F1041 PDF Form 1041 Department of the TreasuryInternal 2021

What is IRS Form 1041?

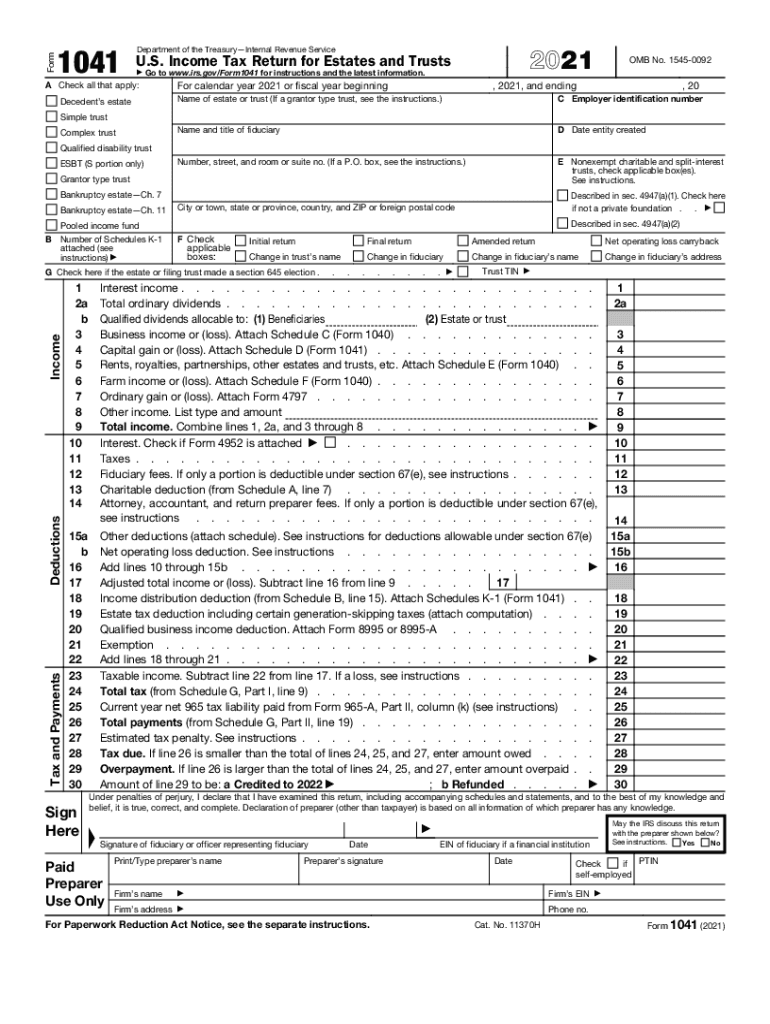

IRS Form 1041, also known as the U.S. Income Tax Return for Estates and Trusts, is a tax form used to report income, deductions, gains, and losses of estates and trusts. This form is essential for fiduciaries who manage the financial affairs of a decedent's estate or a trust. The income generated by the estate or trust must be reported to the Internal Revenue Service (IRS), and any tax due must be paid using this form. Understanding the purpose and requirements of Form 1041 is crucial for compliance with federal tax laws.

Steps to Complete IRS Form 1041

Completing IRS Form 1041 involves several key steps to ensure accurate reporting. First, gather all necessary financial documents related to the estate or trust, including income statements, expense records, and prior tax returns. Next, fill out the form by providing information about the estate's or trust's income, deductions, and distributions. It is important to accurately report all sources of income, such as interest, dividends, and rental income. After completing the form, review it for accuracy, sign it, and file it with the IRS by the appropriate deadline.

Filing Deadlines for IRS Form 1041

The deadline for filing IRS Form 1041 typically falls on the 15th day of the fourth month after the end of the estate's or trust's tax year. For estates operating on a calendar year, this means the form is due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, fiduciaries may file for an automatic six-month extension using Form 7004, which allows more time to complete the tax return without incurring penalties.

Required Documents for IRS Form 1041

To complete IRS Form 1041, several documents are required to substantiate the information reported. These include:

- Income statements for the estate or trust, such as Form 1099s and K-1s.

- Records of expenses incurred by the estate or trust.

- Bank statements and investment statements.

- Prior year tax returns for the decedent or trust.

- Documentation of distributions made to beneficiaries.

Having these documents readily available will facilitate the accurate completion of the form and ensure compliance with tax regulations.

Legal Use of IRS Form 1041

IRS Form 1041 serves a legal purpose in the context of estate and trust taxation. It is required by law for fiduciaries to report the income and expenses of an estate or trust to the IRS. Failure to file Form 1041 can result in penalties, including fines and interest on unpaid taxes. By using this form correctly, fiduciaries ensure that they fulfill their legal obligations and provide transparency regarding the financial activities of the estate or trust.

IRS Guidelines for Completing Form 1041

The IRS provides specific guidelines for completing Form 1041, which include instructions on how to report income, deductions, and distributions. It is essential to follow these guidelines closely to avoid errors that could lead to audits or penalties. The IRS instructions detail how to classify income types, calculate deductions, and determine the tax liability for the estate or trust. Additionally, the IRS offers resources and publications to assist fiduciaries in understanding their responsibilities when filing Form 1041.

Quick guide on how to complete f1041pdf form 1041 department of the treasuryinternal

Effortlessly Prepare F1041 pdf Form 1041 Department Of The TreasuryInternal on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Handle F1041 pdf Form 1041 Department Of The TreasuryInternal on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The Easiest Way to Modify and Electronically Sign F1041 pdf Form 1041 Department Of The TreasuryInternal

- Obtain F1041 pdf Form 1041 Department Of The TreasuryInternal and then click Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Emphasize essential sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to finalize your changes.

- Select your preferred method to share your form, whether via email, text message (SMS), invite link, or download it to your computer.

Forget the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign F1041 pdf Form 1041 Department Of The TreasuryInternal to ensure excellent communication at all stages of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f1041pdf form 1041 department of the treasuryinternal

Create this form in 5 minutes!

How to create an eSignature for the f1041pdf form 1041 department of the treasuryinternal

How to make an e-signature for a PDF in the online mode

How to make an e-signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

How to create an e-signature straight from your smart phone

The best way to make an e-signature for a PDF on iOS devices

How to create an e-signature for a PDF document on Android OS

People also ask

-

What is IRS Form 1041 and who needs to file it?

IRS Form 1041 is the U.S. Income Tax Return for Estates and Trusts. It is used by the fiduciaries of estates and certain trusts to report income, deductions, and tax liability. If you manage an estate or a trust that earns income over a certain threshold, you will need to file this form.

-

How can airSlate SignNow help with IRS Form 1041 filing?

AirSlate SignNow streamlines the signing process for IRS Form 1041 by enabling users to electronically sign and send documents securely. This efficiency reduces paperwork and speeds up the filing process, making it easier to manage the requirements of IRS Form 1041.

-

Is there a cost to use airSlate SignNow for IRS Form 1041 documents?

AirSlate SignNow offers various pricing plans that cater to different business needs, including those handling IRS Form 1041. You can access essential features for free, but premium plans provide advanced tools and increased document limits for a more comprehensive solution.

-

What features does airSlate SignNow offer for IRS Form 1041 management?

AirSlate SignNow provides features such as document templates, automated workflows, and secure cloud storage that simplify the management of IRS Form 1041. These tools enhance productivity by allowing for quick template creation and efficient document tracking.

-

Can airSlate SignNow integrate with other software for IRS Form 1041?

Yes, airSlate SignNow can integrate with a variety of software applications that assist in the completion and filing of IRS Form 1041. This includes accounting and tax preparation software, enhancing your workflow and data management.

-

How does airSlate SignNow ensure the security of IRS Form 1041 documents?

AirSlate SignNow ensures the security of IRS Form 1041 documents through advanced encryption and secure storage protocols. This guarantees that your sensitive information remains protected during the signing and transmission process.

-

What are the benefits of using airSlate SignNow for IRS Form 1041 compared to traditional methods?

Using airSlate SignNow for IRS Form 1041 eliminates delays associated with printing, signing, and mailing documents. The digital solution promotes faster turnaround times, reduces costs, and improves document accuracy through integrated error-checking features.

Get more for F1041 pdf Form 1041 Department Of The TreasuryInternal

- Quitclaim deed from corporation to individual mississippi form

- Ms warranty deed form

- Petition granting form

- Probating will form

- Quitclaim deed from corporation to llc mississippi form

- Motion for discovery form

- Motion for blood tests in order to help determine paternity court ordered mississippi form

- Notice creditors sample form

Find out other F1041 pdf Form 1041 Department Of The TreasuryInternal

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast

- Help Me With Sign New York Web Hosting Agreement

- Sign Connecticut Joint Venture Agreement Template Free

- Sign South Dakota Web Hosting Agreement Free

- Sign Wisconsin Web Hosting Agreement Later

- Sign Wisconsin Web Hosting Agreement Easy

- Sign Illinois Deposit Receipt Template Myself

- Sign Illinois Deposit Receipt Template Free

- Sign Missouri Joint Venture Agreement Template Free

- Sign Tennessee Joint Venture Agreement Template Free