Form 1120 1994

What is the Form 1120

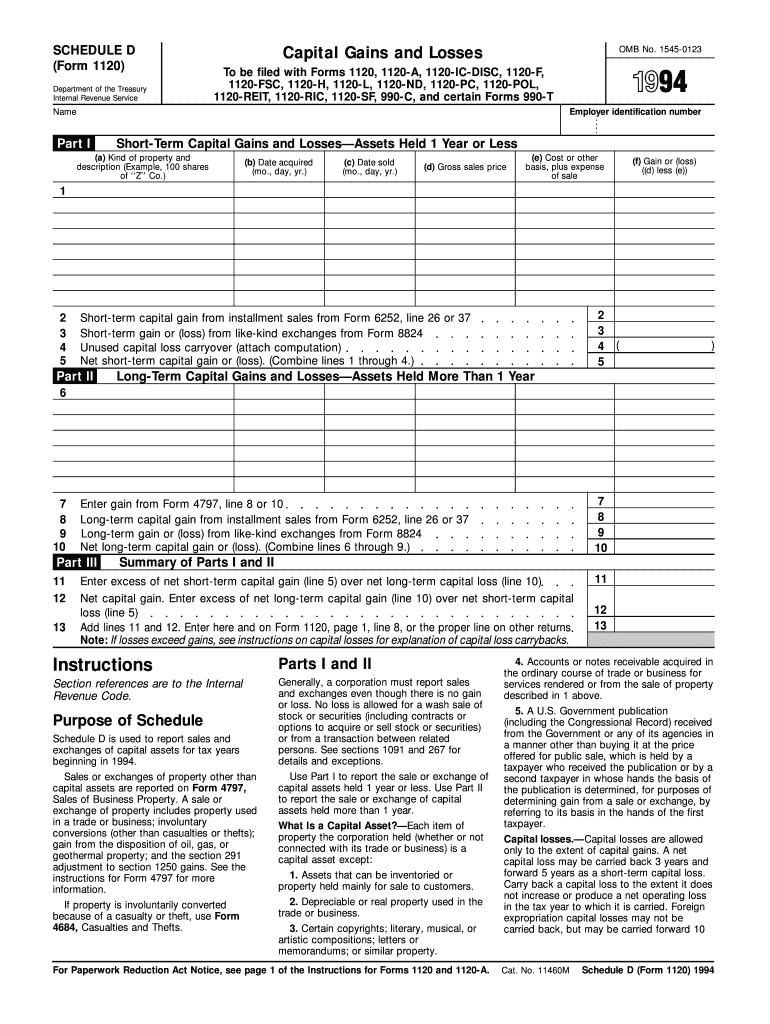

The Form 1120 is the U.S. Corporation Income Tax Return, used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for C corporations, which are separate legal entities from their owners. It provides the Internal Revenue Service (IRS) with a comprehensive overview of a corporation's financial activities during the tax year. Understanding the Form 1120 is crucial for compliance with federal tax laws and for accurately calculating the corporation's tax liability.

How to use the Form 1120

To use the Form 1120 effectively, corporations must gather their financial records, including income statements and balance sheets. The form requires detailed information about the corporation's revenue, expenses, and deductions. Each section must be completed accurately to reflect the corporation's financial status. After filling out the form, it is important to review it for any errors before submission. Corporations can file the Form 1120 electronically or through traditional mail, ensuring they adhere to IRS guidelines for submission.

Steps to complete the Form 1120

Completing the Form 1120 involves several key steps:

- Gather all necessary financial documents, including income statements and expense records.

- Fill out the identification section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report total income, including sales and other income sources, on the appropriate lines.

- Detail allowable deductions, such as salaries, rent, and other business expenses.

- Calculate the taxable income by subtracting total deductions from total income.

- Determine the tax liability based on the applicable corporate tax rates.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

The filing deadline for the Form 1120 is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations can also apply for a six-month extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties.

Legal use of the Form 1120

The legal use of the Form 1120 is governed by IRS regulations, which require accurate reporting of income and expenses. Filing this form is a legal obligation for C corporations, and failure to do so can result in penalties and interest on unpaid taxes. Additionally, the form must be signed by an authorized officer of the corporation, ensuring that the information provided is truthful and complete. Compliance with these legal requirements is essential for maintaining good standing with the IRS.

Key elements of the Form 1120

Key elements of the Form 1120 include:

- Income Section: Reports total income from sales and other sources.

- Deductions Section: Lists allowable business expenses that can be deducted from total income.

- Tax Calculation: Determines the corporation's tax liability based on taxable income.

- Signature: Requires the signature of an authorized corporate officer, affirming the accuracy of the information provided.

Quick guide on how to complete 1994 form 1120 1671214

Effortlessly Prepare Form 1120 on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to swiftly create, modify, and eSign your documents without delays. Administer Form 1120 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Modify and eSign Form 1120 Effortlessly

- Find Form 1120 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 1120 and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1994 form 1120 1671214

Create this form in 5 minutes!

How to create an eSignature for the 1994 form 1120 1671214

How to make an eSignature for a PDF in the online mode

How to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is Form 1120 and why do I need it?

Form 1120 is the U.S. Corporation Income Tax Return that corporations must file annually. It reports income, gains, losses, deductions, and credits to determine their tax liability. Understanding Form 1120 is crucial for compliance and ensuring that your business meets its tax obligations.

-

How can airSlate SignNow help me with Form 1120?

airSlate SignNow simplifies the process of filling out and submitting Form 1120 by enabling electronic signatures and streamlining document management. With its user-friendly interface, you can ensure that your Form 1120 is completed accurately and swiftly, reducing the risk of errors that could lead to complications with the IRS.

-

What are the pricing options for using airSlate SignNow when filing Form 1120?

airSlate SignNow offers various pricing plans to accommodate businesses of all sizes, making it affordable for companies looking to streamline their Form 1120 submissions. By providing cost-effective solutions, airSlate SignNow ensures you are not burdened with additional expenses while ensuring compliance with tax regulations.

-

Can I integrate airSlate SignNow with other accounting software for Form 1120 filing?

Yes, airSlate SignNow seamlessly integrates with various accounting software, allowing you to easily manage the preparation and submission of Form 1120 alongside your financial records. This integration enhances productivity and ensures that all necessary data is accurately reflected on your tax documents.

-

Is airSlate SignNow compliant with regulations regarding Form 1120?

Absolutely! airSlate SignNow adheres to strict regulatory guidelines, ensuring that your electronic filings, including Form 1120, are secure and compliant with IRS requirements. You can confidently utilize our platform knowing that your documents meet all necessary legal standards.

-

What features does airSlate SignNow offer for handling Form 1120?

airSlate SignNow provides a comprehensive suite of features including document templates, collaboration tools, and electronic signatures, making it easy to manage and submit Form 1120. These features enhance the efficiency of the filing process while ensuring that your documents are professionally formatted and compliant.

-

How does airSlate SignNow ensure the security of my Form 1120?

airSlate SignNow prioritizes the security of your documents, including Form 1120, through advanced encryption and secure cloud storage. This commitment to security ensures that your sensitive tax information is protected throughout the e-signature and submission process.

Get more for Form 1120

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497306145 form

- Letter from tenant to landlord for failure of landlord to return all prepaid and unearned rent and security recoverable by 497306146 form

- Illinois codes form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497306148 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497306149 form

- Letter landlord tenant 497306150 form

- Il letter landlord form

- Illinois tenant in form

Find out other Form 1120

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now