1041 Form 2011

What is the 1041 Form

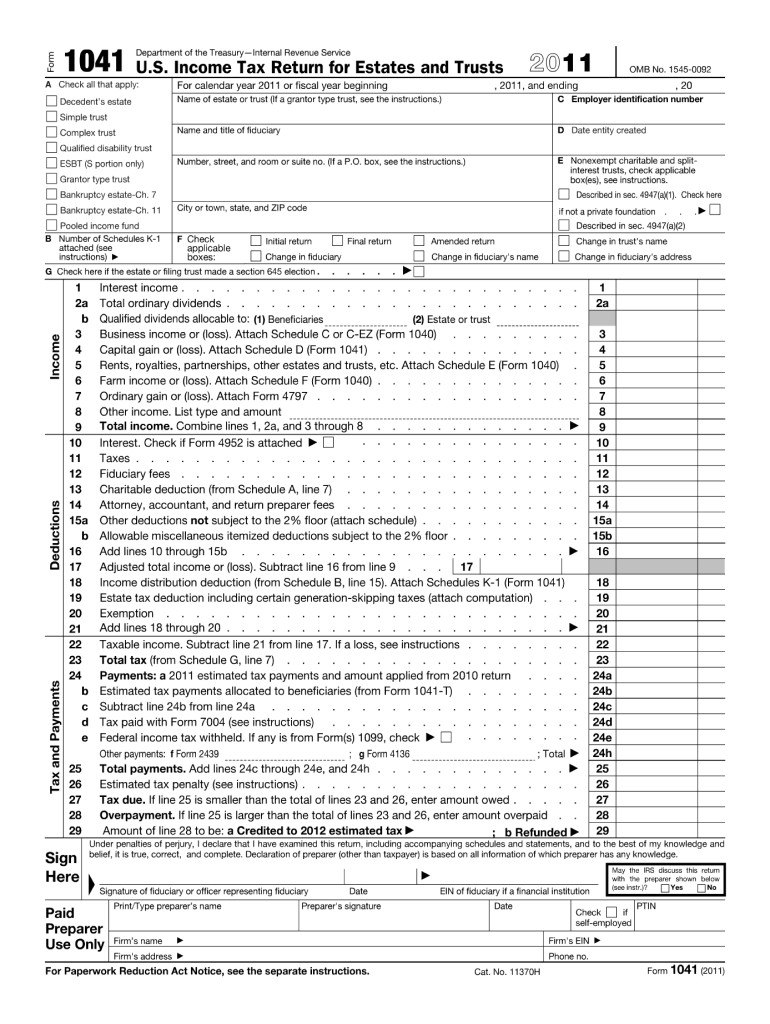

The 1041 Form, officially known as the U.S. Income Tax Return for Estates and Trusts, is a tax document used by estates and trusts to report income, deductions, gains, and losses. This form is essential for fiduciaries who manage estates or trusts that generate income. The income reported on the 1041 Form is typically taxed at the estate or trust level, and any distributions made to beneficiaries may also be reported on their individual tax returns. Understanding the purpose of this form is crucial for compliance with U.S. tax laws.

Steps to complete the 1041 Form

Completing the 1041 Form involves several steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents related to the estate or trust, including income statements, expense records, and any applicable deductions. Next, follow these steps:

- Fill out the basic information, including the name and address of the estate or trust, and the Employer Identification Number (EIN).

- Report income from various sources, such as interest, dividends, and capital gains.

- Claim deductions for allowable expenses, including administrative costs and charitable contributions.

- Calculate the taxable income and determine the tax due.

- Complete the signature section, ensuring that the fiduciary or authorized person signs the form.

Review the completed form for accuracy before submission to avoid penalties or delays.

Legal use of the 1041 Form

The 1041 Form serves a legal purpose in the context of tax reporting for estates and trusts. It is required under U.S. tax law for any estate or trust that has gross income of $600 or more in a tax year. Filing this form is essential to comply with IRS regulations, and failure to do so can result in penalties. Additionally, the information provided on the 1041 Form can impact the tax liabilities of beneficiaries, making it crucial to handle the form correctly and submit it on time.

Filing Deadlines / Important Dates

Timely filing of the 1041 Form is essential to avoid penalties. The due date for the 1041 Form is typically the 15th day of the fourth month following the close of the estate's or trust's tax year. For estates and trusts operating on a calendar year, this means the form is due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to note that extensions may be available, but they must be filed properly to ensure compliance.

How to obtain the 1041 Form

The 1041 Form can be obtained directly from the IRS website, where it is available for download in PDF format. Additionally, physical copies can be requested by calling the IRS or visiting a local IRS office. It is advisable to ensure that you are using the most current version of the form, as tax laws and requirements may change from year to year. Familiarizing yourself with the form's instructions, which accompany the document, can also provide valuable guidance on its completion.

Required Documents

When preparing to complete the 1041 Form, several documents are necessary to provide accurate information. These include:

- Financial statements showing income generated by the estate or trust.

- Records of expenses incurred in managing the estate or trust.

- Documentation of any distributions made to beneficiaries.

- Previous tax returns if applicable, to ensure consistency in reporting.

Having these documents readily available can streamline the process of completing the form and help ensure compliance with tax regulations.

Quick guide on how to complete 2011 1041 form

Effortlessly Prepare 1041 Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to quickly create, modify, and eSign your documents without delays. Handle 1041 Form on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

Edit and eSign 1041 Form with Ease

- Find 1041 Form and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or hide sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 1041 Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 1041 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 1041 form

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the 1041 Form and who needs it?

The 1041 Form is used by estates and trusts to report income, deductions, and taxes. It is essential for executors and trustees to accurately complete this form to ensure compliance with IRS regulations and efficiently manage the estate or trust’s tax responsibilities.

-

How can airSlate SignNow assist with the 1041 Form?

airSlate SignNow provides an easy-to-use platform for sending and eSigning the 1041 Form securely. With its cost-effective solution, users can streamline the process of gathering signatures and ensure that all necessary parties have completed their sections promptly.

-

What features does airSlate SignNow offer for managing the 1041 Form?

airSlate SignNow offers features such as document templates, secure eSignature functionality, and real-time tracking, all of which are helpful when preparing the 1041 Form. These features enhance efficiency and ensure that the form is completed accurately and on time.

-

Is airSlate SignNow cost-effective for filing the 1041 Form?

Yes, airSlate SignNow is a cost-effective solution for filing the 1041 Form, providing users with competitive pricing plans that cater to different needs. By simplifying the eSigning and document management process, it saves both time and resources for individuals and businesses.

-

Can I integrate airSlate SignNow with other software for handling the 1041 Form?

Absolutely! airSlate SignNow offers a variety of integrations with popular accounting and tax software. This makes it easier to sync data, manage documents, and efficiently handle the 1041 Form within your existing workflow.

-

What are the benefits of using airSlate SignNow for the 1041 Form?

Using airSlate SignNow for the 1041 Form allows for increased efficiency, better organization, and enhanced security. Its user-friendly interface and automated features help ensure that forms are completed accurately and can be accessed from anywhere at any time.

-

How do I get started with airSlate SignNow for my 1041 Form needs?

Getting started with airSlate SignNow is simple. You can sign up for an account, choose a plan that fits your needs, and begin uploading and managing your documents, including the 1041 Form. The intuitive platform provides step-by-step guidance to help you through the process.

Get more for 1041 Form

- 600 corporation tax return georgia department of revenue form

- Reason for completing this update must be completed form

- 2020 form 3903 moving expenses

- 2020 instructions for form 8801 instructions for form 8801 credit for prior year minimum taxindividuals estates and trusts

- 5 redeemed nonqualified notices form

- Form 945 a rev december 2020 annual record of federal tax liability

- Form 8869 rev december 2020 qualified subchapter s subsidiary election

- Ifta inc 1stq20 gasoline ifta schedules form

Find out other 1041 Form

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure