Form 1041 2013

What is the Form 1041

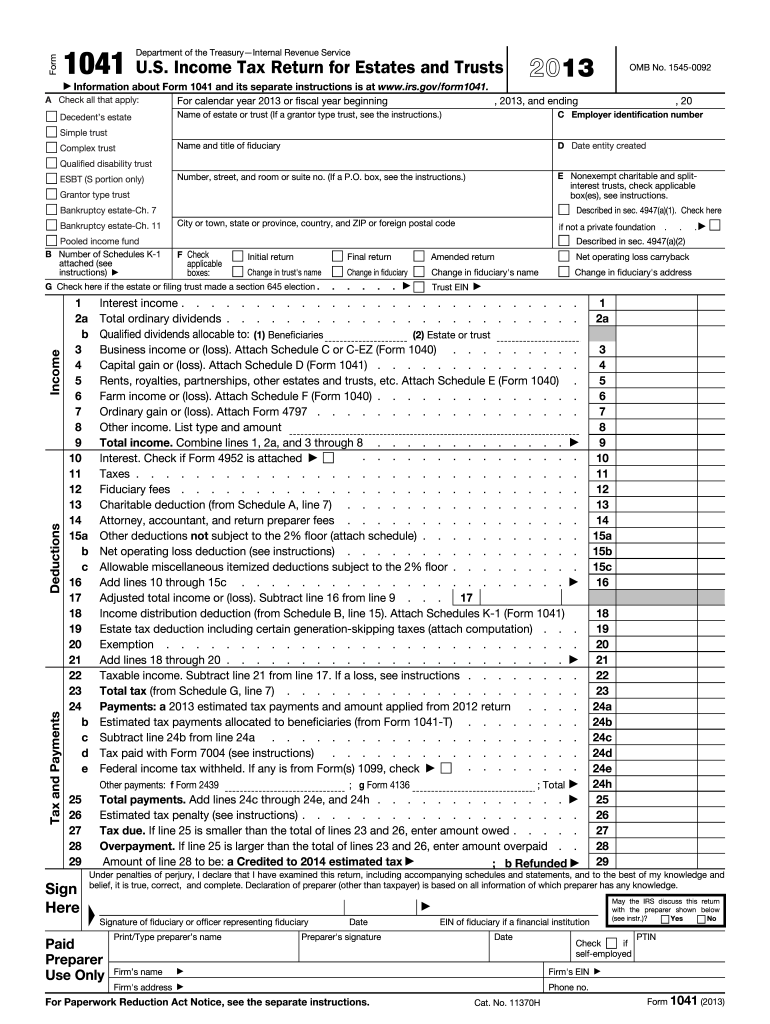

The Form 1041 is a U.S. tax return used by estates and trusts to report income, deductions, gains, and losses. This form is essential for fiduciaries who manage the financial affairs of an estate or trust. It ensures that the income generated by the estate or trust is accurately reported to the Internal Revenue Service (IRS) and that any tax liabilities are settled appropriately. The form is typically filed annually and is due on the 15th day of the fourth month following the end of the estate's or trust's tax year.

Steps to complete the Form 1041

Completing the Form 1041 involves several key steps to ensure accuracy and compliance with IRS requirements. Start by gathering necessary documentation, including income statements, expense records, and any relevant tax forms. Next, fill out the form by providing the estate or trust's identifying information, including the name, address, and Employer Identification Number (EIN). Report all income and deductions on the appropriate lines, ensuring that calculations are precise. After completing the form, review it thoroughly for any errors before submitting it to the IRS.

Legal use of the Form 1041

The legal use of Form 1041 is governed by various tax laws and regulations. It is crucial for fiduciaries to understand that the form must be filed accurately and on time to avoid penalties. The IRS requires that all income generated by the estate or trust be reported, and any deductions claimed must be legitimate and supported by documentation. Failure to comply with these regulations can result in fines or legal repercussions. Utilizing electronic filing methods can enhance compliance and streamline the submission process.

