Schedule D Form 2012

What is the Schedule D Form

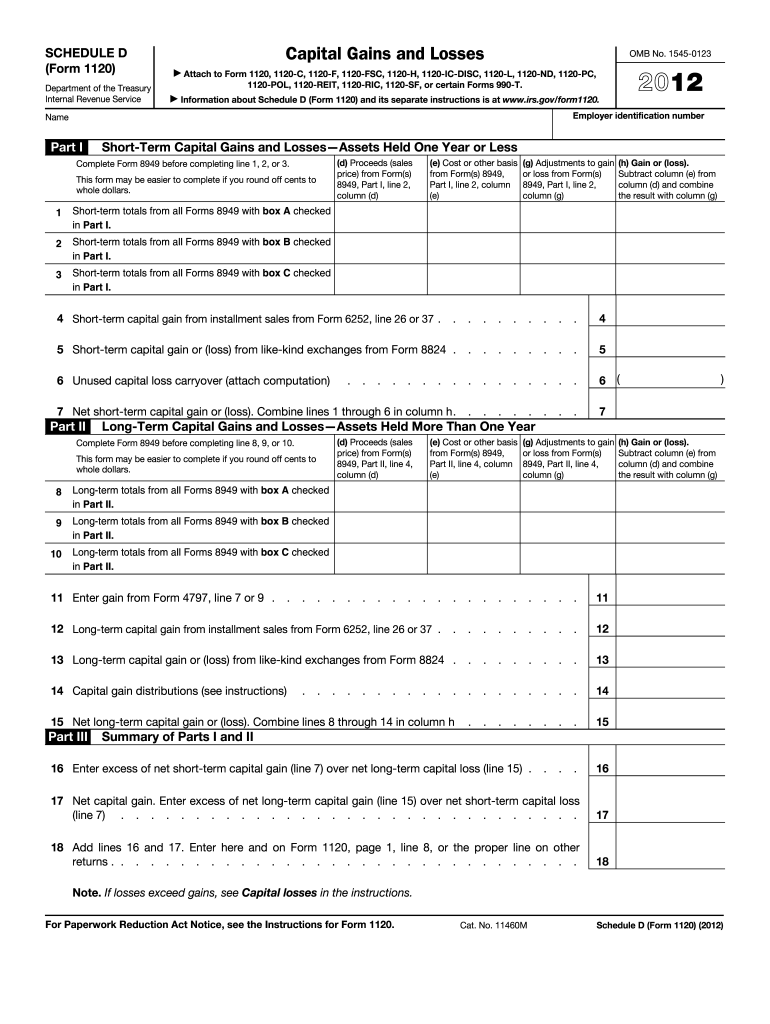

The Schedule D Form is a tax document used by U.S. taxpayers to report capital gains and losses from the sale of securities or other assets. This form is essential for individuals and businesses that engage in investment activities, as it helps in calculating the net gain or loss from these transactions. The information reported on Schedule D is then transferred to the taxpayer's main income tax return, typically Form 1040. Understanding this form is crucial for compliance with Internal Revenue Service (IRS) regulations and for ensuring accurate tax reporting.

How to use the Schedule D Form

Using the Schedule D Form involves several key steps. First, taxpayers must gather all relevant documentation regarding their capital transactions, including purchase and sale records. Next, they will need to categorize their transactions into short-term and long-term gains or losses based on the holding period of the assets. After completing the necessary calculations, the results are reported on the form. Finally, the completed Schedule D is submitted along with the main tax return. Properly using this form can help minimize tax liabilities and ensure compliance with IRS guidelines.

Steps to complete the Schedule D Form

Completing the Schedule D Form requires careful attention to detail. Here are the steps involved:

- Gather documentation for all capital asset transactions.

- Determine whether each transaction is a short-term or long-term gain or loss.

- Calculate total short-term gains and losses on Part I of the form.

- Calculate total long-term gains and losses on Part II of the form.

- Combine the totals from both parts to determine the overall capital gain or loss.

- Transfer the final amount to your Form 1040.

Legal use of the Schedule D Form

The Schedule D Form must be filled out accurately to comply with legal requirements set by the IRS. Failing to report capital gains or losses can lead to penalties, interest on unpaid taxes, or audits. It is important to maintain accurate records and ensure that all transactions are reported correctly. Taxpayers should also be aware of the specific rules regarding the reporting of capital gains, such as the distinction between short-term and long-term gains, as well as any applicable deductions or credits that may affect the overall tax liability.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D Form align with the overall tax return deadlines. Typically, individual taxpayers must submit their tax returns, including Schedule D, by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers may file for an extension, which typically grants an additional six months to submit their returns. However, any taxes owed must still be paid by the original deadline to avoid penalties.

Examples of using the Schedule D Form

Examples of using the Schedule D Form include reporting gains from the sale of stocks, bonds, or real estate. For instance, if an individual sells shares of a company at a profit, they must report this transaction on Schedule D, detailing the purchase price and sale price. Similarly, if a taxpayer sells a rental property, they must calculate and report any capital gains or losses associated with that sale. These examples illustrate the importance of accurately reporting all capital transactions to ensure compliance and proper tax assessment.

Quick guide on how to complete 2012 schedule d form

Complete Schedule D Form seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Manage Schedule D Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and electronically sign Schedule D Form effortlessly

- Locate Schedule D Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive data using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Schedule D Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 schedule d form

Create this form in 5 minutes!

How to create an eSignature for the 2012 schedule d form

How to generate an eSignature for a PDF online

How to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

The way to make an eSignature for a PDF on Android

People also ask

-

What is a Schedule D Form and why do I need it?

The Schedule D Form is an essential tax document used to report capital gains and losses from the sale of securities. If you engage in buying or selling stocks, bonds, or other investments, you will need to fill out this form to accurately report your transactions to the IRS. Utilizing airSlate SignNow can streamline the process of signing and submitting your Schedule D Form electronically.

-

How can airSlate SignNow help me with my Schedule D Form?

airSlate SignNow provides an easy-to-use platform for creating, signing, and managing your Schedule D Form electronically. With our solution, you can quickly fill out the form, add your eSignature, and send it securely, ensuring timely submission to the IRS. This reduces the hassle of paperwork and helps you stay organized during tax season.

-

Is there a cost associated with using airSlate SignNow for the Schedule D Form?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including features for eSigning and document management. The cost is quite competitive, making it a cost-effective solution for handling your Schedule D Form and other important documents. You can choose a plan that fits your budget and enjoy the benefits of streamlined document workflows.

-

Can I integrate airSlate SignNow with other software for my Schedule D Form?

Absolutely! airSlate SignNow integrates seamlessly with popular applications like Google Drive, Dropbox, and CRM systems. This feature allows you to effortlessly manage your Schedule D Form alongside other documents and data, enhancing your overall productivity and efficiency.

-

What features does airSlate SignNow offer for managing the Schedule D Form?

With airSlate SignNow, you gain access to features like customizable templates, in-app signing, and document tracking. These features simplify the process of completing and submitting your Schedule D Form, ensuring you can focus more on your investments and less on paperwork.

-

How secure is my Schedule D Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. Your Schedule D Form and any other documents are protected with bank-level encryption and secure cloud storage. This ensures that your sensitive information remains confidential and safe from unauthorized access.

-

Can I access my Schedule D Form anytime with airSlate SignNow?

Yes, airSlate SignNow allows you to access your Schedule D Form from any device with an internet connection. Whether you are at home, in the office, or on the go, you can easily retrieve and manage your documents, making it convenient to stay on top of your tax obligations.

Get more for Schedule D Form

- Content disposition http mdn 536028013 form

- April 2020 s 012 st 12 wisconsin sales and use tax return state county and stadium sales and use tax st 12 form

- 2019 pa schedule ue allowable employee business expenses pa 40 ue formspublications

- Schedule a on the back of this form and use filing status c

- Whats new for louisiana 2019 individual income tax form

- Fillable online franchisee application form the

- 05 income from form 1 line 10 or form 1 nrpy line 12

- The status of a refund is available at form

Find out other Schedule D Form

- How To Sign New Jersey Affidavit of Heirship

- Sign Oklahoma Affidavit of Heirship Myself

- Sign Washington Affidavit of Death Easy

- Help Me With Sign Pennsylvania Cohabitation Agreement

- Sign Montana Child Support Modification Online

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist