Schedule D Form 2014

What is the Schedule D Form

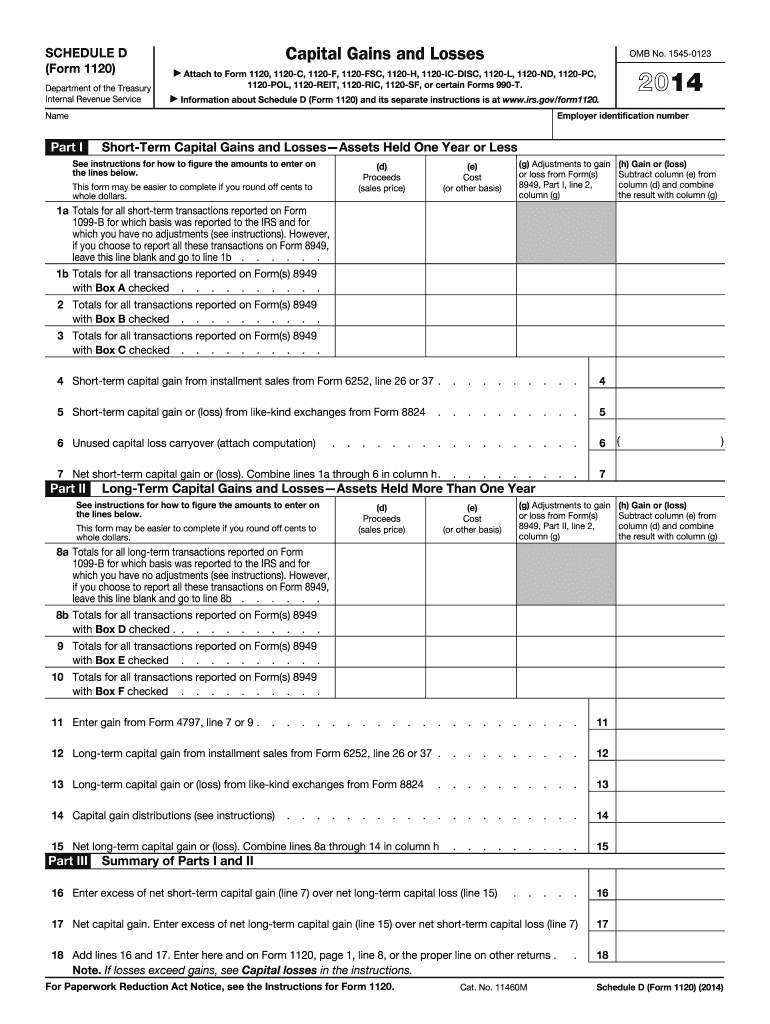

The Schedule D Form is a tax document used by individuals and businesses in the United States to report capital gains and losses. This form is essential for taxpayers who have sold assets such as stocks, bonds, or real estate during the tax year. By accurately completing the Schedule D Form, taxpayers can calculate their overall capital gain or loss, which is then reported on their main tax return. Understanding the components of this form is crucial for ensuring compliance with IRS regulations and optimizing tax liabilities.

How to use the Schedule D Form

Using the Schedule D Form involves several steps. First, gather all necessary documentation related to asset sales, including purchase and sale dates, amounts, and any associated costs. Next, fill out the form by entering details about each transaction, including the type of asset, sale proceeds, and cost basis. After completing the form, transfer the totals to your main tax return, typically Form 1040. It is important to ensure that all information is accurate to avoid delays or penalties from the IRS.

Steps to complete the Schedule D Form

Completing the Schedule D Form requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, including records of asset purchases and sales.

- Identify the type of assets sold and categorize them as short-term or long-term based on the holding period.

- Calculate the gain or loss for each transaction by subtracting the cost basis from the sale price.

- Complete the form by entering the calculated amounts in the appropriate sections.

- Transfer the totals to your main tax return and keep a copy of the Schedule D Form for your records.

Legal use of the Schedule D Form

The Schedule D Form is legally recognized by the IRS as a valid means for reporting capital gains and losses. To ensure its legal standing, taxpayers must adhere to IRS guidelines, including accurate reporting of all transactions and maintaining supporting documentation. Failure to comply with these regulations can result in penalties or audits. It is advisable to consult a tax professional if there are uncertainties regarding the legal implications of using the Schedule D Form.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D Form align with the general tax filing deadlines in the United States. Typically, individual taxpayers must submit their returns by April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to tax deadlines, as timely filing can prevent penalties and interest on unpaid taxes.

Examples of using the Schedule D Form

There are various scenarios in which the Schedule D Form is utilized. For instance, an individual who sells stock in a publicly traded company must report the sale on this form. Similarly, a homeowner who sells their property at a profit must also use the Schedule D Form to report the capital gain. Each of these examples underscores the importance of accurately documenting transactions and understanding potential tax implications.

Quick guide on how to complete 2014 schedule d form

Complete Schedule D Form effortlessly on any gadget

Web-based document administration has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without interruptions. Manage Schedule D Form on any device with airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to alter and eSign Schedule D Form with ease

- Locate Schedule D Form and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to confirm your alterations.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or errors that require new document copies. airSlate SignNow addresses your requirements in document management in just a few clicks from a device of your preference. Modify and eSign Schedule D Form and guarantee outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 schedule d form

Create this form in 5 minutes!

How to create an eSignature for the 2014 schedule d form

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is the Schedule D Form and why do I need it?

The Schedule D Form is used to report capital gains and losses from the sale of securities. If you have investments that you sell during the tax year, you'll need this form to accurately report your financial activity. Using airSlate SignNow can simplify the signing process for your Schedule D Form, ensuring that all necessary signatures are obtained quickly and efficiently.

-

How can airSlate SignNow help me with my Schedule D Form?

airSlate SignNow offers an easy-to-use platform that enables you to eSign your Schedule D Form securely online. With customizable templates and automated workflows, you can streamline the process of preparing and signing your tax documents. This ensures you can submit your Schedule D Form on time without any hassle.

-

Is airSlate SignNow suitable for small businesses handling Schedule D Forms?

Absolutely! airSlate SignNow is a cost-effective solution perfect for small businesses that need to manage their Schedule D Forms. Our platform provides user-friendly tools and integrations that can help you organize, sign, and store your tax documents efficiently.

-

What features does airSlate SignNow offer for managing Schedule D Forms?

airSlate SignNow includes features such as document templates, secure eSigning, and automated reminders for your Schedule D Form. These tools help you ensure that your documents are completed accurately and submitted on time, reducing your administrative burden during tax season.

-

Can I integrate airSlate SignNow with my accounting software for Schedule D Forms?

Yes, airSlate SignNow integrates seamlessly with various accounting software, allowing you to manage your Schedule D Form and other tax documents in one place. This integration simplifies the process of collecting signatures and keeps all your financial records organized.

-

What is the pricing structure for using airSlate SignNow for Schedule D Forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for individuals and teams handling Schedule D Forms. Our pricing is designed to be cost-effective, ensuring you get the best value for your eSigning and document management needs.

-

How secure is airSlate SignNow when eSigning my Schedule D Form?

Security is a top priority at airSlate SignNow. When eSigning your Schedule D Form, we use advanced encryption and compliance with industry standards to protect your sensitive information. You can trust that your documents are safe and secure throughout the signing process.

Get more for Schedule D Form

Find out other Schedule D Form

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile