Form 1065 U S Return of Partnership Income 2024

What is the Form 1065 U S Return Of Partnership Income

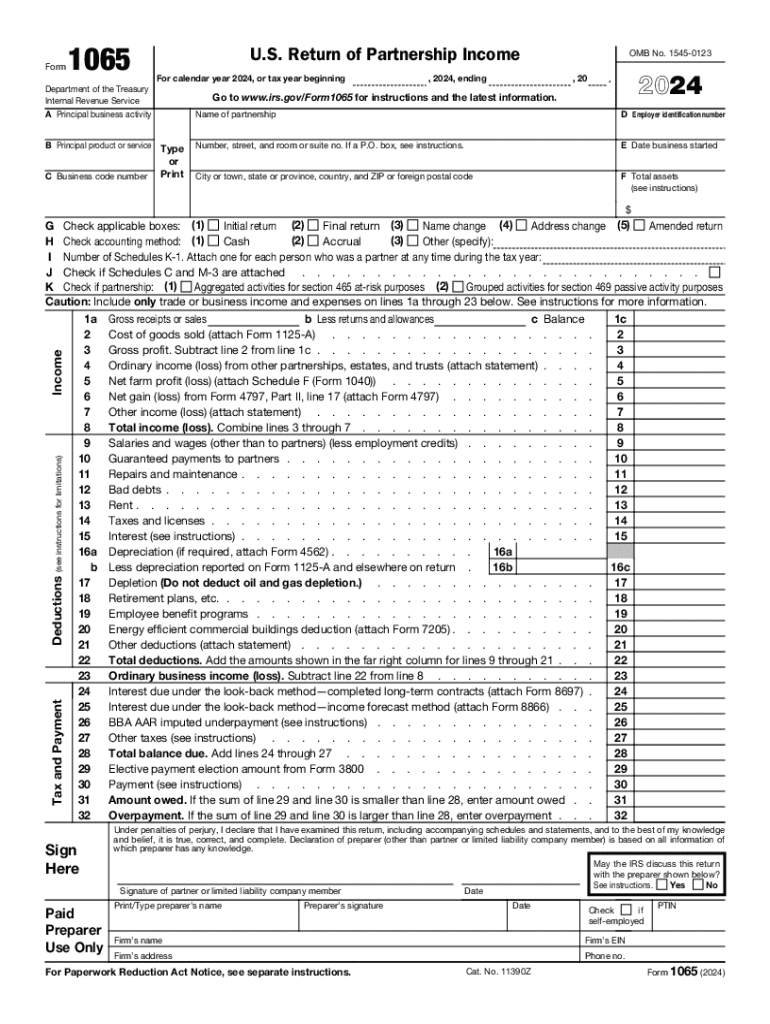

The Form 1065 is the U.S. Return of Partnership Income, a tax document used by partnerships to report their income, deductions, gains, losses, and other important financial information to the Internal Revenue Service (IRS). Partnerships, which can include general partnerships, limited partnerships, and limited liability companies (LLCs) treated as partnerships, must file this form annually. The income reported on Form 1065 is typically passed through to the individual partners, who then report it on their personal tax returns.

Steps to complete the Form 1065 U S Return Of Partnership Income

Completing Form 1065 involves several key steps:

- Gather necessary financial records, including income statements, expense reports, and balance sheets.

- Fill out the basic information section, including the partnership's name, address, and Employer Identification Number (EIN).

- Report income by completing the appropriate sections, detailing all sources of income earned by the partnership.

- List deductions and expenses to determine the partnership's net income or loss.

- Complete Schedule K, which summarizes the income, deductions, and credits for the partnership.

- Distribute Schedule K-1 to each partner, detailing their share of income, deductions, and credits.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

The Form 1065 is typically due on the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the due date is March 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Partnerships can request a six-month extension to file, but this does not extend the time to pay any taxes owed.

Legal use of the Form 1065 U S Return Of Partnership Income

Form 1065 is a legal requirement for partnerships to report their financial activities to the IRS. Filing this form accurately is crucial for compliance with federal tax laws. Failure to file or submitting incorrect information can result in penalties, including fines and interest on unpaid taxes. It is essential for partnerships to maintain accurate records and ensure that all information reported on the form is truthful and complete.

Key elements of the Form 1065 U S Return Of Partnership Income

Several key elements are critical to understanding Form 1065:

- Partnership Information: Basic details about the partnership, including its name, address, and EIN.

- Income Section: A comprehensive report of all income sources, including sales and service income.

- Deductions: A detailed list of allowable expenses that reduce the partnership's taxable income.

- Schedule K: A summary of the partnership's income, deductions, and credits that will be allocated to each partner.

- Schedule K-1: Individualized forms provided to each partner, outlining their share of the partnership's income and deductions.

How to obtain the Form 1065 U S Return Of Partnership Income

The Form 1065 can be obtained directly from the IRS website, where it is available as a downloadable PDF. Additionally, tax preparation software often includes the form, allowing for electronic filing. Partnerships may also request physical copies from local IRS offices or through tax professionals. Ensuring you have the most current version of the form is essential, especially for the tax year being reported.

Handy tips for filling out Form 1065 U S Return Of Partnership Income online

Quick steps to complete and e-sign Form 1065 U S Return Of Partnership Income online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a HIPAA and GDPR compliant solution for maximum straightforwardness. Use signNow to electronically sign and share Form 1065 U S Return Of Partnership Income for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct form 1065 u s return of partnership income

Create this form in 5 minutes!

How to create an eSignature for the form 1065 u s return of partnership income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 1065 and why is it important?

Form 1065 is a tax return used by partnerships to report income, deductions, gains, and losses. It is essential for ensuring compliance with IRS regulations and accurately reporting the partnership's financial activities. Using airSlate SignNow can simplify the process of preparing and eSigning form 1065, making it easier for businesses to manage their tax obligations.

-

How can airSlate SignNow help with form 1065?

airSlate SignNow provides an intuitive platform for creating, sending, and eSigning form 1065. With features like templates and automated workflows, businesses can streamline their tax filing process, ensuring that all necessary signatures are collected efficiently. This not only saves time but also reduces the risk of errors in the submission.

-

What are the pricing options for using airSlate SignNow for form 1065?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need basic eSigning features or advanced document management tools for form 1065, there is a plan that fits your needs. You can choose from monthly or annual subscriptions, ensuring you get the best value for your investment.

-

Is airSlate SignNow secure for handling form 1065?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents like form 1065. The platform uses advanced encryption and secure cloud storage to protect your data. Additionally, it complies with industry standards to ensure that your information remains confidential and secure.

-

Can I integrate airSlate SignNow with other software for form 1065?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, enhancing your workflow for form 1065. This allows you to import data directly from your existing systems, reducing manual entry and improving accuracy in your tax filings.

-

What features does airSlate SignNow offer for managing form 1065?

airSlate SignNow includes features such as customizable templates, automated reminders, and real-time tracking for form 1065. These tools help ensure that all parties involved can easily access and sign the document, streamlining the entire process. Additionally, you can store and manage all your signed forms in one secure location.

-

How does airSlate SignNow improve the efficiency of filing form 1065?

By using airSlate SignNow, businesses can signNowly reduce the time spent on filing form 1065. The platform automates many steps in the eSigning process, allowing for quicker turnaround times and fewer delays. This efficiency not only helps meet deadlines but also enhances overall productivity.

Get more for Form 1065 U S Return Of Partnership Income

Find out other Form 1065 U S Return Of Partnership Income

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template