Form 1041 2015

What is the Form 1041

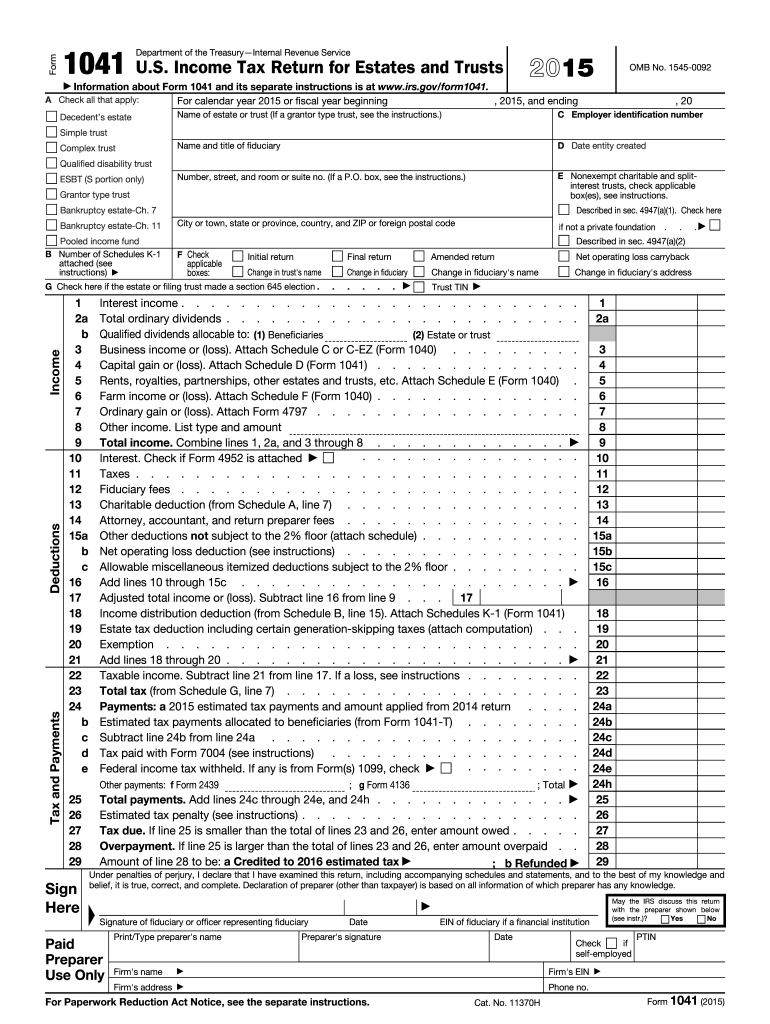

The Form 1041 is the U.S. Income Tax Return for Estates and Trusts. It is used to report income, deductions, gains, and losses of an estate or trust. This form is essential for fiduciaries, who are responsible for managing the assets of an estate or trust and ensuring compliance with tax obligations. The income generated by the estate or trust is taxed at the estate or trust level, and the form allows for the reporting of any distributions made to beneficiaries.

How to use the Form 1041

To use the Form 1041, fiduciaries must gather all necessary financial information related to the estate or trust. This includes income from various sources, such as rental properties, dividends, and interest. Deductions may also be claimed for expenses incurred in managing the estate or trust. After completing the form, it must be filed with the Internal Revenue Service (IRS) to report the estate's or trust's income and determine any tax liability. Beneficiaries may also receive a Schedule K-1, which details their share of the income and deductions.

Steps to complete the Form 1041

Completing the Form 1041 involves several key steps:

- Gather relevant financial documents, including income statements and expense receipts.

- Complete the top section of the form, providing the name and address of the estate or trust.

- Report all sources of income on the appropriate lines, including interest, dividends, and capital gains.

- List any deductions that apply, such as administrative expenses or charitable contributions.

- Calculate the total income and deductions to determine the taxable income.

- Sign and date the form, ensuring that it is submitted by the appropriate deadline.

Filing Deadlines / Important Dates

The filing deadline for Form 1041 is typically April 15 of the year following the tax year, unless the estate or trust operates on a fiscal year. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, fiduciaries can request a six-month extension to file the form, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Legal use of the Form 1041

The legal use of Form 1041 is governed by IRS regulations, which stipulate that the form must be filed by the fiduciary responsible for managing the estate or trust. Accurate reporting of income and deductions is crucial to comply with tax laws. Failure to file or incorrect reporting can result in penalties and interest. It is advisable for fiduciaries to consult with tax professionals to ensure compliance and proper handling of the form.

Required Documents

To complete Form 1041, several documents are necessary:

- Income statements for the estate or trust, including bank statements and investment income.

- Receipts for deductible expenses, such as legal fees and property management costs.

- Documentation of distributions made to beneficiaries, which may require issuing Schedule K-1 forms.

- Prior year tax returns, if applicable, to ensure consistency in reporting.

Quick guide on how to complete 2015 form 1041

Complete Form 1041 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the essential tools to swiftly create, modify, and eSign your documents without any delays. Manage Form 1041 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Form 1041 seamlessly

- Obtain Form 1041 and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new document versions. airSlate SignNow manages all your document needs in just a few clicks from your chosen device. Edit and eSign Form 1041 and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 1041

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 1041

How to make an eSignature for a PDF file in the online mode

How to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your smartphone

The best way to make an eSignature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF on Android

People also ask

-

What is Form 1041 and why is it important?

Form 1041 is the U.S. Income Tax Return for Estates and Trusts. It's important because it reports income, deductions, gains, and losses of estates and trusts. Filing this form correctly is crucial for compliance with IRS regulations and to avoid penalties.

-

How can airSlate SignNow help with Form 1041 documents?

airSlate SignNow simplifies the process of sending and signing Form 1041 documents electronically. With our easy-to-use platform, you can quickly prepare, send, and securely eSign your Form 1041, ensuring a smooth and efficient filing process.

-

What are the benefits of using airSlate SignNow for Form 1041?

Using airSlate SignNow for your Form 1041 provides several benefits, including time savings, increased efficiency, and enhanced security for your sensitive documents. Our platform allows you to track the status of your signatures and streamline your workflow.

-

Is airSlate SignNow affordable for filing Form 1041?

Yes, airSlate SignNow offers a cost-effective solution for managing Form 1041 and other documents. Our pricing plans are designed to fit businesses of all sizes, ensuring you get the best value for your eSignature needs.

-

Can I integrate airSlate SignNow with other software for Form 1041?

Absolutely! airSlate SignNow integrates seamlessly with various platforms, which can be particularly beneficial when preparing Form 1041. You can connect your accounting or tax software to streamline the document preparation and signing process.

-

What features does airSlate SignNow offer for Form 1041 processing?

airSlate SignNow includes features such as customizable templates, robust security measures, and real-time tracking for your Form 1041 documents. These features enhance your ability to manage and sign documents securely and efficiently.

-

How secure is airSlate SignNow when handling Form 1041?

Security is a top priority at airSlate SignNow. We use advanced encryption methods and comply with industry standards to protect your Form 1041 and other sensitive documents throughout the signing process.

Get more for Form 1041

- Form 1122 instructions

- Ga form 500 instructions

- Cte 50 kansas department of revenue ksrevenue form

- 2003 kansas tax form k40

- Boone county fiscal court form 1906

- 2011 michigan home heating credit claim mi 1040cr 7 instructions form

- Cd 401s scorporation tax return 2008 nc department of form

- 2010 it 203 form

Find out other Form 1041

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement