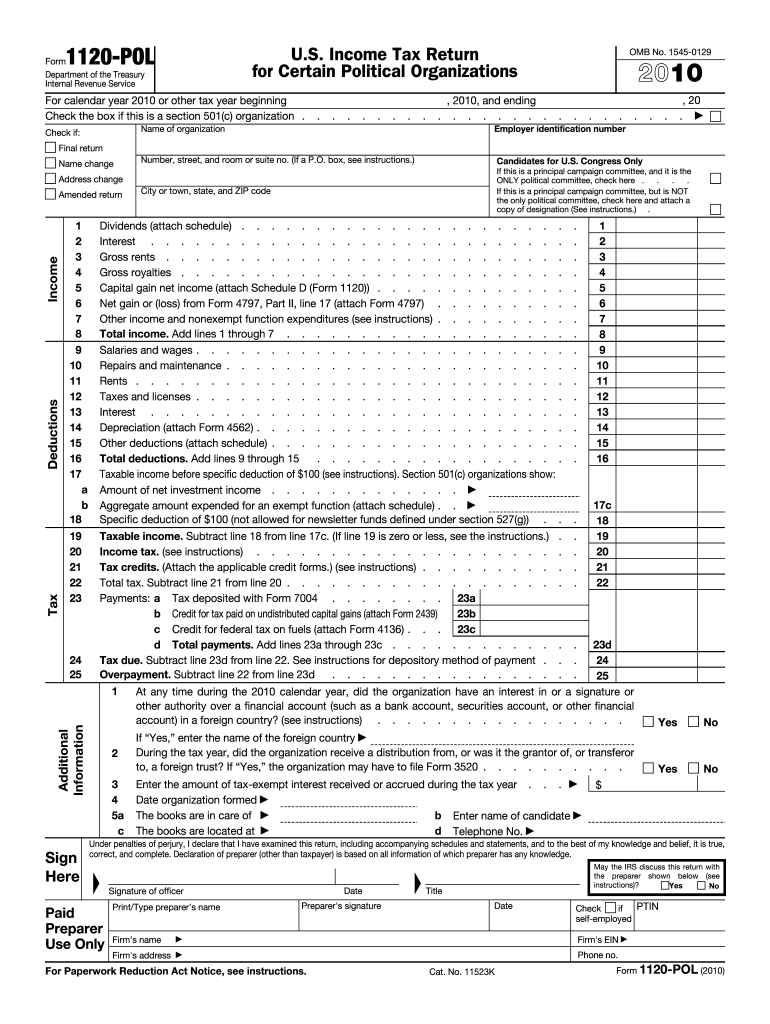

Irs Form Tax 2010

What is the IRS Form Tax?

The IRS Form Tax refers to various tax forms issued by the Internal Revenue Service (IRS) that individuals and businesses must complete to report income, expenses, and other tax-related information. These forms are essential for determining tax liability and ensuring compliance with federal tax laws. Common examples include the 1040 for individual income tax and the W-2 for wage reporting. Understanding the specific purpose of each form is crucial for accurate tax filing.

How to use the IRS Form Tax

Using the IRS Form Tax involves several steps to ensure accurate completion. First, identify the correct form based on your tax situation. Gather all necessary documents, such as income statements and deduction records. Next, fill out the form carefully, ensuring that all information is correct and complete. After completing the form, review it for any errors before submission. Finally, submit the form either electronically or by mail, depending on your preference and the specific form requirements.

Steps to complete the IRS Form Tax

Completing the IRS Form Tax can be streamlined by following these steps:

- Determine which form you need based on your filing status and income type.

- Collect all relevant financial documents, including W-2s, 1099s, and receipts for deductions.

- Fill out the form carefully, ensuring that all entries are accurate.

- Double-check your calculations and information to avoid mistakes.

- Sign and date the form before submission.

- Submit the form by the designated deadline, either electronically or via mail.

Legal use of the IRS Form Tax

The legal use of the IRS Form Tax is governed by federal law, which requires individuals and businesses to report their income accurately. Properly completed forms serve as official documentation of tax obligations and can be used in legal proceedings if necessary. It is important to ensure compliance with all IRS regulations to avoid penalties. Forms must be submitted by the deadlines set by the IRS to maintain their legal validity.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form Tax vary depending on the type of form and the taxpayer's situation. Generally, individual tax returns are due on April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Other forms, such as those for businesses, may have different deadlines. It's essential to stay informed about these dates to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the IRS Form Tax. Taxpayers can file electronically through the IRS e-file system, which is often faster and more secure. Alternatively, forms can be mailed to the appropriate IRS address based on the form type and the taxpayer's location. In-person submission is generally not available, but some tax assistance centers may offer help with filing. Choosing the right submission method can affect processing times and the speed of any potential refunds.

Quick guide on how to complete 2010 irs form tax

Complete Irs Form Tax seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a fantastic environmentally-friendly substitute for conventional printed and signed papers, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without obstacles. Manage Irs Form Tax on any device using airSlate SignNow's Android or iOS applications, and enhance any document-related operation today.

How to modify and electronically sign Irs Form Tax effortlessly

- Locate Irs Form Tax and select Get Form to begin.

- Employ the tools at your disposal to complete your document.

- Emphasize key sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional hand-signed signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Irs Form Tax to ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 irs form tax

Create this form in 5 minutes!

How to create an eSignature for the 2010 irs form tax

How to generate an eSignature for a PDF in the online mode

How to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is the purpose of the IRS Form Tax?

The IRS Form Tax is used for reporting income and calculating tax liabilities for individuals and businesses. Understanding this form can help ensure accurate filing and compliance with tax regulations.

-

How can airSlate SignNow assist with IRS Form Tax submissions?

airSlate SignNow simplifies the process of sending and eSigning IRS Form Tax documents, ensuring they are securely delivered and legally binding. This streamlines your workflow, allowing for quick submissions and mitigated errors.

-

Is airSlate SignNow affordable for small businesses needing IRS Form Tax solutions?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to small businesses. This ensures that even businesses with limited budgets can efficiently manage their IRS Form Tax submissions.

-

What features does airSlate SignNow offer for handling IRS Form Tax?

airSlate SignNow includes features such as template creation for IRS Form Tax, real-time tracking of document status, and integrations with accounting software. These features enhance efficiency and compliance during the filing process.

-

Can I integrate airSlate SignNow with my existing tax software?

Absolutely! airSlate SignNow integrates seamlessly with many popular tax software solutions. This allows you to manage IRS Form Tax documents and signatures without disrupting your existing workflows.

-

What are the benefits of using airSlate SignNow for IRS Form Tax?

Using airSlate SignNow for IRS Form Tax can signNowly reduce processing time and eliminate physical paperwork. Additionally, electronic signatures ensure greater security and compliance with IRS regulations.

-

How secure is airSlate SignNow for submitting IRS Form Tax?

airSlate SignNow employs advanced encryption and security protocols to protect your IRS Form Tax documents. This adherence to security best practices ensures that your sensitive financial information remains confidential.

Get more for Irs Form Tax

- Earlylearningwa form

- Johns creek psychology confidential patient questionnaire form

- Youth sports physical form

- Skin type worksheet skin renew clinic form

- Cenikor forms

- Tb documentation form

- Renewal by synergy cerps log american association of critical bb aacn form

- Letter of support for individuals with no income or no form

Find out other Irs Form Tax

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple