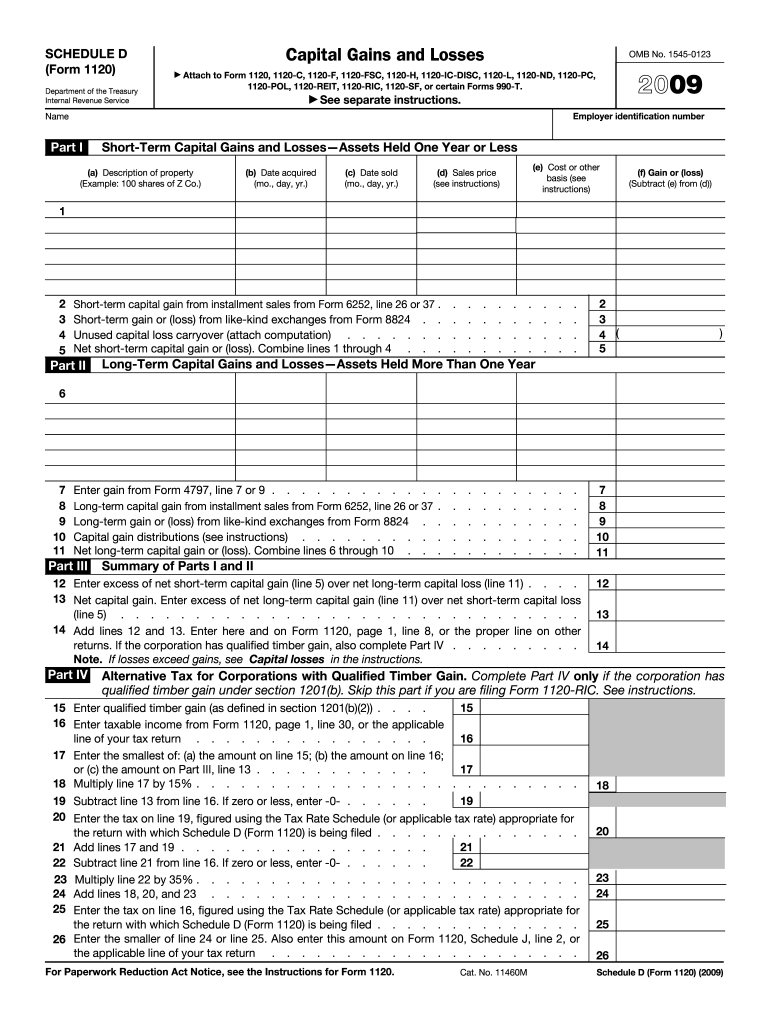

Form 1120 2009

What is the Form 1120

The Form 1120 is the U.S. Corporation Income Tax Return used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for C corporations, which are separate legal entities from their owners. It is filed annually with the Internal Revenue Service (IRS) and provides a comprehensive overview of a corporation's financial activities for the tax year. Understanding this form is crucial for compliance with federal tax obligations.

How to use the Form 1120

Using the Form 1120 involves accurately reporting financial information for the tax year. Corporations must gather their financial records, including income statements and balance sheets, to complete the form. Each section of the form requires specific information, such as gross receipts, cost of goods sold, and various deductions. It is important to follow the instructions provided by the IRS to ensure that all required information is included and correctly reported.

Steps to complete the Form 1120

Completing the Form 1120 requires a systematic approach:

- Gather financial documents, including income statements and balance sheets.

- Fill out the basic information section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report income, including gross receipts and other income sources.

- Calculate deductions, including operating expenses and cost of goods sold.

- Determine the taxable income by subtracting deductions from total income.

- Complete the tax computation section to determine the amount owed.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 1120

The Form 1120 is legally binding when completed accurately and submitted on time. Corporations must adhere to IRS guidelines to ensure compliance with tax laws. Filing this form correctly is essential to avoid penalties and interest charges. Additionally, eSignatures can be used to sign the form electronically, provided that the electronic signing process meets the legal requirements set forth by the IRS.

Filing Deadlines / Important Dates

The filing deadline for Form 1120 is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations may also apply for an automatic six-month extension to file, but any taxes owed must still be paid by the original due date to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Corporations can submit the Form 1120 through various methods:

- Online: Many corporations choose to file electronically using IRS-approved software, which can streamline the process and reduce errors.

- Mail: Corporations can also print and mail their completed forms to the appropriate IRS address based on their location.

- In-Person: While less common, corporations may visit local IRS offices to submit their forms directly.

Quick guide on how to complete 2009 form 1120

Prepare Form 1120 with ease on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct template and securely save it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly without delays. Handle Form 1120 on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 1120 effortlessly

- Obtain Form 1120 and click Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Form your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your amendments.

- Choose how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

No more worrying about lost or mislaid files, tedious form searching, or mistakes that require new document copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Form 1120 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2009 form 1120

Create this form in 5 minutes!

How to create an eSignature for the 2009 form 1120

How to generate an eSignature for your PDF online

How to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

How to make an eSignature for a PDF document on Android

People also ask

-

What is Form 1120 and why do I need it?

Form 1120 is the U.S. Corporation Income Tax Return used by corporations to report income, gains, losses, and deduct credits. Completing Form 1120 is essential for corporate tax compliance, and airSlate SignNow can help streamline this process by allowing you to eSign and send your corporate tax documents securely.

-

How can airSlate SignNow help me with completing Form 1120?

airSlate SignNow simplifies the process of completing Form 1120 by providing customizable templates, easy document sharing, and secure eSigning features. This ensures that your Form 1120 can be filled out accurately and efficiently, saving you time during tax season.

-

Is there a cost associated with using airSlate SignNow for Form 1120?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Depending on your specific requirements for managing Form 1120 and other documents, you can choose from monthly or annual subscription options that fit your budget.

-

What features does airSlate SignNow offer for managing Form 1120?

airSlate SignNow provides a robust set of features for managing Form 1120, including document templates, real-time collaboration, automated workflows, and secure cloud storage. These tools all work together to enhance your document management experience, especially during tax preparation.

-

Are there any integrations available to assist with Form 1120?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and financial software, making it easier for you to manage data and documents related to Form 1120. This integration helps streamline your entire tax process and ensure accurate filings.

-

How secure is airSlate SignNow when handling Form 1120 documents?

Security is a top priority for airSlate SignNow. When you use our platform to handle Form 1120, all documents are encrypted and stored securely, ensuring that your sensitive information is protected from unauthorized access throughout the entire signing process.

-

Can I access Form 1120 on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is fully mobile-friendly, allowing you to access, complete, and eSign Form 1120 from your smartphone or tablet. This flexibility ensures that you can manage your tax documents anytime and anywhere, enhancing your productivity.

Get more for Form 1120

Find out other Form 1120

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form