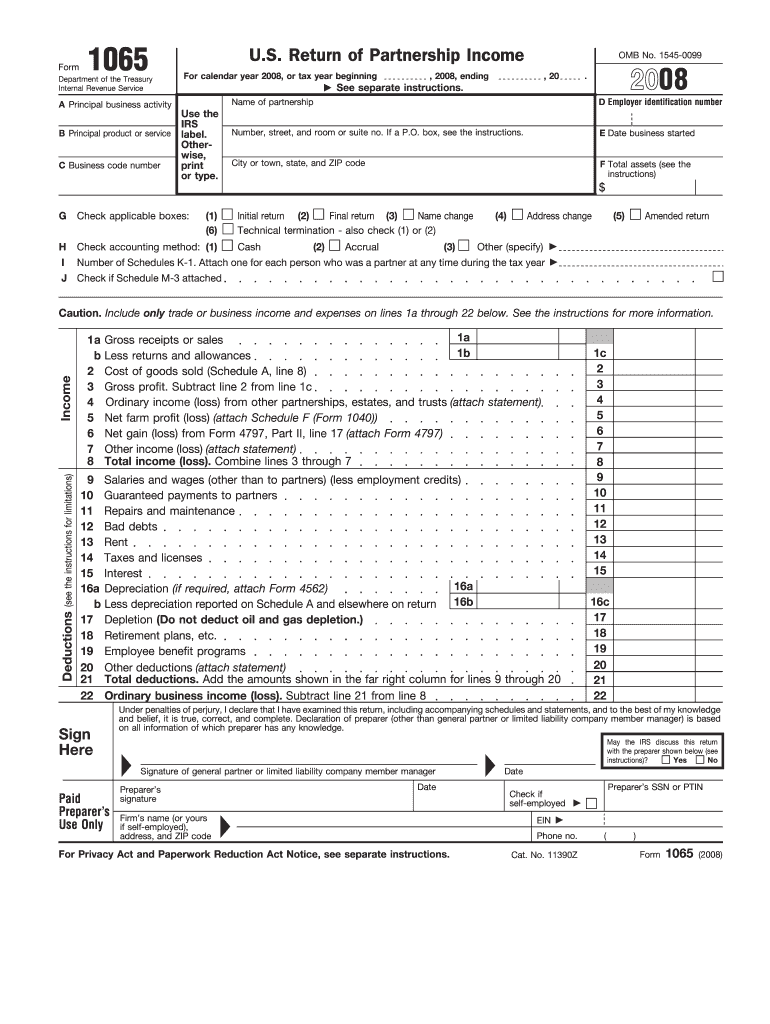

Irs 1065 Form 2008

What is the IRS 1065 Form

The IRS 1065 Form is a tax document used by partnerships to report income, deductions, gains, and losses from their operations. This form is essential for partnerships, which include limited liability companies (LLCs) that choose to be taxed as partnerships. The IRS uses this information to assess the tax obligations of the partnership and its partners. Each partner receives a Schedule K-1, which details their share of the partnership’s income, deductions, and credits, allowing them to report this information on their individual tax returns.

How to use the IRS 1065 Form

To effectively use the IRS 1065 Form, partnerships must accurately report their financial activities for the tax year. The form requires detailed information about the partnership, including its name, address, and employer identification number (EIN). Additionally, partnerships must provide information about each partner, including their ownership percentage and contributions. After completing the form, partnerships must file it with the IRS, ensuring that all information is accurate to avoid penalties.

Steps to complete the IRS 1065 Form

Completing the IRS 1065 Form involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Fill out the basic information section, including the partnership’s name, address, and EIN.

- Report income, deductions, gains, and losses in the appropriate sections of the form.

- Complete Schedule B, which includes questions about the partnership's operations.

- Prepare Schedule K-1 for each partner, detailing their share of income, deductions, and credits.

- Review the completed form for accuracy and ensure all necessary signatures are obtained.

- File the form with the IRS by the deadline, either electronically or by mail.

Legal use of the IRS 1065 Form

The IRS 1065 Form is legally binding when completed accurately and submitted on time. Partnerships must comply with IRS regulations regarding the reporting of income and expenses. Failure to file the form or inaccuracies in reporting can lead to penalties, including fines and interest on unpaid taxes. It is crucial for partnerships to maintain thorough records and ensure compliance with all applicable tax laws to avoid legal issues.

Filing Deadlines / Important Dates

The IRS 1065 Form must be filed annually, with the deadline typically falling on March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Partnerships can request a six-month extension, allowing them to file by September 15. It is important for partnerships to mark these dates on their calendars to ensure timely filing and avoid penalties.

Form Submission Methods

Partnerships can submit the IRS 1065 Form through various methods:

- Online Filing: Partnerships can use IRS-approved e-filing software to submit the form electronically.

- Mail: The completed form can be printed and mailed to the appropriate IRS address based on the partnership's location.

- In-Person: While not common, partnerships may deliver the form directly to an IRS office, though this is generally not recommended due to potential wait times.

Quick guide on how to complete irs 1065 2008 form

Complete Irs 1065 Form seamlessly on any device

Web-based document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed forms, allowing you to access the necessary document and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly without interruptions. Manage Irs 1065 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to edit and electronically sign Irs 1065 Form with ease

- Find Irs 1065 Form and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize key parts of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature by using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your document, either through email, SMS, or invitation link, or download it to your computer.

Put an end to the worry of lost or misplaced documents, tedious form searching, or mistakes that require creating new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign Irs 1065 Form to ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 1065 2008 form

Create this form in 5 minutes!

How to create an eSignature for the irs 1065 2008 form

How to make an eSignature for your PDF in the online mode

How to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the IRS 1065 form and why is it important?

The IRS 1065 form is a vital document used by partnerships to report income, deductions, gains, and losses from their operations. Completing the IRS 1065 form accurately is crucial for compliance with tax regulations and helps avoid penalties. Utilizing tools like airSlate SignNow can simplify the process of preparing and eSigning this form.

-

How can airSlate SignNow help me with the IRS 1065 form?

airSlate SignNow streamlines the process of completing the IRS 1065 form by allowing users to fill out, sign, and send documents electronically. This not only saves time but also ensures that your forms are securely stored and easily accessible. With our user-friendly interface, managing your IRS 1065 form has never been easier.

-

Is there a cost associated with using airSlate SignNow for the IRS 1065 form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our cost-effective solutions provide great value, especially for businesses that frequently handle forms like the IRS 1065 form. You can choose a plan that best fits your requirements, ensuring you get the most out of our services.

-

What features does airSlate SignNow offer for the IRS 1065 form?

airSlate SignNow provides features such as customizable templates, electronic signature capabilities, and document tracking specifically designed for forms like the IRS 1065 form. These features enhance efficiency and help ensure that all necessary information is accurately captured and submitted on time.

-

Can I integrate airSlate SignNow with my accounting software for the IRS 1065 form?

Absolutely! airSlate SignNow offers integrations with various accounting software, making it easy to manage your IRS 1065 form seamlessly. This connectivity ensures that your financial data is accurately reflected in your tax forms, streamlining the filing process.

-

What are the benefits of using airSlate SignNow for tax forms like the IRS 1065?

The primary benefits of using airSlate SignNow for tax forms like the IRS 1065 include increased efficiency, enhanced security, and reduced paperwork. Our platform allows for quick eSigning and sharing of documents, which can signNowly speed up your tax preparation process, ensuring timely filings.

-

Is airSlate SignNow secure for handling sensitive documents like the IRS 1065 form?

Yes, airSlate SignNow prioritizes security and compliance, utilizing advanced encryption to protect sensitive documents, including the IRS 1065 form. Our platform is designed to ensure that your data is safe from unauthorized access, providing peace of mind while you manage your tax documents.

Get more for Irs 1065 Form

- Appeal for exception to academic policy submission form

- 2019 2020 dependent verification worksheet docx form

- 2019 2020 parental information formdocx

- Student employment appointment form suny oneonta

- Surplus equipment disposal form university of massachusetts umass

- Full text of ampquotpanama canal treaty disposition of united form

- Name last first mi student id csudh form

- Release petition form

Find out other Irs 1065 Form

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now