Form 1120 POL U S Income Tax Return for Certain Political Organizations 2023-2026

What is the Form 1120 POL U S Income Tax Return For Certain Political Organizations

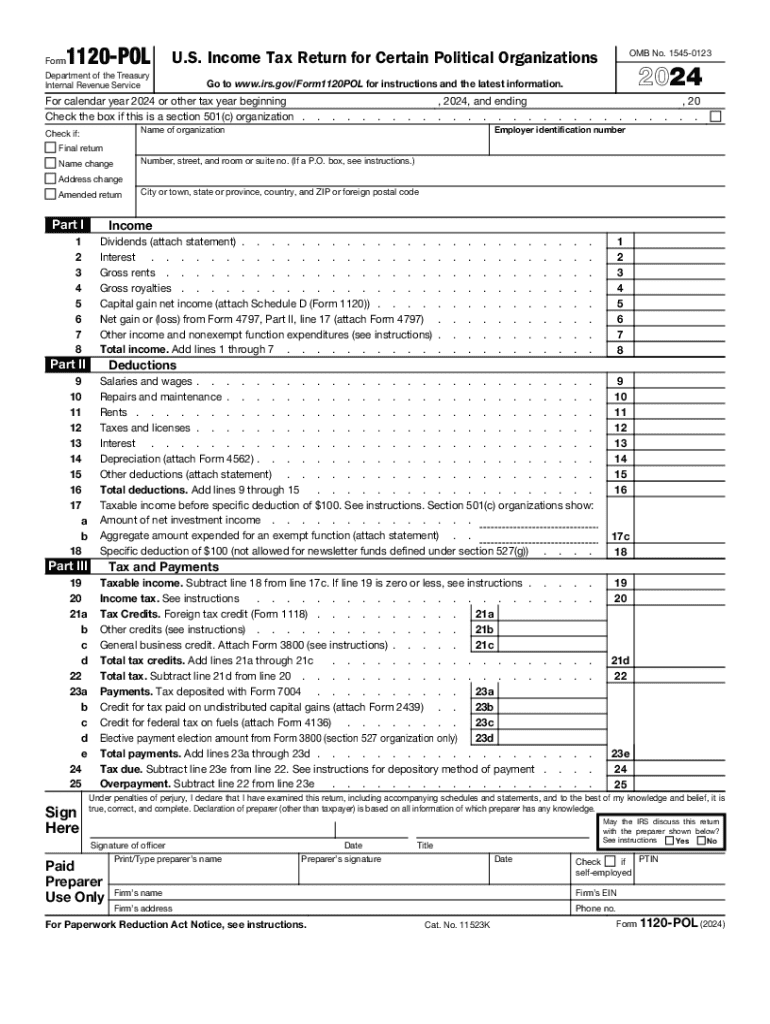

The Form 1120 POL is specifically designed for political organizations in the United States to report their income, gains, losses, deductions, and credits. This form is essential for organizations that are classified as political under the Internal Revenue Code. It allows these entities to comply with federal tax regulations while ensuring transparency in their financial activities. Political organizations must file this form if they have received gross income of $100 or more during the tax year, which includes contributions, dues, and other sources of revenue.

Steps to complete the Form 1120 POL U S Income Tax Return For Certain Political Organizations

Completing the Form 1120 POL involves several key steps:

- Gather financial records: Collect all relevant financial documents, including income statements, bank statements, and records of contributions.

- Fill out the form: Begin with basic information such as the organization's name, address, and Employer Identification Number (EIN). Follow the form's instructions to report income and expenses accurately.

- Calculate tax liability: Determine any tax owed based on the reported income and applicable deductions.

- Review and verify: Ensure all information is accurate and complete before submission to avoid penalties.

- Submit the form: File the completed Form 1120 POL by the due date, either electronically or by mail.

Legal use of the Form 1120 POL U S Income Tax Return For Certain Political Organizations

The legal use of Form 1120 POL is crucial for compliance with federal tax laws. Political organizations must file this form to report their financial activities accurately, ensuring they adhere to the regulations set forth by the Internal Revenue Service (IRS). Failure to file or inaccuracies can lead to penalties, including fines and loss of tax-exempt status. Understanding the legal implications of this form is vital for maintaining organizational integrity and transparency.

Filing Deadlines / Important Dates

Political organizations must be aware of specific deadlines when filing Form 1120 POL. The due date for the return is typically the fifteenth day of the third month after the end of the organization's tax year. For organizations operating on a calendar year, this means the deadline is March 15. Extensions may be available, but organizations must file Form 7004 to request an extension and ensure compliance with IRS regulations.

Required Documents

To complete Form 1120 POL, organizations need to gather several documents:

- Income statements: Detailed records of all income sources, including contributions and fundraising activities.

- Expense records: Documentation of all expenditures related to the organization's operations, including administrative costs and campaign expenses.

- Bank statements: Monthly statements that reflect the organization’s financial transactions.

- Previous tax returns: Copies of past Form 1120 POL filings, if applicable, to ensure consistency and accuracy.

IRS Guidelines

The IRS provides comprehensive guidelines for completing Form 1120 POL. These instructions cover various aspects, including eligibility criteria, reporting requirements, and specific line item instructions. It is essential for organizations to consult these guidelines to ensure compliance and to understand the implications of their financial reporting. Adhering to IRS guidelines helps prevent errors and potential audits, fostering a transparent financial environment for political organizations.

Create this form in 5 minutes or less

Find and fill out the correct form 1120 pol u s income tax return for certain political organizations

Create this form in 5 minutes!

How to create an eSignature for the form 1120 pol u s income tax return for certain political organizations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2018 pol 1120pol form and why is it important?

The 2018 pol 1120pol form is a crucial tax document for corporations in the United States, used to report income, gains, losses, deductions, and credits. Understanding this form is essential for compliance with IRS regulations and ensuring accurate tax filings.

-

How can airSlate SignNow help with the 2018 pol 1120pol form?

airSlate SignNow simplifies the process of preparing and eSigning the 2018 pol 1120pol form. Our platform allows users to easily upload, fill out, and securely send the form for electronic signatures, streamlining the entire tax filing process.

-

What are the pricing options for using airSlate SignNow for the 2018 pol 1120pol?

airSlate SignNow offers flexible pricing plans that cater to different business needs, starting with a free trial. Our cost-effective solutions ensure that you can manage your 2018 pol 1120pol form and other documents without breaking the bank.

-

What features does airSlate SignNow offer for managing the 2018 pol 1120pol?

With airSlate SignNow, you gain access to features like document templates, customizable workflows, and real-time tracking for your 2018 pol 1120pol form. These tools enhance efficiency and ensure that your documents are handled securely and professionally.

-

Can I integrate airSlate SignNow with other software for the 2018 pol 1120pol?

Yes, airSlate SignNow seamlessly integrates with various software applications, including accounting and CRM systems. This integration allows for a smoother workflow when managing your 2018 pol 1120pol form alongside other business processes.

-

What are the benefits of using airSlate SignNow for the 2018 pol 1120pol?

Using airSlate SignNow for your 2018 pol 1120pol form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored safely, giving you peace of mind during tax season.

-

Is airSlate SignNow user-friendly for completing the 2018 pol 1120pol?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the 2018 pol 1120pol form. Our intuitive interface guides users through the process, ensuring that even those with minimal tech skills can navigate it effortlessly.

Get more for Form 1120 POL U S Income Tax Return For Certain Political Organizations

Find out other Form 1120 POL U S Income Tax Return For Certain Political Organizations

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online