Schedule D Form 1120 Capital Gains and Losses 2020

What is the Schedule D Form 1120 Capital Gains And Losses

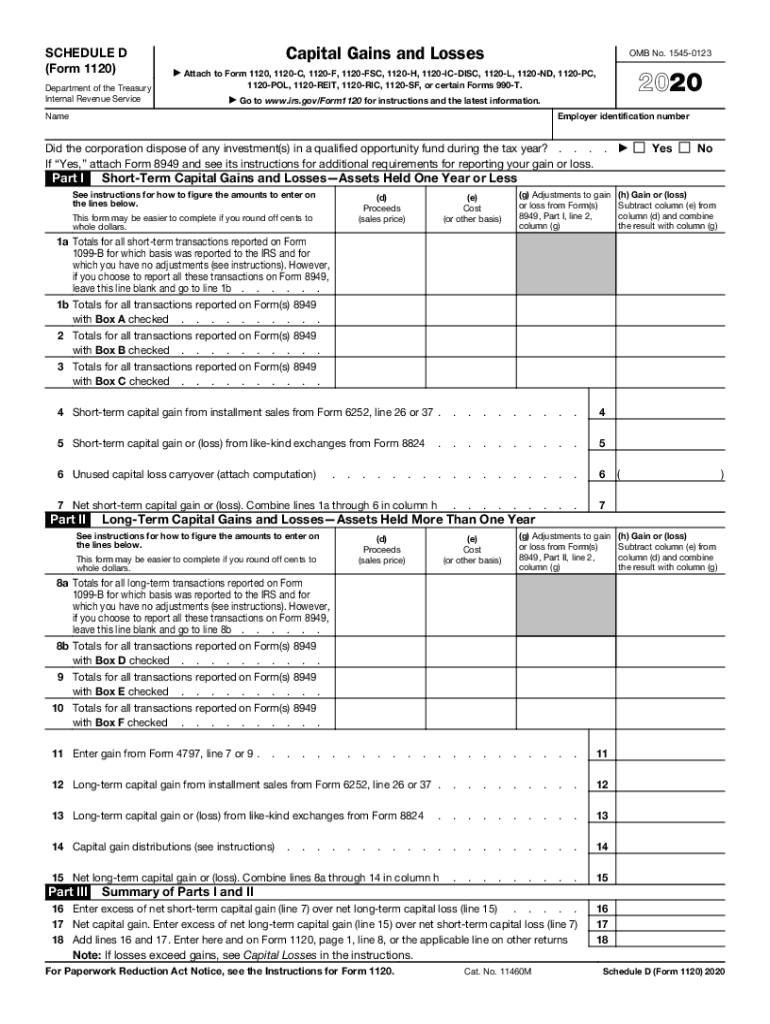

The Schedule D Form 1120 is a critical document used by corporations to report capital gains and losses. This form outlines the details of capital transactions, including sales of assets, investments, and other financial instruments. Understanding this form is essential for accurate tax reporting and compliance with IRS regulations. It helps in calculating the net capital gain or loss, which ultimately impacts the corporation's overall tax liability.

How to use the Schedule D Form 1120 Capital Gains And Losses

Using the Schedule D Form 1120 involves several steps. First, gather all relevant financial records, including transaction details for assets sold during the tax year. Next, complete the form by entering the required information regarding capital gains and losses. This includes identifying the type of asset, the date of acquisition, the date of sale, and the sale proceeds. Finally, ensure that the completed form is attached to the corporation's tax return when filing with the IRS.

Steps to complete the Schedule D Form 1120 Capital Gains And Losses

Completing the Schedule D Form 1120 requires careful attention to detail. Follow these steps:

- Begin with Part I, where you report short-term capital gains and losses from assets held for one year or less.

- Proceed to Part II for long-term capital gains and losses from assets held for more than one year.

- Calculate the total net capital gain or loss by combining the results from both parts.

- Transfer the net gain or loss to the appropriate line on the corporation's tax return.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule D Form 1120. It is important to adhere to these guidelines to avoid penalties. The IRS outlines the types of transactions that must be reported, the required documentation, and the deadlines for submission. Familiarizing yourself with these guidelines can help ensure compliance and accuracy in reporting capital gains and losses.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D Form 1120 are crucial for corporations to avoid penalties. Generally, the form must be filed by the due date of the corporation's tax return, which is typically the fifteenth day of the fourth month after the end of the tax year. For corporations that operate on a calendar year, this means the deadline is April fifteenth. It is advisable to confirm specific dates each year, as they may vary based on weekends or holidays.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Schedule D Form 1120 can result in significant penalties. The IRS may impose fines for late filing or failure to report capital gains and losses accurately. Additionally, interest may accrue on any unpaid taxes associated with the reported gains. Understanding these penalties emphasizes the importance of timely and accurate filing to avoid unnecessary financial burdens.

Quick guide on how to complete 2020 schedule d form 1120 capital gains and losses

Complete Schedule D Form 1120 Capital Gains And Losses effortlessly on any device

Managing documents online has grown increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle Schedule D Form 1120 Capital Gains And Losses seamlessly on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-centric operation today.

How to modify and electronically sign Schedule D Form 1120 Capital Gains And Losses with ease

- Find Schedule D Form 1120 Capital Gains And Losses and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether via email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Schedule D Form 1120 Capital Gains And Losses to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule d form 1120 capital gains and losses

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule d form 1120 capital gains and losses

The best way to make an electronic signature for your PDF file online

The best way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The best way to generate an eSignature for a PDF on Android devices

People also ask

-

What is IRS Schedule D for 2017 and why is it important?

IRS Schedule D for 2017 is a form used to report capital gains and losses for the tax year. Completing this form is crucial for accurately calculating your tax obligations and ensuring compliance with IRS regulations. Understanding how to fill out IRS Schedule D for 2017 can help you maximize deductions and minimize tax liabilities.

-

How does airSlate SignNow simplify the process of signing IRS Schedule D for 2017?

airSlate SignNow offers an intuitive platform that allows you to easily eSign IRS Schedule D for 2017. With our tools, you can quickly send and receive signed documents, ensuring that your tax forms are completed accurately and on time. This streamlines your workflow, reducing the stress often associated with tax season.

-

What pricing options are available for airSlate SignNow when completing IRS Schedule D for 2017?

airSlate SignNow offers a variety of pricing plans to cater to different needs, including individual and business options. Our plans are designed to be cost-effective, especially for users needing to manage IRS Schedule D for 2017 and other documents efficiently. You can choose a plan that suits your volume and usage requirements.

-

Are there specific features in airSlate SignNow that assist with IRS Schedule D for 2017?

Yes, airSlate SignNow provides features specifically designed to assist with IRS Schedule D for 2017, such as customizable templates and automated reminders. These features help you organize your documents and ensure that you don’t miss any deadlines. Additionally, our cloud storage allows easy access to your signed forms at any time.

-

Can I integrate airSlate SignNow with other applications to help manage IRS Schedule D for 2017?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage IRS Schedule D for 2017 and other important documents. Whether it’s accounting software or cloud storage solutions, our integrations help centralize your workflows for a more streamlined tax preparation process.

-

What are the benefits of using airSlate SignNow for IRS Schedule D for 2017?

Using airSlate SignNow for IRS Schedule D for 2017 offers numerous benefits, including speed, security, and ease of use. Our platform ensures secure document handling and provides an efficient way to get your forms signed and filed. This not only saves you time but also enhances your overall tax filing experience.

-

Is my data safe when signing IRS Schedule D for 2017 using airSlate SignNow?

Yes, your data is safe with airSlate SignNow when signing IRS Schedule D for 2017. We prioritize security with advanced encryption and compliance with industry standards. You can trust that your personal and financial information is protected throughout the eSigning process.

Get more for Schedule D Form 1120 Capital Gains And Losses

- Hafhperadwildapricotorgresourcesdocumentsscholarship application form applicants personal data name

- College sa further works forms

- Unisa complaints form

- Rc01 form

- Nj intake and initial assessment form

- Job hazard analysis form 11628511

- Aka affidavit 461302613 form

- Wwwcourseherocomfile105086862d original answer sample formdocx no cause no plaintiffs

Find out other Schedule D Form 1120 Capital Gains And Losses

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament