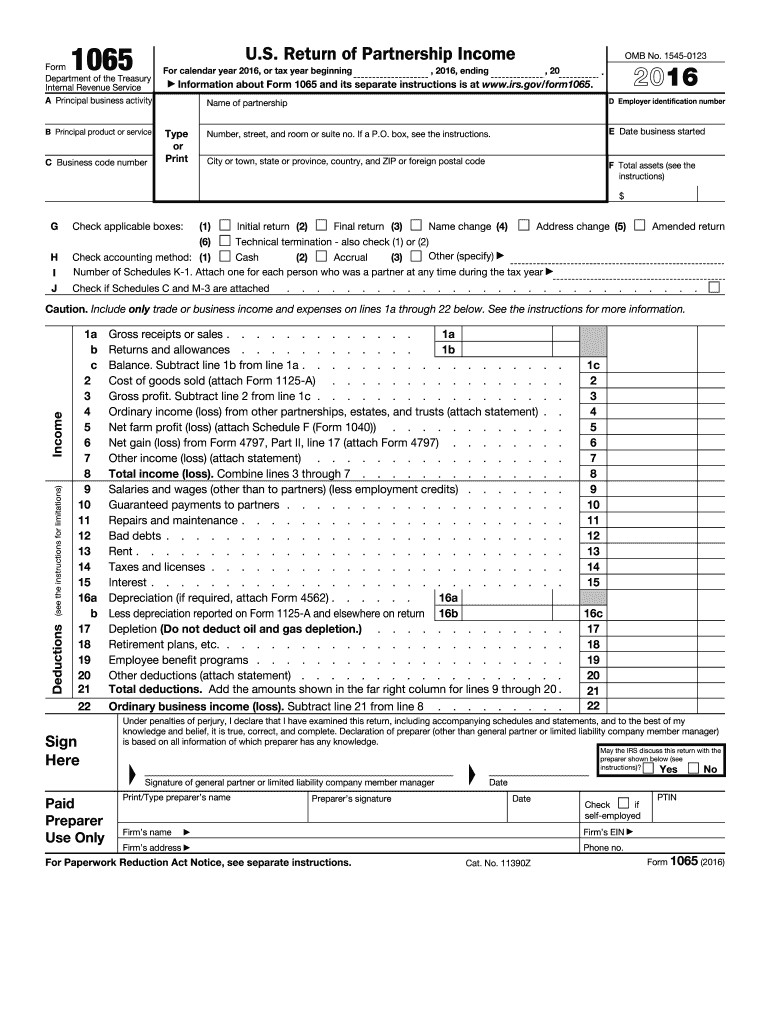

The 1065 Form, officially known as the U.S. Return of Partnership Income, is a tax document used by partnerships to report their income, deductions, gains, and losses to the Internal Revenue Service (IRS). This form is essential for partnerships, as it provides a comprehensive overview of the entity's financial activity for the tax year. Unlike corporations, partnerships do not pay income tax at the entity level; instead, the income is passed through to the individual partners, who report it on their personal tax returns. This form is typically filed annually and is crucial for ensuring compliance with federal tax regulations.

How to use the 1065 Form

Using the 1065 Form involves several steps to accurately report partnership income. First, gather all necessary financial records, including income statements, expense reports, and any other relevant documents. Next, complete the form by entering the partnership's identifying information, such as the name, address, and Employer Identification Number (EIN). Report all income and expenses in the designated sections, ensuring that each entry is supported by appropriate documentation. Once completed, the form must be signed by a partner and submitted to the IRS by the due date, which is typically March 15 for calendar-year partnerships.

Steps to complete the 1065 Form

Completing the 1065 Form requires careful attention to detail. Follow these steps for accurate submission:

- Gather financial documents, including income statements and expense records.

- Fill out the partnership's identifying information at the top of the form.

- Report total income in Part I, including gross receipts and other income sources.

- Detail deductions in Part II, ensuring all expenses are categorized correctly.

- Complete Schedule K, which summarizes the partnership's income, deductions, and credits.

- Prepare Schedule K-1 for each partner, detailing their share of income and deductions.

- Review the form for accuracy and ensure all required signatures are obtained.

- Submit the completed form to the IRS by the due date.

Legal use of the 1065 Form

The 1065 Form serves a legal purpose by ensuring that partnerships report their income and expenses accurately to the IRS. Filing this form is a requirement for partnerships, and failure to do so can result in penalties. The information provided on the form is used to determine each partner's tax liability based on their share of the partnership's income. It is crucial for partnerships to maintain accurate records and file the 1065 Form on time to comply with federal tax laws and avoid potential legal issues.

Filing Deadlines / Important Dates

Partnerships must adhere to specific deadlines when filing the 1065 Form. The standard due date for filing is March 15 for partnerships operating on a calendar year. If additional time is needed, partnerships can file for an extension, which typically allows for an additional six months. However, it is important to note that while an extension to file is granted, any taxes owed must still be paid by the original due date to avoid penalties and interest charges.

Required Documents

To complete the 1065 Form accurately, several documents are necessary. These include:

- Partnership financial statements, including income and expense reports.

- Records of all income sources, such as sales and service revenue.

- Documentation of deductions, including receipts for business expenses.

- Partner information, including Social Security numbers or EINs for each partner.

- Any prior year tax returns that may provide additional context or information.

Quick guide on how to complete 1065 form 2016

Complete 1065 Form effortlessly on any device

The management of documents online has surged in popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the requisite form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly and without delays. Manage 1065 Form on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

How to modify and eSign 1065 Form with ease

- Find 1065 Form and click on Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Select important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Verify the details and click on the Done button to save your modifications.

- Decide how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow fulfills your document management requirements in just a few clicks from a device of your preference. Edit and eSign 1065 Form to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1065 form 2016

Create this form in 5 minutes!

How to create an eSignature for the 1065 form 2016

How to create an eSignature for the 1065 Form 2016 online

How to generate an electronic signature for your 1065 Form 2016 in Google Chrome

How to make an electronic signature for putting it on the 1065 Form 2016 in Gmail

How to create an electronic signature for the 1065 Form 2016 right from your mobile device

How to make an electronic signature for the 1065 Form 2016 on iOS devices

How to create an eSignature for the 1065 Form 2016 on Android OS

People also ask

-

What is the 1065 Form and why do I need it?

The 1065 Form is a crucial tax document used by partnerships in the United States to report income, deductions, gains, and losses. If your business operates as a partnership, you are required to file this form annually with the IRS. Using airSlate SignNow, you can easily prepare, send, and eSign the 1065 Form, ensuring compliance and accuracy.

-

How can airSlate SignNow help with completing the 1065 Form?

airSlate SignNow provides a user-friendly platform that simplifies the process of completing the 1065 Form. Our solution allows you to fill out the form electronically, add signatures, and securely send it to partners or accountants. This eliminates the hassle of paper forms and speeds up the submission process.

-

Is there a cost associated with using airSlate SignNow for the 1065 Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including options for those specifically needing to manage documents like the 1065 Form. Our plans are designed to be cost-effective, providing robust features at competitive prices. You can choose a plan that fits your budget and workflow.

-

Can I integrate airSlate SignNow with other accounting software for the 1065 Form?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to streamline your workflow when preparing the 1065 Form. This integration ensures that your financial data is up-to-date and that the form is completed accurately without unnecessary duplication of work.

-

What are the benefits of using airSlate SignNow for the 1065 Form?

Using airSlate SignNow for the 1065 Form offers several benefits, including enhanced efficiency, reduced paperwork, and improved accuracy. Our platform allows for easy collaboration among partners, quick eSigning, and secure cloud storage. This ensures that your partnership's tax documents are always accessible and organized.

-

Is it easy to eSign the 1065 Form with airSlate SignNow?

Yes, eSigning the 1065 Form with airSlate SignNow is incredibly easy. Our intuitive interface allows users to sign documents electronically in just a few clicks. This not only saves time but also ensures that the signing process is legally binding and compliant with regulations.

-

Are there templates available for the 1065 Form in airSlate SignNow?

Yes, airSlate SignNow provides templates for the 1065 Form, making it simple for users to get started. These templates can be customized to fit your partnership's specific needs, ensuring that all necessary information is included. This feature helps you save time while preparing your tax documents.

Get more for 1065 Form

Find out other 1065 Form

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online