Form 1041 2010

What is the Form 1041

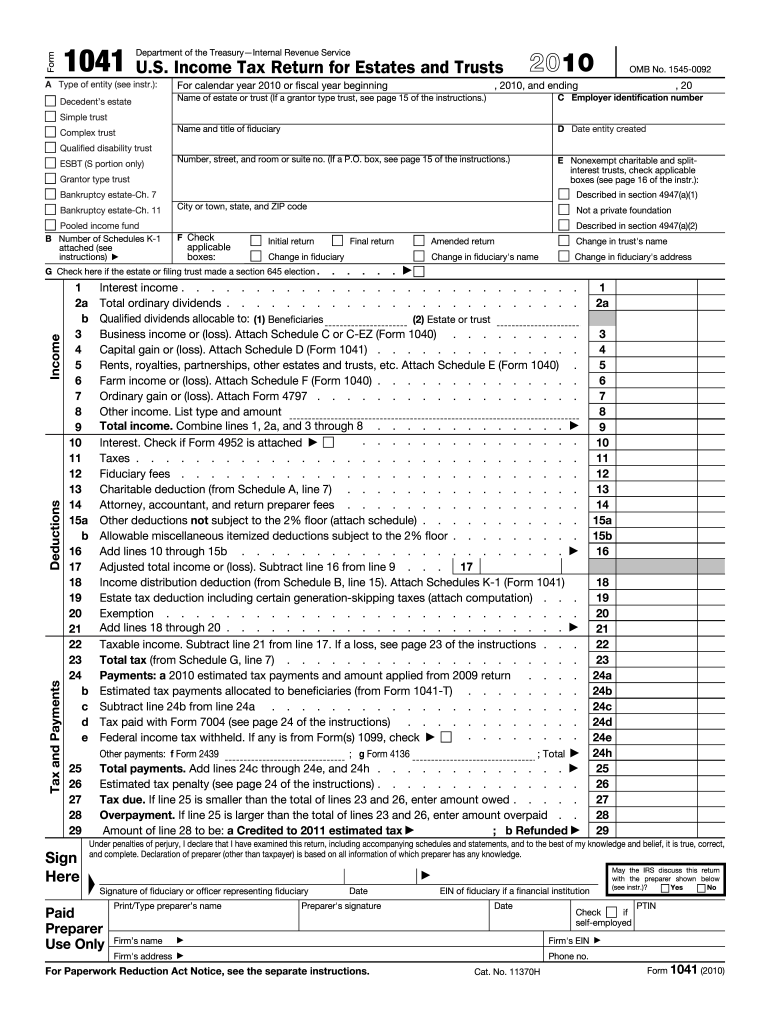

The Form 1041 is a U.S. tax document used for reporting income, deductions, gains, and losses of estates and trusts. It is essential for fiduciaries who manage these entities, ensuring compliance with federal tax regulations. The form allows the estate or trust to report its income and pay any taxes owed on that income. Understanding the purpose of Form 1041 is crucial for anyone involved in managing an estate or trust, as it helps maintain transparency and accountability in financial dealings.

How to use the Form 1041

Using the Form 1041 involves several steps that ensure accurate reporting of an estate's or trust's financial activities. First, gather all necessary financial documents, including income statements, expense records, and any relevant tax documents. Next, fill out the form by entering the required information, such as the estate's or trust's name, address, and taxpayer identification number. It is important to report all income generated during the tax year and claim applicable deductions. Once completed, the form must be filed with the IRS, either electronically or by mail, depending on the preferences and requirements of the fiduciary.

Steps to complete the Form 1041

Completing Form 1041 involves a systematic approach to ensure accuracy. Begin by downloading the form from the IRS website or obtaining a physical copy. Follow these steps:

- Fill in the basic information about the estate or trust, including its name and identification number.

- Report income, including interest, dividends, and capital gains.

- Deduct allowable expenses, such as administrative costs and distributions to beneficiaries.

- Calculate the tax liability using the appropriate tax rates.

- Sign and date the form, ensuring that the fiduciary's information is accurate.

Review the completed form for any errors before submission to avoid delays or penalties.

Filing Deadlines / Important Dates

Filing deadlines for Form 1041 are critical for compliance. Generally, the form is due on the fifteenth day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this typically means the deadline is April 15. If additional time is needed, a six-month extension can be requested, allowing for a new deadline of October 15. It is essential to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

Legal use of the Form 1041

The legal use of Form 1041 ensures that estates and trusts fulfill their tax obligations under U.S. law. This form must be filed by the fiduciary responsible for managing the estate or trust, and it must accurately reflect all income and deductions. Failure to file or inaccurate reporting can lead to penalties, including fines and interest on unpaid taxes. It is advisable for fiduciaries to consult tax professionals to ensure compliance and proper handling of the form.

Required Documents

To complete Form 1041 accurately, several documents are required. These typically include:

- Financial statements for the estate or trust, detailing income and expenses.

- Tax identification number for the estate or trust.

- Records of distributions made to beneficiaries.

- Any relevant tax documents, such as W-2s or 1099s.

Having these documents organized and accessible will streamline the process of filling out the form and ensure compliance with IRS regulations.

Quick guide on how to complete 2010 form 1041 1651700

Complete Form 1041 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 1041 on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Form 1041 with ease

- Obtain Form 1041 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from a device of your choice. Modify and eSign Form 1041 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 form 1041 1651700

Create this form in 5 minutes!

How to create an eSignature for the 2010 form 1041 1651700

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is Form 1041, and why do I need it?

Form 1041 is the U.S. Income Tax Return for Estates and Trusts, essential for reporting income generated by an estate or trust. If you are managing an estate or trust, filing Form 1041 is necessary to fulfill tax obligations. Understanding how to accurately complete this form can simplify your tax reporting process.

-

How can airSlate SignNow help me with Form 1041?

airSlate SignNow streamlines the process by allowing you to easily send and obtain electronic signatures for your Form 1041 documents. With its intuitive interface, you can complete and manage Form 1041 online, ensuring compliance while saving time. It’s a user-friendly solution tailored for busy estate managers.

-

What are the pricing options for using airSlate SignNow for Form 1041?

airSlate SignNow offers flexible pricing plans to meet various needs, making it a cost-effective choice for filing Form 1041. You can choose from different tiers based on the features you require, ensuring that you only pay for what you need. Check their website for the latest pricing details and potential discounts.

-

Are there any specific features for assisting with Form 1041 on airSlate SignNow?

Yes, airSlate SignNow includes features specifically beneficial for managing Form 1041, such as customizable templates and automatic reminders. You can easily upload or create your Form 1041, manage signers, and track document status in real-time. These features help ensure that all necessary signatures are collected efficiently.

-

What integrations does airSlate SignNow offer that can help with Form 1041?

airSlate SignNow integrates seamlessly with various accounting and document management software to enhance your workflow for Form 1041. Integrations with tools like Salesforce, Google Drive, and Dropbox ensure that you can easily access and share your Form 1041 data. This connectivity streamlines your overall document management process.

-

Is airSlate SignNow secure for handling tax forms like Form 1041?

Absolutely, airSlate SignNow prioritizes security with robust encryption and compliance measures for handling sensitive documents like Form 1041. Their platform adheres to industry-standard security protocols, safeguarding your data against unauthorized access. You can confidently manage your tax forms knowing that your information is protected.

-

Can I access my completed Form 1041 anytime with airSlate SignNow?

Yes, airSlate SignNow provides you with the ability to access your completed Form 1041 anytime and from anywhere. All your documents are stored securely in the cloud, allowing you to retrieve them as needed. This ease of access is especially beneficial during tax season when timely filings are crucial.

Get more for Form 1041

- Pdf form ct 51 request for additional extension of time to file for

- Form ct 34 sh new york s corporation shareholders information schedule tax year 2020

- Instructions for form ct 13 unrelated business income tax return tax year 2020

- Form it 242 claim for conservation easement tax credit tax year 2020

- Applicable for the tax period september 1 2020 to november 30 2020 only form

- Instructions for form it 201 full year resident income tax return tax year 2020

- Ny ct 3 a 2019 fill out tax template onlineus legal forms

- It 201 nys form

Find out other Form 1041

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form