Form 1065 2013

What is the Form 1065

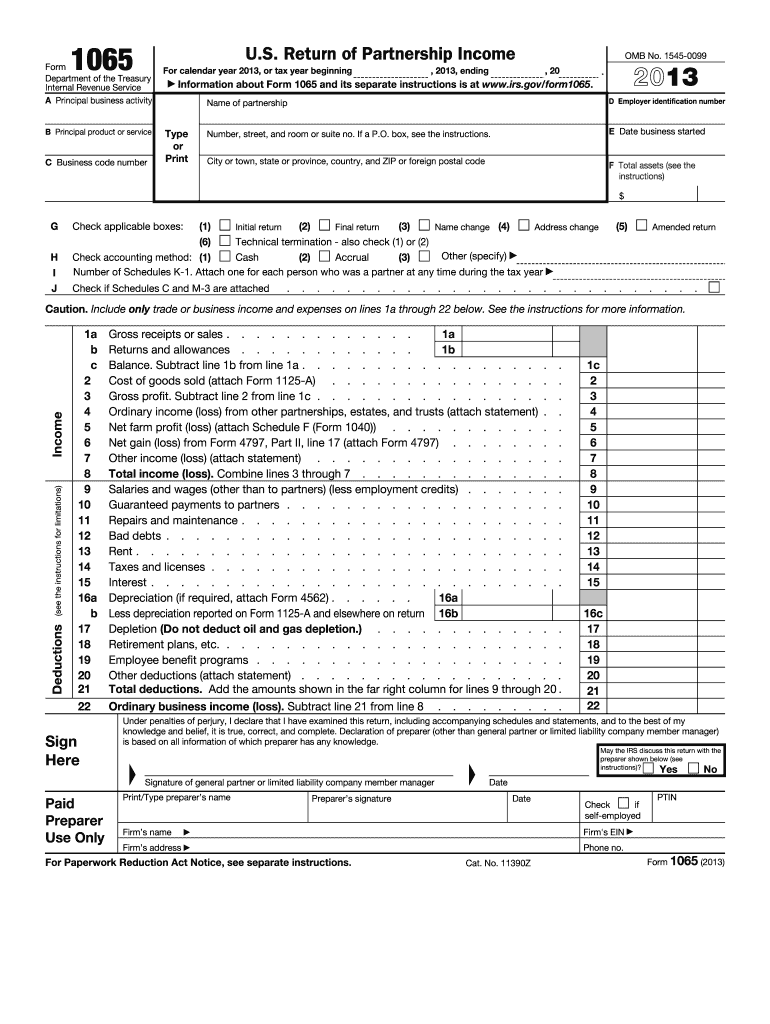

The Form 1065 is a U.S. tax document used by partnerships to report income, deductions, gains, losses, and other important financial information. It serves as an informational return, meaning it does not result in a tax liability for the partnership itself. Instead, the income and losses are passed through to the individual partners, who report them on their personal tax returns. This form is crucial for partnerships to comply with IRS regulations and maintain transparency in their financial dealings.

How to use the Form 1065

To use the Form 1065 effectively, partnerships should first gather all necessary financial documents, including income statements, expense records, and other relevant data. The form requires detailed information about the partnership's financial activities over the tax year. After filling out the form, partnerships must ensure that each partner receives a Schedule K-1, which details their share of the partnership's income, deductions, and credits. This information is essential for partners when they file their individual tax returns.

Steps to complete the Form 1065

Completing the Form 1065 involves several key steps:

- Gather all financial records, including income, expenses, and prior year tax returns.

- Fill out the basic information section, including the partnership's name, address, and Employer Identification Number (EIN).

- Report the partnership's income and deductions on the appropriate lines of the form.

- Complete the Schedule B section, which includes questions about the partnership's operations.

- Prepare the Schedule K-1 for each partner, detailing their share of income and deductions.

- Review the completed form for accuracy before submission.

Legal use of the Form 1065

The legal use of the Form 1065 is governed by IRS regulations. Partnerships must file this form annually, ensuring that all information is accurate and complete. Failure to file or inaccuracies can lead to penalties. The form must be signed by a partner or authorized representative, affirming that the information provided is true and correct to the best of their knowledge. Additionally, partnerships must comply with any state-specific requirements regarding the filing of this form.

Filing Deadlines / Important Dates

The deadline for filing Form 1065 is typically March 15 for partnerships operating on a calendar year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Partnerships can apply for a six-month extension by filing Form 7004, but this does not extend the time to pay any taxes owed. It is essential for partnerships to keep track of these deadlines to avoid penalties and interest on late filings.

Required Documents

When preparing to file Form 1065, partnerships should have the following documents ready:

- Financial statements, including profit and loss statements and balance sheets.

- Records of all income received and expenses incurred during the tax year.

- Previous year's Form 1065, if applicable, for reference.

- Partner information, including names, addresses, and Social Security Numbers or EINs.

IRS Guidelines

The IRS provides specific guidelines for completing and filing Form 1065. These guidelines include instructions on how to report various types of income and deductions, as well as how to handle specific situations such as changes in partnership structure or ownership. It is important for partnerships to refer to the latest IRS instructions for Form 1065 to ensure compliance with current tax laws and regulations.

Quick guide on how to complete 2013 form 1065

Complete Form 1065 effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the correct version and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form 1065 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Form 1065 with ease

- Find Form 1065 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form 1065 and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 1065

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 1065

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What is Form 1065 and why do I need it?

Form 1065 is an essential tax form used by partnerships to report income, deductions, and credits. It's critical for ensuring compliance with IRS requirements and provides a transparent overview of the partnership's financial standing. Using airSlate SignNow can help streamline the eSigning process for Form 1065, making it easier to gather necessary signatures quickly.

-

How can airSlate SignNow assist with eSigning Form 1065?

AirSlate SignNow offers a user-friendly platform that simplifies the eSigning process for Form 1065. With features like customizable templates and real-time tracking, users can easily manage document workflows and ensure all required signatures are obtained efficiently. This saves time and reduces the complications often associated with paper-based signing.

-

Is airSlate SignNow affordable for small businesses needing to file Form 1065?

Yes, airSlate SignNow provides a cost-effective solution perfect for small businesses that need to file Form 1065. With flexible pricing plans, users can choose the option that best fits their needs without compromising on essential features. This allows small teams to manage their signing needs without straining their budget.

-

What features does airSlate SignNow offer for managing Form 1065?

AirSlate SignNow includes various features designed to facilitate the effective management of Form 1065, such as customizable document templates, team collaboration tools, and automated reminders. With these tools, users can signNowly enhance their workflow efficiency and ensure timely submission of tax documents. Additionally, the intuitive interface makes navigating these features easy for all users.

-

Can airSlate SignNow integrate with accounting software for Form 1065?

Absolutely! AirSlate SignNow seamlessly integrates with various accounting software, allowing for smooth management of Form 1065 and other financial documents. This integration helps ensure that your data is accurate and up-to-date, making it easier to prepare your tax filings without manual data entry. Such connectivity streamlines operations and promotes efficiency in financial record-keeping.

-

How does airSlate SignNow ensure the security of Form 1065 documents?

AirSlate SignNow prioritizes the security of your documents, including Form 1065, by using advanced encryption methods and secure cloud storage. This means your sensitive information is protected throughout the signing process. Compliance with regulations such as HIPAA and GDPR further assures users that their data is handled with the highest levels of care and confidentiality.

-

What is the process to eSign Form 1065 with airSlate SignNow?

To eSign Form 1065 with airSlate SignNow, simply upload the document to the platform, add the necessary fields for signatures, and invite the relevant parties to sign. The process is designed to be intuitive, allowing you to track the document's status in real-time. This efficient workflow means you can complete the signing process swiftly, ensuring you meet your filing deadlines.

Get more for Form 1065

Find out other Form 1065

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document