Qualified Dividends Worksheet 2023-2026

What is the Qualified Dividends Worksheet

The Qualified Dividends Worksheet is a tax form used to calculate the tax owed on qualified dividends received during the tax year. Qualified dividends are typically taxed at a lower rate than ordinary income, making this worksheet essential for accurate tax reporting. Understanding this worksheet is crucial for taxpayers who receive dividends from stocks or mutual funds that meet specific criteria set by the IRS.

How to use the Qualified Dividends Worksheet

To effectively use the Qualified Dividends Worksheet, begin by gathering all relevant financial documents that detail your dividend income. This includes brokerage statements and any Form 1099-DIV received. Follow the instructions carefully to input your dividend amounts, ensuring you differentiate between qualified and non-qualified dividends. The worksheet will guide you through calculating the appropriate tax rate applicable to your qualified dividends, allowing for accurate reporting on your tax return.

Steps to complete the Qualified Dividends Worksheet

Completing the Qualified Dividends Worksheet involves several key steps:

- Gather your financial documents, including Form 1099-DIV.

- Identify the total amount of qualified dividends received.

- Fill in the worksheet, ensuring to separate qualified dividends from ordinary dividends.

- Calculate the tax owed on qualified dividends based on the applicable tax rate.

- Transfer the calculated amount to your tax return.

IRS Guidelines

The IRS provides specific guidelines for using the Qualified Dividends Worksheet. These guidelines clarify what constitutes a qualified dividend, including the holding period and the type of stock or mutual fund. Familiarizing yourself with these guidelines can help ensure compliance and optimize your tax situation. It is important to refer to the latest IRS publications for any updates or changes to the rules governing qualified dividends.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Qualified Dividends Worksheet is essential for timely submission of your tax return. Typically, individual tax returns are due by April fifteenth of each year. If you require additional time, you may file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. Be aware of any changes in deadlines that may occur due to federal holidays or other circumstances.

Required Documents

To complete the Qualified Dividends Worksheet accurately, several documents are necessary:

- Form 1099-DIV, which reports dividend income.

- Brokerage statements detailing dividend payments.

- Any previous year tax returns for reference, if needed.

Having these documents ready will streamline the process and help ensure accurate reporting of your dividend income.

Quick guide on how to complete qualified dividends worksheet

Easily Prepare Qualified Dividends Worksheet on Any Device

Digital document management has become increasingly favored by both organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow gives you all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Manage Qualified Dividends Worksheet on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

How to Edit and eSign Qualified Dividends Worksheet with Ease

- Locate Qualified Dividends Worksheet and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form, either via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate the worry of lost or misplaced files, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any preferred device. Edit and eSign Qualified Dividends Worksheet while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct qualified dividends worksheet

Create this form in 5 minutes!

How to create an eSignature for the qualified dividends worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

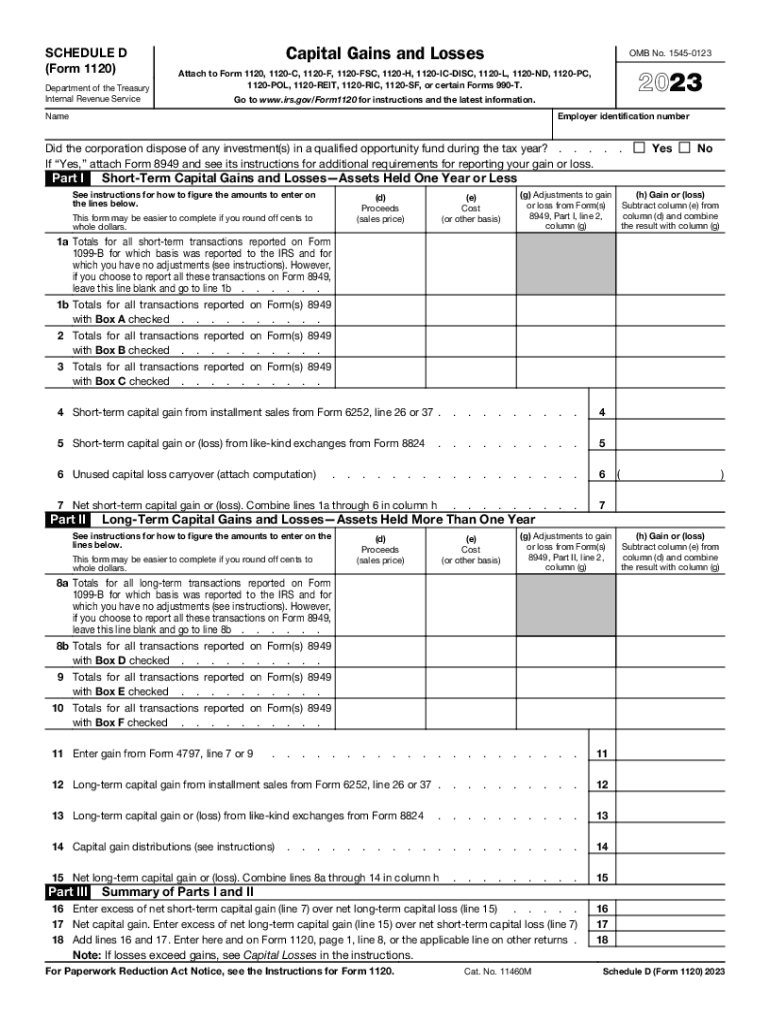

What is a Schedule D tax worksheet?

A Schedule D tax worksheet is a form used to report capital gains and losses from the sale of securities. It helps individuals and businesses calculate their tax obligations effectively, ensuring they have the necessary documentation for accurate filing. Utilizing airSlate SignNow can simplify the process of signing and sharing these important documents.

-

How does airSlate SignNow help with Schedule D tax worksheets?

airSlate SignNow streamlines the process of preparing and signing a Schedule D tax worksheet by providing an easy-to-use digital platform. Users can fill out and eSign their worksheets quickly, ensuring compliance and accuracy in tax filings. This efficiency can save valuable time and reduce errors in tax documentation.

-

What features does airSlate SignNow offer for tax-related documents?

With airSlate SignNow, users benefit from features like customizable templates, automated workflows, and secure document storage. These tools facilitate the creation and management of tax-related documents, including the Schedule D tax worksheet. Enhanced security measures also ensure that sensitive financial information is protected.

-

Is there a subscription fee for using airSlate SignNow?

Yes, airSlate SignNow offers a range of subscription plans tailored to different business needs. These plans include various features to assist with document management, such as the Schedule D tax worksheet. You can choose a plan that best fits your volume of document transactions and specific needs related to tax filings.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing for convenient synchronization of data. This integration makes it easier to manage your Schedule D tax worksheet alongside other financial documents and ensures that all your records are up to date for tax preparation.

-

What are the benefits of using airSlate SignNow for tax worksheets?

Using airSlate SignNow for your Schedule D tax worksheet offers several benefits including time savings, enhanced collaboration, and secure electronic signing. By digitizing your tax processes, you minimize the risk of errors and improve overall efficiency. The platform's user-friendly interface also allows for easy navigation, making tax filing stress-free.

-

Can I access my Schedule D tax worksheet on mobile devices?

Yes, airSlate SignNow is optimized for mobile devices, allowing you to access your Schedule D tax worksheet anytime, anywhere. Whether you are on the go or working from home, you can conveniently manage your tax documents using your smartphone or tablet. This flexibility enhances productivity and keeps your tax tasks on track.

Get more for Qualified Dividends Worksheet

Find out other Qualified Dividends Worksheet

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast