Schedule D Form 2011

What is the Schedule D Form

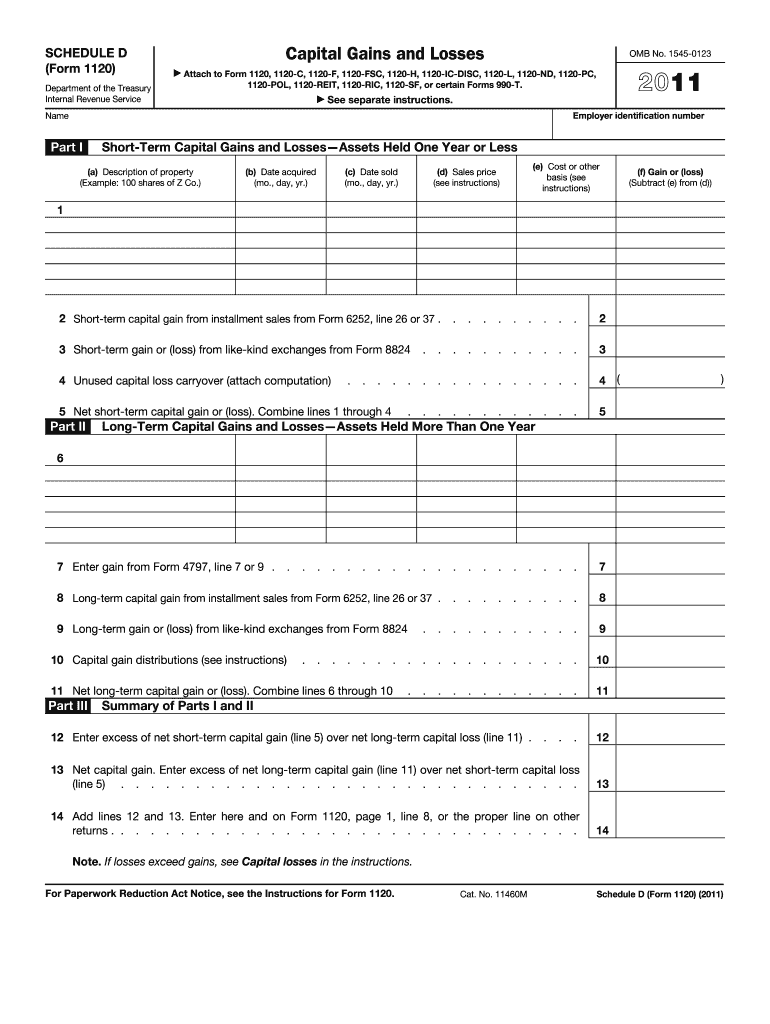

The Schedule D Form is a tax document used by individuals and businesses in the United States to report capital gains and losses from the sale of assets. This form is essential for taxpayers who have sold stocks, bonds, or real estate, as it helps determine the tax implications of these transactions. By accurately reporting capital gains and losses, taxpayers can ensure they meet their tax obligations and potentially reduce their overall tax liability.

How to use the Schedule D Form

Using the Schedule D Form involves several steps. First, gather all relevant information regarding your capital gains and losses, including details of the transactions. Next, follow the instructions provided on the form to report each transaction accurately. It is important to categorize gains and losses as either short-term or long-term, as this classification affects the tax rate applied. Finally, attach the completed Schedule D Form to your main tax return, typically Form 1040, when filing with the IRS.

Steps to complete the Schedule D Form

Completing the Schedule D Form requires careful attention to detail. Here are the key steps:

- Collect all necessary documentation, including brokerage statements and records of asset purchases and sales.

- Determine whether each transaction results in a gain or a loss.

- Classify gains and losses as short-term or long-term based on the holding period of the assets.

- Fill out the form by entering the details of each transaction in the appropriate sections.

- Calculate the total gains and losses and determine your net capital gain or loss.

- Transfer the totals to your main tax return.

Legal use of the Schedule D Form

The Schedule D Form is legally recognized by the IRS as a valid method for reporting capital gains and losses. To ensure compliance, taxpayers must accurately complete the form and adhere to IRS guidelines. This includes maintaining proper records of all transactions and ensuring that the information reported is truthful and complete. Failure to comply with these regulations can lead to penalties or audits.

Filing Deadlines / Important Dates

Filing the Schedule D Form is subject to the same deadlines as your annual tax return. Typically, individual taxpayers must submit their returns by April 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers may also file for an extension, allowing them additional time to submit their returns, but any taxes owed must still be paid by the original deadline to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Schedule D Form can be submitted in various ways. Taxpayers have the option to file online using tax preparation software, which often simplifies the process and ensures accuracy. Alternatively, the form can be printed and mailed to the IRS. For those who prefer in-person submission, many local IRS offices accept tax returns directly. It is important to choose a submission method that best fits your needs and ensures timely delivery.

Quick guide on how to complete 2011 schedule d form

Easily prepare Schedule D Form on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed paperwork, as you can access the required form and safely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents promptly without delays. Manage Schedule D Form on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to edit and eSign Schedule D Form effortlessly

- Obtain Schedule D Form and click on Get Form to begin.

- Use the tools available to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your updates.

- Choose your preferred method for sending your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Schedule D Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 schedule d form

Create this form in 5 minutes!

How to create an eSignature for the 2011 schedule d form

The best way to make an eSignature for your PDF document in the online mode

The best way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is a Schedule D Form?

The Schedule D Form is used to report capital gains and losses from the sale of stocks, bonds, and other investments. By accurately filling out the Schedule D Form, taxpayers can calculate their overall taxable income from capital assets. It's essential for anyone engaged in investing to understand how to properly complete this form to ensure compliance and optimize their tax filings.

-

How can airSlate SignNow help with the Schedule D Form?

airSlate SignNow provides an efficient platform for signing and managing your Schedule D Form online. With its user-friendly interface, you can easily upload, edit, and eSign the document, ensuring a smooth filing process. This saves you time and helps reduce the chances of errors in your submission.

-

What features does airSlate SignNow offer for managing the Schedule D Form?

airSlate SignNow offers features such as customizable templates, cloud storage, and secure eSignature options specifically useful for the Schedule D Form. You can also track document statuses and send reminders to ensure timely submissions. All these features simplify the management of your tax documents, including the Schedule D Form.

-

Is airSlate SignNow cost-effective for individuals filing a Schedule D Form?

Yes, airSlate SignNow is a cost-effective solution for individuals and businesses needing to file the Schedule D Form. With flexible pricing plans and a range of features tailored to your needs, you can manage your tax documents without breaking the bank. This affordability makes it an ideal choice for efficient document handling.

-

Can I integrate airSlate SignNow with other tax software for Schedule D Form filing?

Absolutely! airSlate SignNow can be integrated with various tax software, making it easy to manage your Schedule D Form alongside your other financial documents. These integrations streamline your workflow, ensuring you can easily access and eSign forms without switching between platforms.

-

What are the benefits of using airSlate SignNow for the Schedule D Form?

Using airSlate SignNow for your Schedule D Form offers numerous benefits, including enhanced document security, ease of use, and reduced turnaround times. You’ll enjoy the convenience of managing your forms digitally, leading to greater efficiency in meeting your tax obligations. Plus, eSigning is a legally binding way to finalize your documents swiftly.

-

Is there customer support available for using the Schedule D Form with airSlate SignNow?

Yes, airSlate SignNow offers excellent customer support to assist you with any questions or issues related to your Schedule D Form. Whether you need help with the features or integration, their support team is ready to help. You can access resources such as FAQ sections, tutorials, and direct support for optimized filing.

Get more for Schedule D Form

- Aaa reimbursement form

- Conventional application terra properties form

- Appraisal transfer letter to another lender form

- Walk through addendum form

- Bounce house release form

- Becomes a part of lease contract form

- Deville apartments amp builders rental application apartments for form

- Vinebrook homes rental application form

Find out other Schedule D Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors