1065 Form 2010

What is the 1065 Form

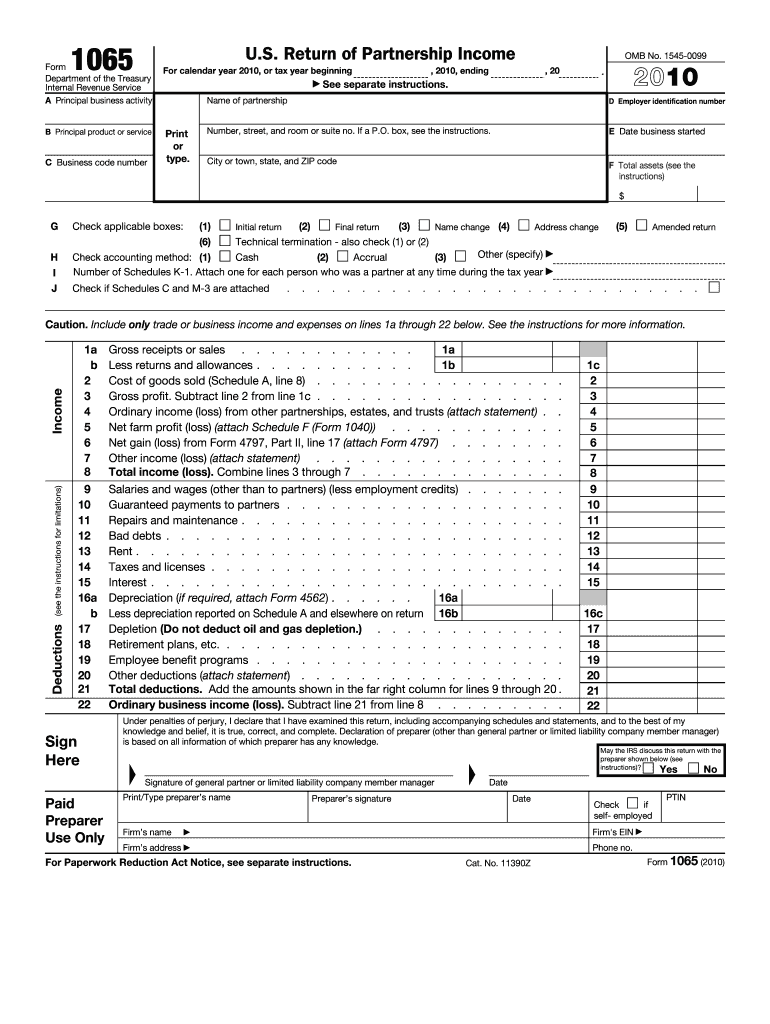

The 1065 Form is a crucial tax document used by partnerships in the United States to report income, deductions, gains, and losses from the partnership's operations. This form is filed annually with the Internal Revenue Service (IRS) and provides a comprehensive overview of the partnership's financial activities. Each partner receives a Schedule K-1, which details their share of the partnership's income, deductions, and credits, allowing them to report this information on their individual tax returns.

Steps to complete the 1065 Form

Completing the 1065 Form involves several important steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary financial records, including income statements, expense reports, and details of each partner's contributions. Next, fill out the basic information, such as the partnership's name, address, and Employer Identification Number (EIN). Then, report the partnership's income and deductions on the appropriate lines. Finally, complete the Schedule K-1 for each partner, ensuring that their share of income and deductions is correctly calculated. Review the form for accuracy before submission.

How to obtain the 1065 Form

The 1065 Form can be easily obtained from the IRS website. It is available as a downloadable PDF file, which can be printed and filled out by hand or completed electronically. Additionally, many tax preparation software programs include the 1065 Form as part of their offerings, allowing for a more streamlined and efficient completion process. Ensure that you are using the most current version of the form to comply with IRS requirements.

Legal use of the 1065 Form

The legal use of the 1065 Form is essential for partnerships to accurately report their financial activities to the IRS. Filing this form is a legal obligation for partnerships, and failure to do so can result in penalties. The information reported on the 1065 Form is used to determine each partner's tax liability, making it vital for compliance with federal tax laws. It is important to ensure that all information is accurate and complete to avoid issues with the IRS.

Filing Deadlines / Important Dates

The filing deadline for the 1065 Form is typically March 15 of each year for partnerships operating on a calendar year basis. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Partnerships can request a six-month extension to file by submitting Form 7004, but this does not extend the deadline for paying any taxes owed. It is crucial to keep track of these dates to avoid late filing penalties.

Key elements of the 1065 Form

Key elements of the 1065 Form include various sections that capture essential financial information. These sections typically cover income, deductions, and credits. The form requires detailed reporting of the partnership's gross receipts, cost of goods sold, and various business expenses. Additionally, the form includes a section for reporting each partner's share of income and deductions through the Schedule K-1, which is crucial for individual tax reporting. Accurate completion of these elements is vital for compliance and transparency.

Quick guide on how to complete 2010 1065 form

Prepare 1065 Form effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the correct form and securely store it online. airSlate SignNow equips you with all the features necessary to create, modify, and eSign your documents quickly and without delays. Manage 1065 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-based task today.

The easiest way to modify and eSign 1065 Form without difficulty

- Find 1065 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional ink signature.

- Review all details and then click the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate worries about lost or misplaced files, lengthy form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign 1065 Form and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 1065 form

Create this form in 5 minutes!

How to create an eSignature for the 2010 1065 form

The best way to generate an electronic signature for a PDF file in the online mode

The best way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is the 1065 Form?

The 1065 Form is a partnership tax return form used by partnerships to report income, deductions, gains, and losses. It is essential for partnerships to file this form accurately to comply with IRS regulations. Using airSlate SignNow can simplify the process of eSigning and submitting your 1065 Form.

-

How does airSlate SignNow facilitate the signing of the 1065 Form?

airSlate SignNow offers a user-friendly platform for electronically signing and sending your 1065 Form. With features like templates and real-time collaboration, you can ensure that all necessary parties review and sign the document efficiently. This streamlines compliance and reduces turnaround time.

-

What are the pricing options for using airSlate SignNow for the 1065 Form?

airSlate SignNow provides various pricing plans to accommodate different business needs, including options for small businesses to larger enterprises. Each plan includes features that enhance the signing process of essential documents like the 1065 Form. Visit our website for detailed pricing information.

-

Can I integrate airSlate SignNow with my accounting software for the 1065 Form?

Yes, airSlate SignNow integrates with popular accounting software, allowing for efficient management of your 1065 Form and related documents. This integration ensures your data remains consistent, helping to avoid errors during the filing process. Connect with your preferred tools easily and streamline your workflow.

-

What are the benefits of using airSlate SignNow for the 1065 Form?

Using airSlate SignNow for your 1065 Form offers numerous benefits, including enhanced security, easy access, and efficient document management. The platform's automation features not only save time but also reduce human error, ensuring your tax documents are accurate and submitted on time.

-

Is airSlate SignNow compliant with legal and regulatory standards for the 1065 Form?

Absolutely, airSlate SignNow is compliant with legal standards for electronic signatures, making it a reliable option for your 1065 Form. The platform adheres to regulations set forth by the IRS and other governing bodies, ensuring your signed documents are legally binding.

-

How can I get help with signing my 1065 Form using airSlate SignNow?

If you need assistance with signing your 1065 Form, airSlate SignNow provides comprehensive support through tutorials, FAQs, and customer service. Our team can guide you through the signing process, ensuring a smooth experience from start to finish. signNow out via our support channels for personalized help.

Get more for 1065 Form

- Collective letter 11 preferential etsi conditions for accommodation and other services in the sophia antipolis aarea edition form

- Zusatzblatt fr familienangehrige zum antrag auf form

- Certegy vip enrollment form

- Samordnet registermelding del 1 hovedblankett registrering i enhetsregisteret form

- History park facility use application web based rfp form

- Nhra bh form

- Application r certificate form

- Professional reference questionnaire abih form

Find out other 1065 Form

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure