Form 1065 2018

What is the Form 1065

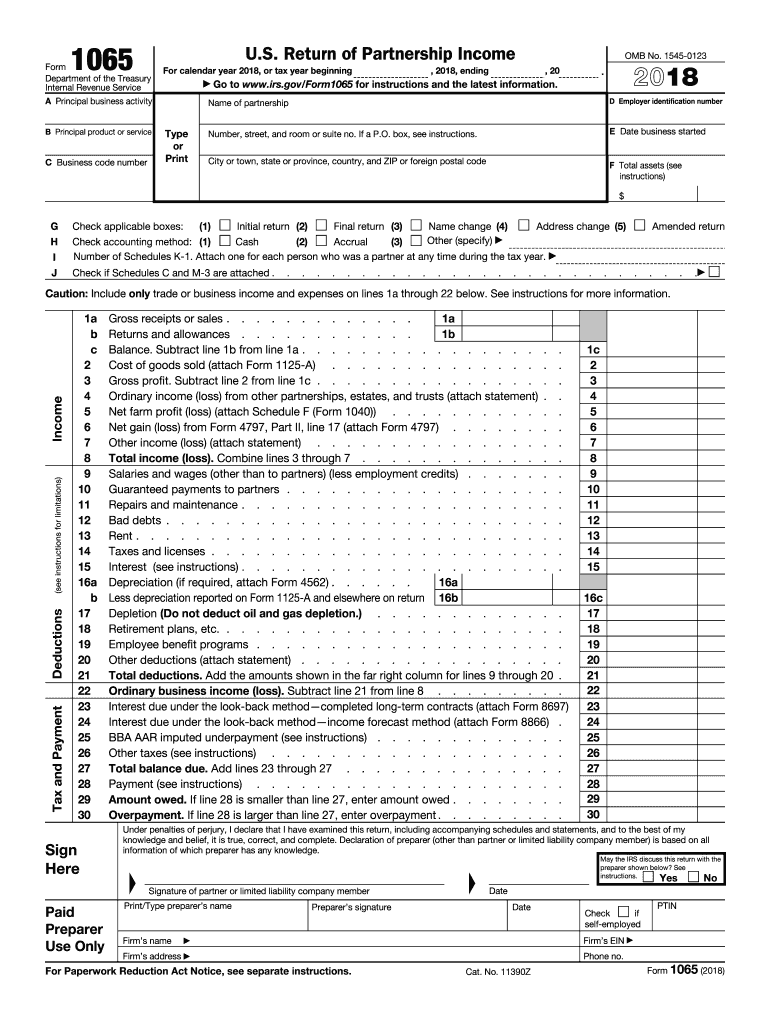

IRS Form 1065, also known as the U.S. Return of Partnership Income, is a tax form used by partnerships to report their income, deductions, gains, and losses. This form is essential for partnerships, which are defined as business entities involving two or more individuals who share profits and losses. Unlike corporations, partnerships do not pay income tax at the entity level; instead, the income is passed through to the partners, who report it on their individual tax returns. Understanding the purpose of Form 1065 is crucial for compliance and accurate tax reporting.

Steps to Complete the Form 1065

Completing IRS Form 1065 involves several key steps to ensure accurate reporting. The form consists of multiple sections, including the main form and several schedules. Here are the essential steps:

- Gather Information: Collect all necessary financial records, including income statements, expense reports, and partner information.

- Complete Page 1: Enter the partnership's general information, such as the Employer Identification Number (EIN), business name, and address. Indicate the type of return and accounting method used.

- Fill Out Schedules: Complete Schedules B, K, L, M-1, and M-2, providing detailed information about the partnership's operations and financials.

- Review and Sign: Ensure all information is accurate and complete. The form must be signed by a partner or a paid preparer before submission.

How to Obtain the Form 1065

IRS Form 1065 can be obtained through various methods, ensuring easy access for partnerships. The form is available online on the IRS website, where users can download and print it. Additionally, tax preparation software often includes the form, allowing for electronic completion and submission. Partnerships can also request a physical copy by contacting the IRS directly or visiting a local IRS office.

Filing Deadlines / Important Dates

Timely filing of IRS Form 1065 is crucial to avoid penalties. The standard deadline for filing the form is March 15 of the year following the tax year being reported. If the partnership requires additional time, it can file for an automatic six-month extension, pushing the deadline to September 15. It is important to note that while the form can be extended, any taxes owed must still be paid by the original due date to avoid interest and penalties.

Key Elements of the Form 1065

Understanding the key elements of IRS Form 1065 is vital for accurate completion. The form includes several important sections:

- Income Section: Report total income, including ordinary business income and other income sources.

- Deductions Section: Detail all allowable deductions, such as salaries, rent, and other business expenses.

- Schedule K: Provide information on each partner's share of income, deductions, and credits.

- Schedule L: Present a balance sheet showing the partnership's assets, liabilities, and capital.

Legal Use of the Form 1065

IRS Form 1065 is legally required for partnerships to report their financial activities to the IRS. Failure to file the form or inaccuracies in reporting can lead to penalties, including fines and interest on unpaid taxes. It is essential for partnerships to understand their legal obligations regarding this form, as it ensures compliance with federal tax laws and accurate reporting of income and expenses.

Quick guide on how to complete form 1065 2018 2019

Uncover the most efficient method to complete and sign your Form 1065

Are you still spending time preparing your official documents in hard copies instead of online? airSlate SignNow provides a superior way to fill out and sign your Form 1065 and associated forms for public services. Our intelligent eSignature solution equips you with everything necessary to process paperwork swiftly and in accordance with official standards - comprehensive PDF editing, management, protection, signing, and sharing features all available within a user-friendly interface.

Only a few steps are necessary to complete to fill out and sign your Form 1065:

- Upload the editable template to the editor using the Get Form button.

- Review which information you need to include in your Form 1065.

- Navigate between the fields with the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is signNow or Redact areas that are no longer relevant.

- Click on Sign to generate a legally binding eSignature using your preferred method.

- Add the Date next to your signature and finalize your task by clicking the Done button.

Store your completed Form 1065 in the Documents folder within your account, download it, or export it to your preferred cloud storage. Our solution also provides versatile file sharing options. There’s no need to print your forms when you can send them to the appropriate public office - accomplish this via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct form 1065 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

The IRS sent me a form 1065, but I am a sole proprietor. Do I ignore this form and fill out a schedule C?

I would assume that you applied for an employer identification number and checked the partnership box by mistake instead of sole proprietor. If this is the case, this requires you to obtain a new EIN.If you properly filled out the application for an EIN, you can ignore the 1065 notice.Your EIN acknowledgement letter from the IRS will state what type of return they expect you to file under the EIN.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the form 1065 2018 2019

How to generate an electronic signature for your Form 1065 2018 2019 online

How to generate an electronic signature for your Form 1065 2018 2019 in Chrome

How to generate an electronic signature for putting it on the Form 1065 2018 2019 in Gmail

How to create an electronic signature for the Form 1065 2018 2019 straight from your smartphone

How to generate an eSignature for the Form 1065 2018 2019 on iOS devices

How to make an eSignature for the Form 1065 2018 2019 on Android

People also ask

-

What is Form 1065 and why do I need it?

Form 1065 is the U.S. Return of Partnership Income, which is essential for reporting income, deductions, gains, and losses from partnerships. If you operate a partnership, completing Form 1065 is necessary for tax compliance. Using airSlate SignNow, you can easily eSign and submit your Form 1065 securely and efficiently.

-

How does airSlate SignNow simplify the eSigning of Form 1065?

airSlate SignNow streamlines the eSigning process for Form 1065 by allowing multiple users to sign documents simultaneously, reducing the time needed for completion. With its user-friendly interface, you can prepare and send your Form 1065 for signature in just a few clicks. This ensures that your tax filings are processed quickly and accurately.

-

Is airSlate SignNow compliant with the IRS for submitting Form 1065?

Yes, airSlate SignNow is compliant with IRS regulations for electronic signatures, ensuring that your eSigned Form 1065 meets all legal requirements. This compliance gives you peace of mind knowing that your partnership tax return is valid and secure. Trust airSlate SignNow to keep your documents safe while adhering to all necessary guidelines.

-

What are the key features of airSlate SignNow for managing Form 1065?

airSlate SignNow offers several features specifically designed for managing Form 1065, including customizable templates, document tracking, and in-app collaboration tools. These features allow you to efficiently prepare, send, and store Form 1065, making tax season less stressful. Additionally, you can integrate with various accounting software to streamline your workflow.

-

Can I integrate airSlate SignNow with my accounting software for Form 1065?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, enhancing your ability to manage Form 1065 efficiently. This integration allows you to pull data directly from your accounting records, reducing manual entry and minimizing errors. With this setup, preparing your Form 1065 becomes a more streamlined process.

-

What is the pricing structure for using airSlate SignNow for Form 1065?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making it cost-effective for eSigning Form 1065. You can choose from monthly or annual subscriptions, depending on your needs. Each plan includes essential features to help you manage your documents efficiently without breaking the bank.

-

How secure is my data when using airSlate SignNow for Form 1065?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like Form 1065. The platform employs bank-level encryption and secure cloud storage to protect your data from unauthorized access. You can have confidence that your personal and financial information is safe while using our eSigning services.

Get more for Form 1065

Find out other Form 1065

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast