Form 1065 2022

What is the Form 1065

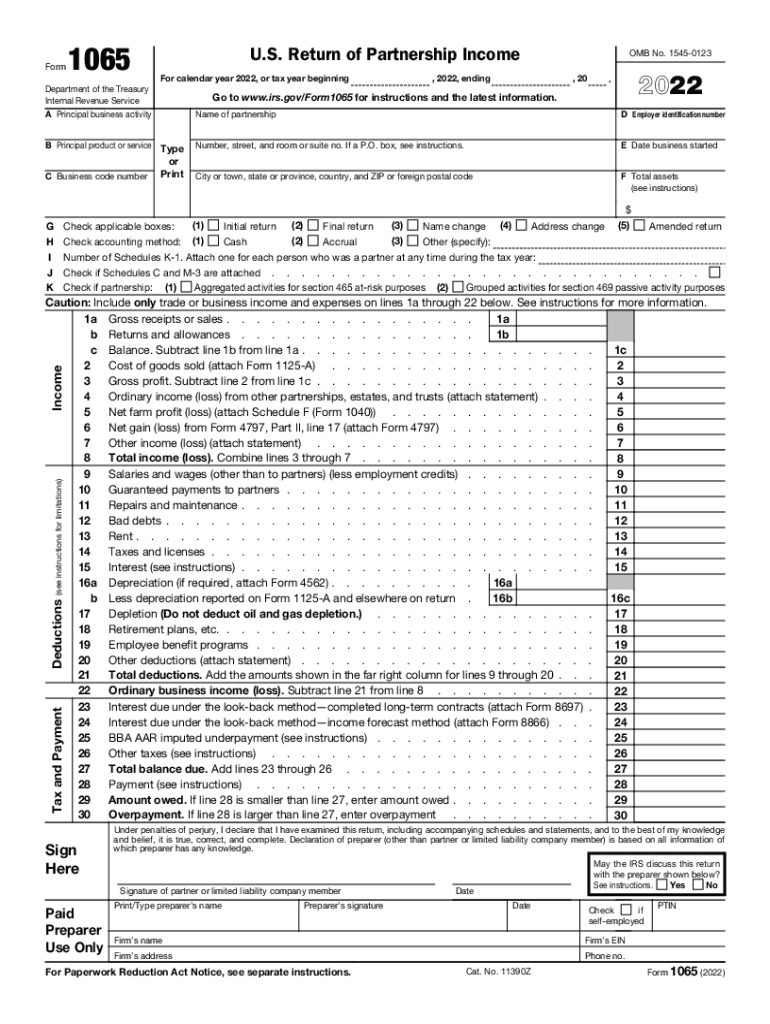

The Form 1065 is a tax document used by partnerships to report income, deductions, gains, and losses from their operations. This form is essential for partnerships to inform the Internal Revenue Service (IRS) about their financial activities for the tax year. It serves as an informational return, meaning that the partnership itself does not pay taxes directly on its income. Instead, the income is passed through to the individual partners, who report it on their personal tax returns. Understanding the purpose and structure of Form 1065 is crucial for compliance and accurate reporting.

Steps to complete the Form 1065

Completing Form 1065 involves several steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary financial records, including income statements, balance sheets, and any relevant documentation related to deductions and credits. Next, fill out the basic information section, which includes the partnership's name, address, and Employer Identification Number (EIN). After that, report the partnership's income and deductions on the appropriate lines of the form. It is also important to complete Schedule K, which summarizes the income, deductions, and credits for the partners. Finally, ensure that all partners review and sign the form before submission to confirm the accuracy of the information provided.

Filing Deadlines / Important Dates

Form 1065 must be filed annually, and the deadline for submission typically falls on the fifteenth day of the third month after the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Partnerships can request a six-month extension to file Form 1065, but this does not extend the time to pay any taxes owed. It is essential to keep track of these deadlines to avoid penalties and interest for late filing.

Legal use of the Form 1065

Form 1065 is legally binding and must be completed accurately to comply with IRS regulations. The information provided on this form is used to determine each partner's share of the partnership's income and deductions. Failing to file Form 1065 or submitting inaccurate information can lead to penalties, including fines and additional scrutiny from the IRS. Partnerships should ensure that their records are thorough and that the form is completed in accordance with IRS guidelines to maintain legal compliance.

Key elements of the Form 1065

Understanding the key elements of Form 1065 is vital for accurate completion. The form includes various sections, such as the income section, where partnerships report total income from all sources. Additionally, there are sections for deductions, which can include business expenses, salaries, and other allowable costs. Schedule K is another critical component, as it provides a summary of each partner's share of the partnership's income, deductions, and credits. Each of these elements plays a crucial role in ensuring that the partnership's financial activities are reported correctly to the IRS.

Required Documents

To complete Form 1065, several documents are required to ensure accurate reporting. Partnerships should gather financial statements, including profit and loss statements and balance sheets, to provide a clear picture of their financial status. Additionally, records of any deductions claimed, such as receipts for business expenses and payroll records, are necessary. Partners should also have their Social Security numbers or EINs available, as this information is required for reporting purposes. Collecting these documents in advance can streamline the process of completing Form 1065 and help avoid errors.

Quick guide on how to complete 2022 form 1065

Prepare Form 1065 effortlessly on any device

Digital document management has increased in popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without any delays. Manage Form 1065 on any device using airSlate SignNow’s Android or iOS applications and simplify your document-related processes today.

The easiest way to edit and eSign Form 1065 without effort

- Locate Form 1065 and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate issues related to lost or misfiled documents, menial form hunting, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your preference. Edit and eSign Form 1065 and ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 1065

Create this form in 5 minutes!

People also ask

-

What is Form 1065 and why is it important?

Form 1065 is a U.S. tax form used to report the income, deductions, gains, and losses of a partnership. It's crucial for ensuring compliance with IRS regulations and provides essential financial information to both partners and the government. Properly handling Form 1065 can prevent penalties and facilitate accurate tax reporting.

-

How can airSlate SignNow simplify the completion of Form 1065?

airSlate SignNow offers a user-friendly platform that allows businesses to quickly eSign and send Form 1065. With customizable templates and easy document management, users can ensure that their tax forms are completed accurately and efficiently. This streamlines the process, reducing the time spent on paperwork.

-

What are the pricing options for using airSlate SignNow for Form 1065?

airSlate SignNow offers competitive pricing plans tailored for various business needs. Whether you're a solo entrepreneur or part of a larger organization, you can choose from several subscription tiers that allow easy eSigning and document management for Form 1065 and other important documents. A free trial is also available to test all features.

-

Does airSlate SignNow offer integrations with accounting software for Form 1065?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, enhancing your ability to prepare and file Form 1065. This integration allows for automatic data population, reducing manual entry errors and increasing efficiency. You can manage your financial documentation in a cohesive ecosystem.

-

How secure is airSlate SignNow when handling sensitive documents like Form 1065?

Security is a top priority at airSlate SignNow, especially for sensitive documents such as Form 1065. The platform uses advanced encryption protocols and secure cloud storage to protect your information. Additionally, it complies with relevant legal standards to ensure that your data remains safe and confidential.

-

Can multiple users collaborate on Form 1065 using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on Form 1065. This feature enables team members to review, edit, and sign the document from different locations, facilitating smooth collaboration. The platform also tracks changes and maintains a record of who made edits for accountability.

-

What are the benefits of eSigning Form 1065 with airSlate SignNow?

ESigning Form 1065 with airSlate SignNow offers numerous benefits, including faster processing, reduced paperwork, and enhanced accessibility. You can sign documents from anywhere at any time, which simplifies the filing process. This not only saves time but also helps in maintaining organization and compliance.

Get more for Form 1065

- Mechanic lien form

- Quitclaim deed by two individuals to husband and wife ohio form

- Ohio general deed form

- Limited warranty deed from two individuals to husband and wife ohio form

- Ohio transfer death form

- General warranty deed limited liability company to an individual ohio form

- Request for ordinary mail service ohio form

- Individual to trust 497322188 form

Find out other Form 1065

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement