Form 1120 2015

What is the Form 1120

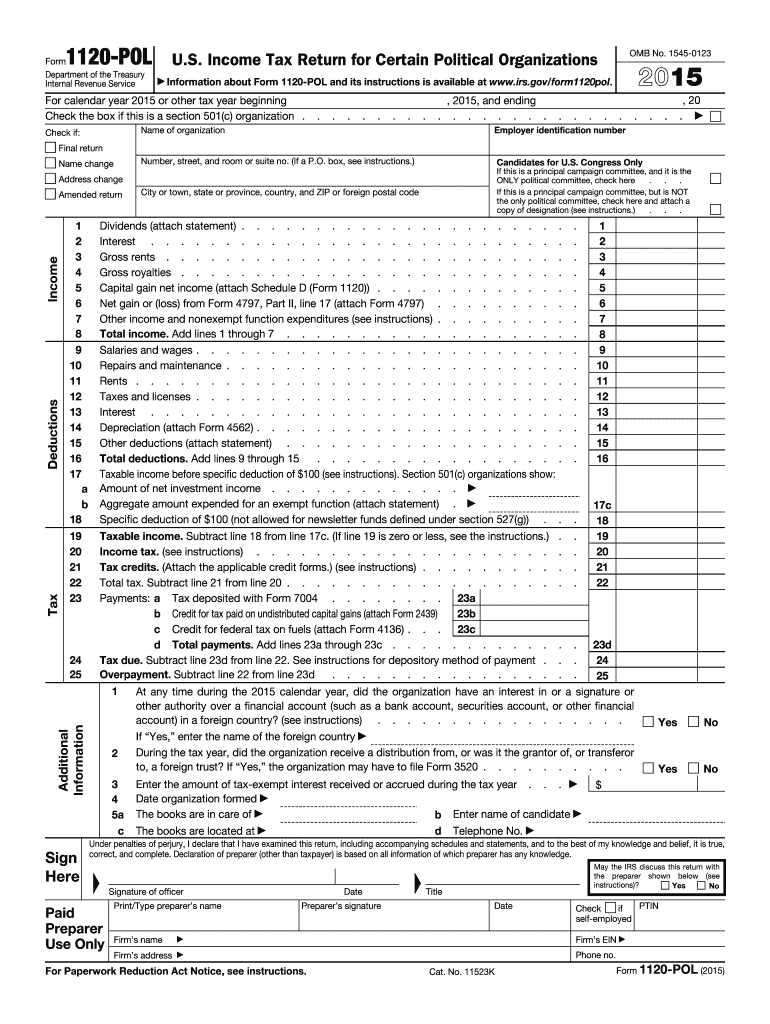

The Form 1120 is the U.S. Corporation Income Tax Return used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for C corporations, which are separate legal entities from their owners. It allows the IRS to assess the corporation's tax liability based on its earnings. Corporations must file Form 1120 annually, detailing their financial activity for the previous tax year.

How to use the Form 1120

Using Form 1120 involves several steps to ensure accurate reporting of a corporation's financial information. First, gather all necessary financial documents, including income statements, balance sheets, and records of expenses. Next, complete the form by filling in sections related to income, deductions, and tax credits. It's crucial to follow the IRS instructions carefully to avoid errors. Finally, submit the completed form either electronically or by mail, depending on your preference and the IRS guidelines.

Steps to complete the Form 1120

Completing Form 1120 requires careful attention to detail. Here are key steps to follow:

- Gather financial records, including income, expenses, and deductions.

- Fill out the identification section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report total income, including sales, dividends, and interest.

- Detail deductions, such as salaries, rent, and utilities.

- Calculate the taxable income by subtracting total deductions from total income.

- Determine the tax liability using the appropriate corporate tax rates.

- Complete any additional schedules required for specific deductions or credits.

Legal use of the Form 1120

Form 1120 must be used in compliance with IRS regulations to ensure its legal validity. Accurate reporting is essential, as any discrepancies can lead to penalties or audits. Corporations must keep detailed records to support the information reported on the form. Additionally, eSigning the form through a compliant platform can enhance its legal standing, provided it meets the requirements outlined by the ESIGN Act and UETA.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for Form 1120 to avoid penalties. The standard due date for filing is the fifteenth day of the fourth month after the end of the corporation's tax year. For corporations operating on a calendar year, this typically falls on April 15. If additional time is needed, corporations can file for an extension, which grants an additional six months, but any taxes owed must still be paid by the original due date to avoid interest and penalties.

Form Submission Methods (Online / Mail / In-Person)

Form 1120 can be submitted through various methods, providing flexibility for corporations. The IRS encourages electronic filing, which can be done through approved software or tax professionals. Alternatively, corporations can mail a paper copy of the completed form to the appropriate IRS address based on their location. In-person submissions are generally not available for Form 1120, as the IRS does not accept forms at local offices.

Quick guide on how to complete 2015 form 1120

Effortlessly Create Form 1120 on Any Device

Managing documents online has become increasingly favored among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely keep it online. airSlate SignNow provides you with all the essential tools to create, alter, and electronically sign your files swiftly without any hold-ups. Administer Form 1120 on any device using the airSlate SignNow apps for Android or iOS and enhance any document-based workflow today.

How to Alter and Electronically Sign Form 1120 with Ease

- Locate Form 1120 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text (SMS), invitation link, or downloading it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device you choose. Modify and electronically sign Form 1120 and guarantee smooth communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 1120

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 1120

The way to generate an eSignature for your PDF file in the online mode

The way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is Form 1120, and why is it important for businesses?

Form 1120 is the U.S. Corporation Income Tax Return that corporations must file annually with the IRS. This form reports a corporation's income, deductions, and tax liability. It's essential for compliance and helps businesses manage their tax obligations effectively.

-

How can airSlate SignNow assist with filing Form 1120?

airSlate SignNow streamlines the process of preparing and submitting Form 1120 by allowing users to electronically sign and send necessary documents securely. This digital solution reduces paperwork and enhances organization, making it easier to meet filing deadlines.

-

What features does airSlate SignNow offer for users completing Form 1120?

With airSlate SignNow, users can access customizable templates, real-time tracking, and collaboration tools, ensuring everyone involved can complete Form 1120 efficiently. The platform also provides an audit trail for compliance purposes.

-

Is there a cost associated with using airSlate SignNow for Form 1120?

Yes, airSlate SignNow offers several pricing plans to accommodate different business needs. Each plan provides access to features that can simplify the completion of Form 1120, ensuring businesses can stay within budget while improving efficiency.

-

Can I integrate airSlate SignNow with other software for handling Form 1120?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage Form 1120 within your existing workflows. This integration helps ensure data consistency and reduces manual entry errors.

-

What benefits does airSlate SignNow offer for businesses managing Form 1120?

By using airSlate SignNow, businesses can enhance their document management efficiency, reduce the risk of errors, and accelerate the filing of Form 1120. The digital process provides a more streamlined and cost-effective solution compared to traditional methods.

-

How secure is airSlate SignNow when handling Form 1120?

airSlate SignNow employs robust encryption and security protocols to protect sensitive information, including that found in Form 1120. Users can trust that their data is safe as they streamline their document processes.

Get more for Form 1120

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497303777 form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for nonresidential property 497303778 form

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for residential property 497303779 form

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for nonresidential property 497303780 form

- Business credit application georgia form

- Individual credit application georgia form

- Interrogatories to plaintiff for motor vehicle occurrence georgia form

- Interrogatories to defendant for motor vehicle accident georgia form

Find out other Form 1120

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple