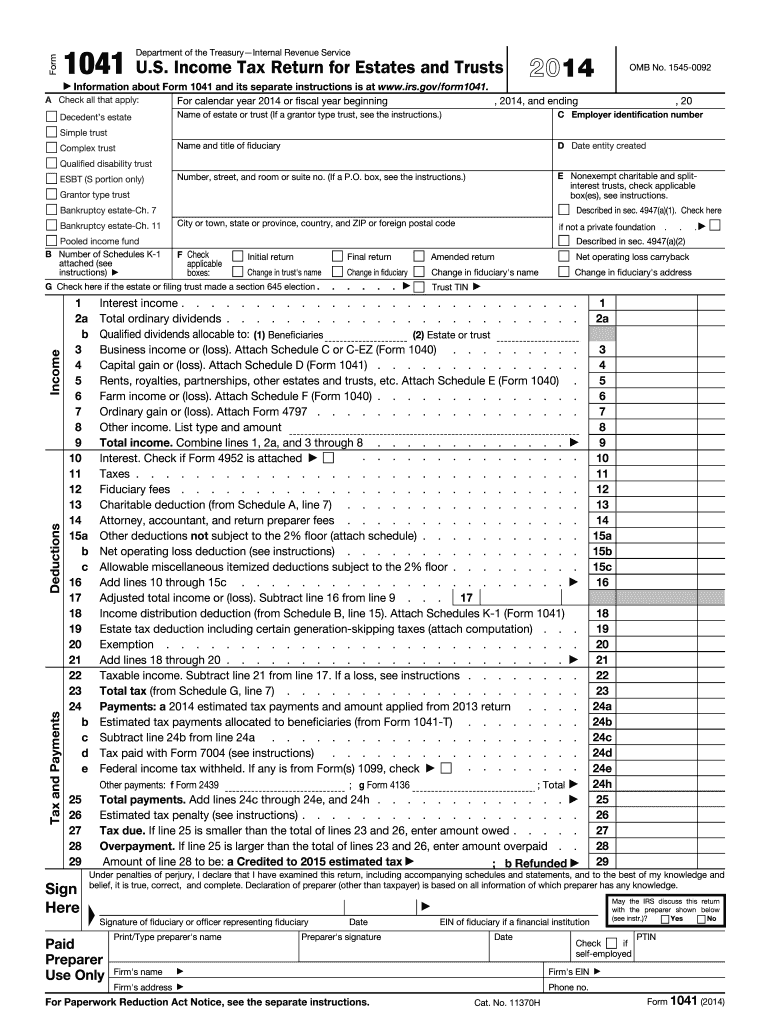

Irs Form 1041 2014

What is the IRS Form 1041

The IRS Form 1041 is a tax return form used by estates and trusts to report income, deductions, gains, and losses. This form is essential for fiduciaries who manage the financial affairs of an estate or trust. It allows them to report the income generated by the estate or trust and calculate the tax owed. The form is also used to distribute income to beneficiaries, who may need to report it on their individual tax returns.

How to use the IRS Form 1041

To use the IRS Form 1041 effectively, fiduciaries must gather all relevant financial information related to the estate or trust. This includes income from investments, rental properties, and any other sources. The form requires detailed reporting of income, deductions, and distributions made to beneficiaries. It is crucial to follow the instructions provided by the IRS carefully to ensure accurate reporting and compliance with tax laws.

Steps to complete the IRS Form 1041

Completing the IRS Form 1041 involves several key steps:

- Gather all necessary financial documents, including income statements and expense records.

- Fill out the identification section, including the name and taxpayer identification number of the estate or trust.

- Report all sources of income in the appropriate sections, ensuring accuracy in amounts reported.

- Calculate deductions for expenses related to the estate or trust, such as administrative costs and legal fees.

- Distribute income to beneficiaries and report these distributions on the form.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

The IRS Form 1041 must be filed by the 15th day of the fourth month following the end of the tax year for the estate or trust. For estates that operate on a calendar year, this means the deadline is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to be aware of these deadlines to avoid penalties and ensure timely compliance.

Legal use of the IRS Form 1041

The legal use of the IRS Form 1041 is governed by federal tax regulations. It is essential for fiduciaries to ensure that the form is filled out accurately and submitted on time to comply with the law. Failure to file the form or inaccuracies can result in penalties and interest on unpaid taxes. The form must also adhere to the guidelines set forth by the IRS regarding income reporting and beneficiary distributions.

Required Documents

When preparing to file the IRS Form 1041, several documents are required:

- Financial statements for the estate or trust, including income and expense records.

- Documentation of distributions made to beneficiaries.

- Any relevant tax documents, such as W-2s or 1099s, for income reporting.

- Records of deductions claimed, including receipts and invoices for expenses.

Quick guide on how to complete 2014 irs form 1041

Effortlessly prepare Irs Form 1041 on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents quickly and without interruption. Manage Irs Form 1041 across any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

Easily modify and eSign Irs Form 1041

- Find Irs Form 1041 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure confidential details using tools offered by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form hunting, or errors that require printing additional copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Irs Form 1041 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 irs form 1041

Create this form in 5 minutes!

How to create an eSignature for the 2014 irs form 1041

The best way to make an electronic signature for your PDF document in the online mode

The best way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What is IRS Form 1041 and how is it used?

IRS Form 1041 is the U.S. Income Tax Return for Estates and Trusts. This form is used to report income, deductions, gains, and losses of an estate or trust. If you manage an estate or trust, understanding how to complete IRS Form 1041 is essential for compliance with tax regulations.

-

How can airSlate SignNow assist with IRS Form 1041?

AirSlate SignNow simplifies the process of signing IRS Form 1041 by allowing users to eSign documents securely and efficiently. With our platform, you can ensure that all necessary signatures are gathered quickly, which streamlines the filing process for IRS Form 1041.

-

Is airSlate SignNow cost-effective for filing IRS Form 1041?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to file IRS Form 1041. Our pricing plans are designed to accommodate various needs, ensuring that you can manage tax documents without overspending.

-

What features does airSlate SignNow offer for IRS Form 1041?

AirSlate SignNow provides features such as document templates, eSignature capabilities, and secure document storage. These tools make it easy to prepare and manage IRS Form 1041, ensuring that you have everything you need at your fingertips.

-

Can I integrate airSlate SignNow with other applications for IRS Form 1041?

Absolutely! AirSlate SignNow integrates seamlessly with various applications, enhancing your workflow when dealing with IRS Form 1041. This integration allows you to streamline document management and eSignature processes, making compliance easier.

-

What are the benefits of using airSlate SignNow for IRS Form 1041?

Using airSlate SignNow for IRS Form 1041 offers numerous benefits, including increased efficiency and reduced turnaround times for document signing. Our platform also ensures compliance and security, providing peace of mind when managing sensitive tax documents.

-

How secure is airSlate SignNow for handling IRS Form 1041?

AirSlate SignNow prioritizes security, employing advanced encryption and authentication protocols to protect your IRS Form 1041 and other documents. You can trust that your information is safe from unauthorized access while using our platform.

Get more for Irs Form 1041

Find out other Irs Form 1041

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application