Filing Deadlines / Important Dates

Filing deadlines for Form 1041 are critical to ensure compliance with IRS regulations. The form is generally due on the 15th day of the fourth month after the end of the tax year. For estates or trusts operating on a calendar year, this means the form is due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, fiduciaries may request a six-month extension, allowing them to file by October 15, provided they submit Form 7004 by the original due date.

Required Documents

To accurately complete Form 1041, several documents are required. These include:

- Income statements for the estate or trust, such as interest and dividends.

- Records of any deductions, including administrative expenses and distributions to beneficiaries.

- Previous tax returns if applicable, to provide context for the current filing.

- Any supporting documentation for claims made on the form, such as receipts and invoices.

Having these documents organized and accessible will facilitate a smoother filing process.

Form Submission Methods (Online / Mail / In-Person)

Form 1041 can be submitted through various methods, offering flexibility for fiduciaries. The form can be filed electronically using IRS-approved software, which often simplifies the process and reduces the chance of errors. Alternatively, it can be mailed to the appropriate IRS address based on the estate or trust's location. In-person submission is generally not available for this form, but fiduciaries can consult with tax professionals for assistance. Ensuring that the form is submitted by the deadline is essential to avoid penalties.

Quick guide on how to complete 2013 form 1041

Effortlessly prepare Form 1041 on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without any delays. Manage Form 1041 on any device using airSlate SignNow's Android or iOS apps and streamline any document-related tasks today.

How to modify and electronically sign Form 1041 with ease

- Find Form 1041 and click on Get Form to begin.

- Make use of the tools provided to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced papers, tedious form searches, and mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 1041 and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 1041

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 1041

The best way to generate an eSignature for your PDF online

The best way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The way to create an eSignature for a PDF document on Android

People also ask

-

What is Form 1041 and who needs to file it?

Form 1041 is the U.S. Income Tax Return for Estates and Trusts. It is required for estates and trusts that generate income during the tax year. If you're managing an estate or trust with gross income exceeding $600, you must file Form 1041.

-

How can airSlate SignNow help with the e-signing of Form 1041?

airSlate SignNow simplifies the e-signing process for Form 1041, allowing you to send documents securely and obtain signatures quickly. With its user-friendly interface, you can effortlessly track the status of your Form 1041 and reduce turnaround time signNowly.

-

What are the associated costs for using airSlate SignNow for Form 1041?

airSlate SignNow offers various pricing plans to cater to different business needs. You can start with a free trial to test its features for managing Form 1041, and choose a plan that fits your requirements, ensuring you get the best value for e-signing your documents.

-

Does airSlate SignNow offer templates for Form 1041?

Yes, airSlate SignNow provides customizable templates for Form 1041, streamlining the document preparation process. This feature helps ensure that all necessary components of the form are included, reducing errors and improving efficiency.

-

Can I integrate airSlate SignNow with other software for handling Form 1041?

Absolutely! airSlate SignNow integrates seamlessly with various platforms like Google Drive, Dropbox, and CRM systems to facilitate document management for Form 1041. This integration enables you to import and export forms effortlessly, enhancing your workflow.

-

Is airSlate SignNow compliant with regulations for processing Form 1041?

Yes, airSlate SignNow is compliant with all necessary regulations for the secure e-signing and transmission of Form 1041. The platform employs advanced encryption and security measures to protect your sensitive information.

-

What features make airSlate SignNow ideal for managing Form 1041?

airSlate SignNow offers several features specifically beneficial for managing Form 1041, including e-signatures, mobile accessibility, and document tracking. These features ensure that the process of completing and filing your Form 1041 is efficient and straightforward.

Get more for Form 1041

- Pasadena city college dsps application form

- Official transcript form

- Cardozo transcript request form

- Please also refer to the mhirt supplemental program information document for

- Authorization for release of information unmc

- Queens college second form

- Non degree seeking student registration form rutgers school of

- Medication prescriberparent authorization colorado state form

Find out other Form 1041

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form