Instructions for Schedule D Form 1120 S 2020Instructions for Schedule D Form 1120 S 2020Instructions for Schedule D Form 1120 S 2022

Understanding the Schedule D Tax Form

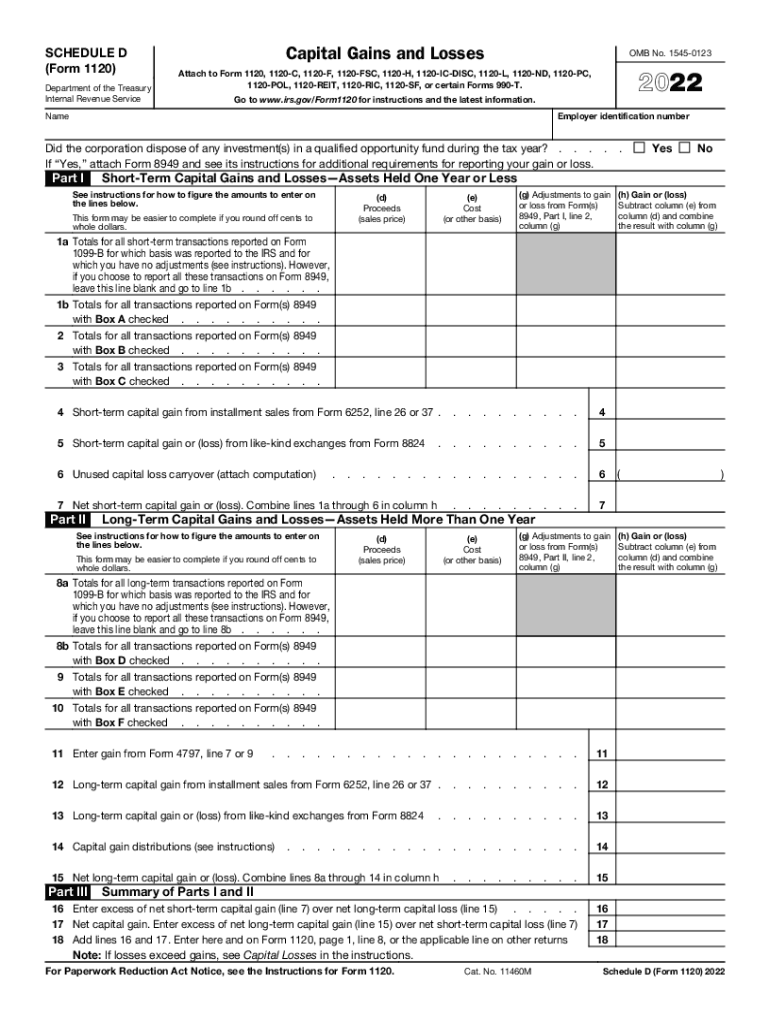

The Schedule D tax form is essential for reporting capital gains and losses to the IRS. This form is used by individuals and entities to detail their transactions involving stocks, bonds, and other capital assets. Understanding how to complete the 2011 Schedule D is crucial for ensuring accurate tax filings and compliance with IRS regulations.

Taxpayers must report their total capital gains and losses, which can affect their overall tax liability. The form includes sections for short-term and long-term capital gains, allowing taxpayers to distinguish between assets held for less than one year and those held for longer periods.

Steps to Complete the 2011 Schedule D

Completing the 2011 Schedule D involves several key steps:

- Gather all relevant documents, including brokerage statements and records of asset purchases and sales.

- Determine the holding period for each asset to classify them as short-term or long-term.

- Calculate the total capital gains and losses for each category, ensuring that you account for any carryover losses from previous years.

- Fill out the Schedule D form accurately, entering the totals in the appropriate sections.

- Transfer the final amounts to your main tax return form, such as Form 1040.

IRS Guidelines for Schedule D

The IRS provides specific guidelines for completing the Schedule D tax form. These guidelines include instructions on how to report different types of capital gains and losses, as well as the necessary calculations for determining your tax liability. It is important to refer to the IRS instructions for the 2011 Schedule D to ensure compliance with all requirements.

Additionally, taxpayers should be aware of any changes in tax laws that may affect how capital gains are taxed, including any applicable rates for long-term versus short-term gains.

Filing Deadlines for Schedule D

Filing deadlines for the 2011 Schedule D align with the standard tax filing deadlines in the United States. Typically, individual taxpayers must file their tax returns by April 15 of the following year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day.

Taxpayers seeking extensions should file Form 4868 to obtain an automatic six-month extension, but it is important to note that this does not extend the time to pay any taxes owed.

Common Penalties for Non-Compliance

Failing to accurately complete and file the 2011 Schedule D can result in penalties from the IRS. Common penalties include:

- Failure-to-file penalties, which can accrue if the form is not submitted by the deadline.

- Failure-to-pay penalties, which apply if taxes owed are not paid on time.

- Interest on unpaid taxes, which can accumulate over time.

To avoid these penalties, it is essential to ensure that all information is accurate and submitted in a timely manner.

Quick guide on how to complete instructions for schedule d form 1120 s 2020instructions for schedule d form 1120 s 2020instructions for schedule d form 1120 s

Complete Instructions For Schedule D Form 1120 S 2020Instructions For Schedule D Form 1120 S 2020Instructions For Schedule D Form 1120 S seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, enabling you to find the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Instructions For Schedule D Form 1120 S 2020Instructions For Schedule D Form 1120 S 2020Instructions For Schedule D Form 1120 S on any device with airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

How to alter and electronically sign Instructions For Schedule D Form 1120 S 2020Instructions For Schedule D Form 1120 S 2020Instructions For Schedule D Form 1120 S effortlessly

- Find Instructions For Schedule D Form 1120 S 2020Instructions For Schedule D Form 1120 S 2020Instructions For Schedule D Form 1120 S and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow supplies for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it onto your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Instructions For Schedule D Form 1120 S 2020Instructions For Schedule D Form 1120 S 2020Instructions For Schedule D Form 1120 S to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for schedule d form 1120 s 2020instructions for schedule d form 1120 s 2020instructions for schedule d form 1120 s

Create this form in 5 minutes!

How to create an eSignature for the instructions for schedule d form 1120 s 2020instructions for schedule d form 1120 s 2020instructions for schedule d form 1120 s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2011 schedule d and why do I need it?

The 2011 schedule d is a tax form used for reporting capital gains and losses from investments. If you're filing your taxes and have sold assets, this schedule is essential to accurately calculate your taxable income. Using airSlate SignNow, you can easily sign and submit your 2011 schedule d electronically.

-

How can airSlate SignNow help with my 2011 schedule d?

airSlate SignNow can streamline the process of preparing and submitting your 2011 schedule d. With our platform, you can securely eSign your documents and ensure that all necessary forms are completed accurately, minimizing the risk of errors that could lead to delays or audits.

-

What are the pricing options for using airSlate SignNow for my documents?

airSlate SignNow offers flexible pricing plans to cater to different business needs. Whether you're an individual or a large corporation, you can find a cost-effective solution to manage your documents, including your 2011 schedule d, without breaking the bank.

-

Is it safe to use airSlate SignNow for sensitive documents like my 2011 schedule d?

Absolutely! airSlate SignNow prioritizes the security of your documents with advanced encryption and compliance with data protection regulations. You can confidently eSign your 2011 schedule d, knowing your information is protected and confidential.

-

Can I integrate airSlate SignNow with other software I use for tax filing?

Yes, airSlate SignNow offers integrations with various software applications that simplify the tax filing process. By connecting with your accounting or tax software, you can seamlessly manage and eSign your 2011 schedule d alongside other important documents.

-

What features does airSlate SignNow provide for legal document eSigning?

AirSlate SignNow provides a robust set of features, including customizable templates, audit trails, and automated workflows. These features enhance the eSigning process for your 2011 schedule d and other documents, making it more efficient and reliable.

-

How quickly can I eSign my 2011 schedule d using airSlate SignNow?

With airSlate SignNow, eSigning your 2011 schedule d can be done in just a few minutes. The user-friendly interface allows you to expedite the signing process, so you can focus on other important tasks while ensuring timely submissions.

Get more for Instructions For Schedule D Form 1120 S 2020Instructions For Schedule D Form 1120 S 2020Instructions For Schedule D Form 1120 S

Find out other Instructions For Schedule D Form 1120 S 2020Instructions For Schedule D Form 1120 S 2020Instructions For Schedule D Form 1120 S

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form