Schedule D SCHEDULE DForm 1120 Department of the 2021

What is the Schedule D?

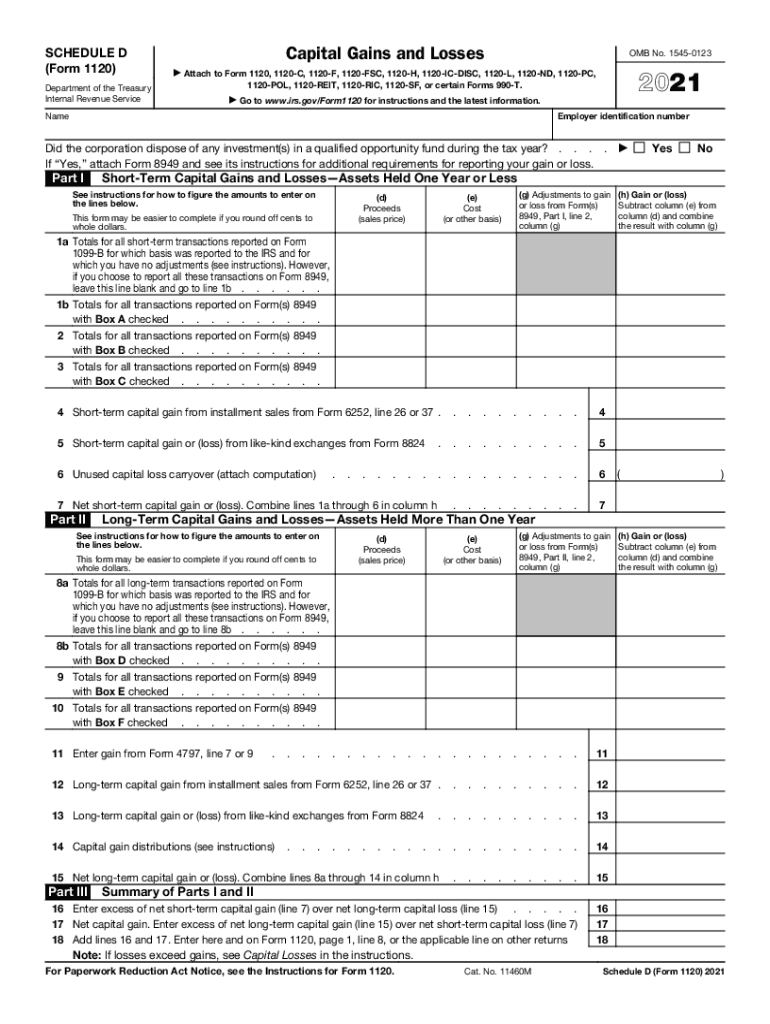

The 2020 Form Schedule D is a tax form used by individuals and corporations in the United States to report capital gains and losses from the sale of assets. This form is essential for calculating the tax owed on these transactions. It is part of the IRS tax filing process and is typically filed alongside the main tax return, such as Form 1040 for individuals or Form 1120 for corporations. Understanding how to complete this form accurately is crucial for ensuring compliance with tax regulations.

Steps to Complete the Schedule D

Completing the 2020 Schedule D involves several steps that require careful attention to detail. Start by gathering all necessary documentation related to asset sales, including purchase and sale dates, amounts, and any associated costs. Then, follow these steps:

- Fill out the top section with your personal information or business details.

- Report each transaction on the appropriate lines, detailing the asset type, acquisition date, sale date, and proceeds.

- Calculate your total capital gains and losses, ensuring to separate short-term from long-term transactions.

- Transfer the final amounts to your main tax return.

Double-check your entries for accuracy to avoid potential issues with the IRS.

How to Obtain the Schedule D

The 2020 Schedule D can be obtained from the IRS website or through tax preparation software. It is available in PDF format, which can be downloaded and printed for completion. Additionally, many tax professionals can provide this form as part of their services. Ensure you are using the correct version for the tax year to avoid complications during filing.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule D, which include instructions on reporting different types of capital gains and losses. These guidelines clarify how to handle various scenarios, such as the sale of stocks, bonds, or real estate. It is important to refer to the official IRS instructions for the 2020 Schedule D to ensure compliance and to understand any updates or changes in tax laws that may affect your filing.

Filing Deadlines / Important Dates

Filing deadlines for the 2020 Schedule D align with the general tax return deadlines. Typically, individual taxpayers must file their returns by April 15 of the following year. If you require additional time, you may file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. Corporations may have different deadlines based on their fiscal year, so it is essential to verify the specific dates applicable to your situation.

Penalties for Non-Compliance

Failure to accurately complete and file the 2020 Schedule D can result in significant penalties from the IRS. These penalties may include fines for late filing, underreporting income, or failing to report capital gains altogether. In some cases, interest may accrue on unpaid taxes. To mitigate these risks, it is advisable to ensure that all information is complete and correct before submission.

Quick guide on how to complete schedule d schedule dform 1120 department of the

Effortlessly Prepare Schedule D SCHEDULE DForm 1120 Department Of The on Any Device

Online document management has gained popularity among businesses and individuals. It offers a perfect environmentally friendly substitute for conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Schedule D SCHEDULE DForm 1120 Department Of The on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Schedule D SCHEDULE DForm 1120 Department Of The with Ease

- Find Schedule D SCHEDULE DForm 1120 Department Of The and click on Get Form to begin.

- Make use of the tools available to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to finalize your edits.

- Select your preferred method to send your form, whether by email, text message (SMS), an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Schedule D SCHEDULE DForm 1120 Department Of The to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule d schedule dform 1120 department of the

Create this form in 5 minutes!

How to create an eSignature for the schedule d schedule dform 1120 department of the

The way to make an electronic signature for your PDF online

The way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to make an e-signature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The way to make an e-signature for a PDF on Android

People also ask

-

What is the purpose of the 2020 form schedule d?

The 2020 form schedule d is used for reporting capital gains and losses from the sale of securities. This form helps taxpayers summarize their investment activities during the year and accurately calculate their tax obligations. By using an efficient eSigning platform like airSlate SignNow, you can easily manage and sign your 2020 form schedule d.

-

How can airSlate SignNow assist with completing the 2020 form schedule d?

airSlate SignNow provides a user-friendly interface that allows you to easily fill out your 2020 form schedule d. You can upload your financial documents, eSign, and share them securely with tax professionals. This streamlines your tax filing process, ensuring accuracy and compliance.

-

Is there a cost to use airSlate SignNow for the 2020 form schedule d?

Yes, airSlate SignNow offers various pricing plans designed for different needs. You can choose a plan that fits your budget while enjoying features that make handling documents like the 2020 form schedule d fast and efficient. The pricing is transparent, with no hidden fees, ensuring a cost-effective solution.

-

What features does airSlate SignNow offer for managing forms like the 2020 form schedule d?

airSlate SignNow includes features such as document templates, automated workflows, and tracking capabilities. These features help you streamline the completion and signing process of your 2020 form schedule d. Additionally, you can customize templates to suit your specific tax needs.

-

Can I integrate airSlate SignNow with other software for filing the 2020 form schedule d?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and tax software. This allows you to directly import data necessary for completing your 2020 form schedule d, making your filing process much more efficient and organized.

-

What are the benefits of using airSlate SignNow for the 2020 form schedule d?

Using airSlate SignNow for your 2020 form schedule d simplifies the entire signing process. It enhances collaboration by allowing multiple parties to review and sign documents remotely. Furthermore, the platform provides secure storage for your signed forms, ensuring compliance and easy access when needed.

-

Is the 2020 form schedule d easy to eSign using airSlate SignNow?

Yes, the 2020 form schedule d is very easy to eSign with airSlate SignNow. The platform is designed for user-friendliness, allowing users to sign documents electronically in just a few clicks. This eliminates the hassle of printing, scanning, or mailing physical copies.

Get more for Schedule D SCHEDULE DForm 1120 Department Of The

- Sheetrock drywall contractor package georgia form

- Flooring contractor package georgia form

- Trim carpentry contractor package georgia form

- Fencing contractor package georgia form

- Hvac contractor package georgia form

- Landscaping contractor package georgia form

- Commercial contractor package georgia form

- Excavation contractor package georgia form

Find out other Schedule D SCHEDULE DForm 1120 Department Of The

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement